UBS delivered a pre-tax profit of CHF 1 billion despite a trading income loss of CHF 1.8 billion resulting from the unauthorized trading incident reported in September and significant volatility in global financial markets. Our wealth management businesses recorded combined net new money broadly in line with the prior quarter. An improvement in our BIS tier 1 ratio to 18.4% and an increase in our BIS tier 1 capital to CHF 38.1 billion both underlined our position as one of the world's best capitalized banks.

- Pre-tax profit CHF 980 million, including a CHF 1,849 million trading income loss resulting from the unauthorized trading incident and an own credit gain of CHF 1,765 million

- Net profit attributable to UBS shareholders increased to CHF 1,018 million; diluted earnings per share CHF 0.27

- CHF 2 billion cost reduction program on track; total restructuring charges CHF 387 million in the third quarter; operating costs down 2%

- Third quarter performance reflects the following:

- Significantly increased market volatility due to heightened concerns around eurozone debt and worsening economic data

- Sharp declines in global market indices, leading to a reduction in invested assets for the Group

- Significant currency exchange rate volatility had an overall negative effect on profitability, particularly the substantial strengthening of the Swiss franc against major currencies, though the Swiss franc depreciated against the euro after the Swiss National Bank announced in early September that it would no longer tolerate a euro exchange rate of less than CHF 1.20

- Significantly increased market volatility due to heightened concerns around eurozone debt and worsening economic data

- Group revenues CHF 6.4 billion compared with CHF 7.2 billion, including the CHF 1.8 billion trading income loss resulting from the unauthorized trading incident and an own credit gain of CHF 1.8 billion, with declines in revenues reflecting the challenging market conditions described above

- BIS tier 1 ratio improved to 18.4% and tier 1 capital increased to CHF 38.1 billion, confirming our continued capital strength

- Client deposits remain our largest source of funding and grew by CHF 15 billion to CHF 370 billion

- Residual risk exposures, including our exposures to auction rate securities, were reduced further

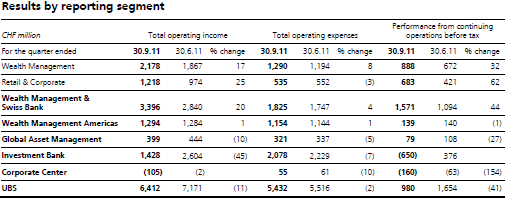

- Wealth Management's pre-tax profit up 32% to CHF 888 million; gross margin on invested assets excluding gains from the sale of treasury-related investments resilient at 97 basis points; net new money CHF 3.8 billion

- Retail & Corporate's pre-tax profit up 62% to CHF 683 million, mainly due to gains from the sale of treasury-related investments

- Wealth Management Americas' pre-tax profit broadly in line with the prior quarter at CHF 139 million despite turbulent markets and CHF 13 million of total restructuring charges; net new money up CHF 1.4 billion to CHF 4.0 billion

- Global Asset Management's pre-tax profit CHF 79 million; CHF 1.5 billion net new money inflows from third parties, excluding money market flows

Investment Bank's pre-tax loss CHF 650 million, reflecting market conditions and the CHF 1.8 billion trading income loss resulting from the unauthorized trading incident

Zurich/Basel, 25 October 2011 - Commenting on UBS’s third quarter 2011 results, Group CEO Sergio Ermotti said: "We continued to put our clients first and focused on providing the highest-quality advice and services in volatile trading conditions, enabling the majority of our businesses to deliver profit. UBS clients and shareholders can rest assured that our financial, capital and funding positions remain unquestionably solid. We are finalizing the plans essential to implementing the Investment Bank's client-centric strategy, which will strengthen our wealth management offering, reduce the firm's risks and improve returns to shareholders. We are well positioned in areas of future growth and our targeted investments, together with our focus on efficiency, will strengthen the firm. I am very confident about the future of our business."

Third-quarter net profit attributable to UBS shareholders CHF 1,018 million

Net profit attributable to UBS shareholders was CHF 1,018 million, compared with CHF 1,015 million in the second quarter of 2011. Pre-tax profit declined by CHF 674 million to CHF 980 million. This was mainly due to the trading income loss of CHF 1,849 million related to the unauthorized trading incident, lower revenues in the Investment Bank, and total restructuring charges of CHF 387 million. This was partly offset by an own credit gain of CHF 1,765 million and a gain of CHF 722 million from the sale of treasury-related investments. We recorded a net income tax benefit of CHF 40 million, compared with a net income tax expense of CHF 377 million in the prior quarter. Net profit attributable to non-controlling interests declined to CHF 2 million from CHF 263 million.

Wealth Management’s pre-tax profit was CHF 888 million, compared with CHF 672 million in the previous quarter. The quarter included a gain of CHF 433 million from the sale of treasury-related investments, as well as CHF 85 million in restructuring charges associated with our cost reduction program. In addition, income was affected by seasonally lower client activity and adverse market conditions. The gross margin for the quarter was 120 basis points. When adjusted for the sale of positions from treasury-related investments, the gross margin remained resilient at 97 basis points, reflecting 6% lower income compared with a 5% decline in average invested assets. Net new money inflows were CHF 3.8 billion compared with CHF 5.6 billion in the previous quarter. International wealth management reported net inflows of CHF 3.9 billion compared with CHF 5.5 billion in the prior quarter, with continued net inflows in the Asia-Pacific region and emerging markets, as well as globally from ultra high net worth clients. Our European onshore business reported net outflows, reflecting outflows of approximately CHF 1.5 billion related to the departure of client advisors who had joined our firm as part of a past acquisition in Germany. Excluding this, our European onshore business reported net inflows. Our European cross-border business recorded net outflows, mainly from the cross-border business related to neighboring countries of Switzerland. Invested assets were CHF 720 billion on 30 September 2011, a decrease of CHF 28 billion from 30 June 2011. This decline was mainly due to a significant decrease in global equity markets during the quarter, partly offset by an ultimately positive net currency effect toward the end of the quarter and net new money inflows. Operating expenses increased to CHF 1,290 million from CHF 1,194 million, mainly due to restructuring charges.

Retail & Corporate’s pre-tax profit was CHF 683 million compared with CHF 421 million in the previous quarter. The quarter included a CHF 289 million gain from the sale of treasury-related investments, and CHF 24 million in restructuring charges associated with our cost reduction program. Total operating income was CHF 1,218 million, up 25% from the prior quarter. In addition, collective loan loss provisions increased by CHF 73 million, mainly due to the increased credit risks arising predominantly from Swiss corporate clients impacted by the strengthening of the Swiss franc. Net interest income was CHF 595 million, up 3% from the prior quarter due to an increase in treasury-related income. Net fee and commission income of CHF 291 million was 3% lower than the second quarter, mainly due to a significant decrease in the asset base at the beginning of the quarter as a result of weaker equity markets. Net trading income increased by CHF 28 million, or 36%, mainly as a result of a gain related to credit default swaps on certain loans as well as higher foreign exchange income linked to client trading activities. Operating expenses decreased to CHF 535 million from CHF 552 million.

Wealth Management Americas’ pre-tax profit decreased 1% to CHF 139 million from CHF 140 million. In US dollar terms, the pre-tax profit rose slightly as higher operating income was almost entirely offset by higher operating expenses. Operating income increased 1% to CHF 1,294 million from CHF 1,284 million as a result of higher net interest and trading income as well as an increase in realized gains on the sale of securities held as available-for-sale. These effects were partly offset by lower transaction-based revenues resulting from lower client activity. Third quarter net new money was CHF 4.0 billion compared with CHF 2.6 billion in the second quarter. Financial advisors employed with UBS for more than one year and net recruiting of financial advisors contributed to the improvement in net new money. The gross margin on invested assets in Swiss franc terms increased by 4 basis points to 80 basis points, as income increased 1% compared with a 4% decline in average invested assets. Total operating expenses increased 1% to CHF 1,154 million from CHF 1,144 million. The third quarter included total net restructuring charges of CHF 13 million.

Global Asset Management’s pre-tax profit was CHF 79 million compared with CHF 108 million in the prior quarter, and included restructuring charges of CHF 12 million associated with our cost reduction program. Total operating income was CHF 399 million compared with CHF 444 million. Net management fees were lower due to both lower average market valuations and the Swiss franc being stronger for the majority of the quarter, as well as lower transaction fees in global real estate. Performance fees were down in alternative and quantitative investments due to challenging trading conditions during the quarter. Traditional investments also reported a decrease in performance fees. Excluding money market flows, net new money inflows from third parties were CHF 1.5 billion compared with inflows of CHF 5.7 billion in the second quarter. Net inflows were recorded in Asia Pacific, Switzerland and Europe, Middle East and Africa and net outflows in the Americas. Net outflows, excluding money market flows, from clients of UBS’s wealth management businesses were CHF 2.8 billion compared with net outflows of CHF 2.2 billion. The majority of these net outflows were recorded in booking center Switzerland as investors remained cautious in the volatile market environment and tended to move into cash and equivalents. Total gross margin was 30 basis points compared with 32 basis points in the prior quarter, mainly as a result of lower performance and transaction fees. Total operating expenses were CHF 321 million compared with CHF 337 million.

The Investment Bank recorded a pre-tax loss of CHF 650 million compared with a loss of CHF 406 million in the third quarter of 2010. The pre-tax loss, excluding own credit gains of CHF 1,765 million and a trading income loss relating to the unauthorized trading incident of CHF 1,849 million, was CHF 566 million compared with a loss, excluding the own credit gain, of CHF 19 million in the third quarter of 2010. This was due to lower revenues across all business areas in difficult market conditions and the strengthening of the Swiss franc. In investment banking, total revenues were CHF 215 million compared with CHF 422 million. Combined advisory and capital markets revenues decreased 14% to CHF 503 million from CHF 583 million. Securities revenues decreased 27% to CHF 1,303 million from CHF 1,773 million. Equities revenues decreased 30% to CHF 630 million from CHF 904 million. FICC revenues decreased 23% to CHF 673 million from CHF 869 million. A strong performance in the macro business, due to high market volatility and good client flows in foreign exchange, was more than offset by the impact of illiquid credit markets. Total operating expenses decreased 8% to CHF 2,078 million from CHF 2,248 million. Operating expenses for the quarter included a total of CHF 238 million in restructuring costs associated with our cost reduction program.

The Corporate Center’s pre-tax result was a loss of CHF 160 million compared with a loss of CHF 63 million in the previous quarter. This result was mainly due to a valuation loss of CHF 209 million on our option to acquire the SNB StabFund's equity, which was partially offset by a gain on the sale of a property in Switzerland of CHF 78 million.

Capital position and balance sheet

Our BIS tier 1 capital has increased by CHF 0.7 billion and the risk-weighted assets remained approximately at the 30 June 2011 level, improving our BIS tier 1 capital ratio to 18.4% on 30 September 2011 from 18.1% at the end of the previous quarter. Our BIS core tier 1 capital ratio was 16.3%, up from 16.1% on 30 June 2011. On 30 September 2011, our balance sheet assets stood at CHF 1,447 billion, CHF 210 billion higher than on 30 June 2011, mainly due to market and currency driven increases in positive replacement values.

Invested assets

Invested assets were CHF 2,025 billion as of 30 September 2011, compared with CHF 2,069 billion as of 30 June 2011. This decline was primarily attributable to negative market performance, partially offset by the depreciation of the Swiss franc. Of the invested assets, CHF 850 billion were attributable to Wealth Management & Swiss Bank (CHF 720 billion thereof attributable to Wealth Management and CHF 130 billion attributable to Retail & Corporate); CHF 651 billion were attributable to Wealth Management Americas; and CHF 524 billion were attributable to Global Asset Management.

Outlook

Prospects for global economic growth remain largely contingent on the satisfactory resolution of eurozone sovereign debt and banking industry concerns, as well as issues surrounding US economic growth, employment and the US Federal budget deficit. In the absence of such developments, current market conditions and trading activity are unlikely to improve materially, potentially creating headwinds for growth in revenues and net new money. Nevertheless, we will continue to leverage our unparalleled client franchise and competitive advantages in wealth management through closer alignment with a more focused Investment Bank. Implementation of the Investment Bank's client-centric strategy will make the business less complex and more capital efficient and ensure it provides more reliable returns to our shareholders. Our financial, capital and funding positions remain solid and we believe the action we are taking now will strengthen the firm further, delivering improved value to our clients and shareholders. We have every reason to remain confident about our future.

Media release available at www.ubs.com/media

Further information on UBS’s quarterly results is available at www.ubs.com/investors:

• Third quarter 2011 financial report

• Third quarter 2011 results slide presentation

• Letter to shareholders (English, German, French and Italian)

Webcast

The results presentation, with Sergio P. Ermotti, Group Chief Executive Officer, Tom Naratil, Group Chief Financial Officer, and Caroline Stewart, Global Head of Investor Relations, will be webcast live on www.ubs.com/media at the following time on 25 October 2011:

* 0900 CEST

* 0800 BST

* 0300 US EST

Webcast playback will be available from 1400 CEST on 25 October 2011.

UBS AG

Media contact

Switzerland: +41-44-234-85 00

UK: +44-207-567 47 14

Americas: +1-212-882 58 57

APAC: +852-297-1 82 00

www.ubs.com