UBS ended the year with an even stronger capital position and sound liquidity and funding positions, and maintained its standing as one of the world's best capitalized banks. In the fourth quarter, the firm made clear progress towards achieving its strategic goals, reducing Basel III risk-weighted assets (RWA) by an estimated CHF 20 billion and building capital ratios further. UBS's wealth management businesses together delivered quarterly net new money inflows of CHF 5.0 billion, demonstrating clients' continued confidence in the firm amid ongoing market uncertainty. UBS also continued to make progress delivering its previously announced cost reduction program.

The firm's targeted capital structure, which includes 13% in Basel III tier 1 common equity, sends a clear signal about safety and stability. As a clear expression of optimism about the firm's future, UBS reiterates its intention to propose a dividend of CHF 0.10 per share for the financial year 2011 and thereafter implement a progressive capital return program. UBS also intends to issue loss-absorbing capital in 2012 as a step towards meeting the Swiss regulator's requirement that systemically important banks hold up to 19% in total Basel III capital in future.

Full-year highlights

- Net profit attributable to UBS shareholders CHF 4.2 billion; diluted earnings per share

CHF 1.10 - Pre-tax profit up 16% in Wealth Management to CHF 2.7 billion and up 8% in Retail & Corporate to CHF 1.9 billion; Wealth Management Americas continued its convincing turnaround with a pre-tax profit of CHF 504 million compared with a loss of CHF 130 million in 2010

- Costs reduced by CHF 2.1 billion; bonus pool cut 40% on the prior year

- Over CHF 50 billion improvement in wealth management businesses' net new money on the prior year as they attracted net inflows in the Americas, Asia Pacific, emerging markets and globally from ultra high net worth clients

Fourth-quarter highlights

- Pre-tax profit CHF 584 million; net profit attributable to UBS shareholders CHF 393 million; diluted earnings per share CHF 0.10

- Group revenues CHF 6.0 billion; underlying revenues up 5%

- Capital position strengthened further:

- Basel 2.5 tier 1 ratio rose to 16.0% from 13.2%

- Basel 2.5 tier 1 capital increased by CHF 0.9 billion to CHF 38.4 billion

- Basel II tier 1 ratio rose to 19.7% from 18.4%

- Basel III RWA reduced by an estimated CHF 20 billion1, with no significant impact on profitability and including sales of auction rate securities positions, showing clear progress in the implementation of our strategy to reduce RWA in both core and legacy Investment Bank businesses

- Invested assets CHF 2.2 trillion, up 7% on the prior quarter mainly due to positive market performance

- Wealth Management's pre-tax profit CHF 471 million; net new money CHF 3.1 billion, with continued net inflows in Asia Pacific, emerging markets and globally from ultra high net worth clients

- Retail & Corporate recorded a resilient performance with pre-tax profit of CHF 412 million

- Wealth Management Americas' pre-tax profit CHF 114 million; net new money CHF 1.9 billion, driven by recruiting of experienced financial advisors

- Global Asset Management's pre-tax profit up 49% to CHF 118 million due to higher net management fees and higher performance fees

- Investment Bank actively reduced VaR and RWA in turbulent markets; strong performance in credit, macro and emerging markets outweighed by the effect of challenging market conditions on revenues, leading to a pre-tax loss of CHF 256 million

Zurich/Basel, 7 February 2012 – Commenting on UBS’s fourth-quarter results, Group CEO Sergio P. Ermotti said: "More than ever, our clients demand safety, stability and the best investment advice to steer them successfully through turbulent markets. We are uniquely positioned to deliver exactly this. We continue to strengthen our capital, putting us ahead as the industry as a whole builds towards new capital requirements, and we place clients at the very center of everything we do, with comprehensive products and services tailored solely to their needs. Making the best possible use of these clear competitive advantages will enable us to provide attractive and sustainable returns to our shareholders."

Fourth-quarter net profit attributable to UBS shareholders CHF 393 million

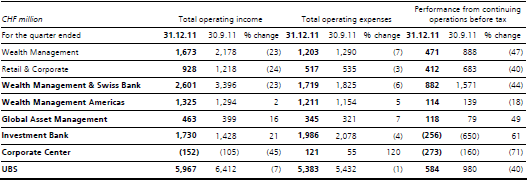

Net profit attributable to UBS shareholders was CHF 393 million compared with CHF 1,018 million in the third quarter. Pre-tax profit declined by CHF 396 million to CHF 584 million. In the fourth quarter, we recorded a net income tax expense of CHF 189 million compared with a net income tax benefit of CHF 40 million in the prior quarter. Operating expenses were CHF 5,383 million, down CHF 49 million, or 1%, compared with the third quarter. Salaries and variable compensation decreased by CHF 317 million, or 12%, mainly reflecting reduced expenses for variable compensation and lower restructuring charges. We employed 64,820 personnel as of 31 December 2011 compared with 65,921 personnel as of 30 September 2011. The decrease in personnel of 1,101 during the quarter is mainly related to our cost reduction program.

Wealth Management’s pre-tax profit was CHF 471 million in the fourth quarter of 2011 compared with CHF 888 million in the previous quarter, which included a gain of CHF 433 million from the sale of our strategic investment portfolio and CHF 85 million of restructuring charges. Excluding this gain, the gross margin on invested assets declined by 6 basis points to 91 basis points as a result of lower client activity and lower interest income. Net new money inflows of CHF 3.1 billion were recorded in the fourth quarter. International wealth management reported slightly higher net inflows of CHF 4.2 billion, as net inflows continued in Asia Pacific and emerging markets, as well as globally from ultra high net worth clients. In Europe, we reported small net new money inflows. Invested assets were CHF 750 billion on 31 December 2011, up CHF 30 billion from 30 September 2011, with half of the improvement occurring towards the end of the quarter. This increase mainly reflected a recovery in global equity markets during the quarter, the depreciation of the Swiss franc against the US dollar and net new money inflows. Operating expenses decreased to CHF 1,203 million from CHF 1,290 million.

Retail & Corporate’s pre-tax profit was CHF 412 million in the fourth quarter of 2011 compared with CHF 683 million in the third quarter, which included a CHF 289 million gain from the sale of our strategic investment portfolio.The fourth quarter included CHF 8 million of restructuring charges associated with our cost reduction program compared with CHF 24 million in the prior quarter.

Adjusted for the abovementioned third-quarter gain from the sale of our strategic investment portfolio, operating income remained stable, as a decline in income was offset by lower credit loss expenses following a CHF 73 million increase in collective loan loss provisions in the third quarter. Operating expenses decreased to CHF 517 million from CHF 535 million in the third quarter.

Wealth Management Americas’ pre-tax profit was CHF 114 million compared with CHF 139 million in the prior quarter. In US dollar terms, operating income decreased 5% as a result of lower fees and commissions as well as a decrease in income from financial investments held in our available-for-sale portfolio. Operating expenses declined 3% in US dollar terms, reflecting lower personnel and non-personnel expenses, including lower restructuring charges and a decline in litigation provision charges. Net new money was CHF 1.9 billion compared with CHF 4.0 billion in the previous quarter. Net recruiting of financial advisors drove net new money during the quarter. Including interest and dividend income, net new money inflows were CHF 7.9 billion compared with inflows of CHF 8.0 billion in the prior quarter. The gross margin on invested assets in Swiss franc terms decreased by 2 basis points to 78 basis points, as income increased 3% compared with a 5% increase in average invested assets.

Global Asset Management’spre-tax profit in the fourth quarter of 2011 was CHF 118 million compared with CHF 79 million in the prior quarter. Total operating income was CHF 463 million compared with CHF 399 million. Net management fees increased due to higher average invested assets resulting from the depreciation of the Swiss franc and improved market valuations. Additional contributors to the increase in net management fees included CHF 9 million from the ING Investment Management business acquired in Australia and higher transaction fees in global real estate. Performance fees were higher by CHF 15 million, primarily in alternative and quantitative investments. Excluding money market flows, net new money inflows from third parties were CHF 0.3 billion compared with CHF 1.5 billion in the third quarter. Third party net inflows were recorded in Europe and the Middle East, Switzerland and Asia Pacific, and net outflows were recorded in the Americas. Total gross margin was 34 basis points compared with 30 basis points in the prior quarter, primarily as a result of higher performance and transaction fees. Total operating expenses were CHF 345 million compared with CHF 321 million in the prior quarter.

The Investment Bank recorded a pre-tax loss of CHF 256 million in the fourth quarter of 2011 compared with a pre-tax profit of CHF 100 million in the fourth quarter of 2010. Excluding own credit, the pre-tax loss was CHF 186 million compared with a pre-tax profit of CHF 608 million at the end of the fourth quarter of 2010, reflecting lower revenues across all business areas amidst more challenging market conditions. In investment banking, total revenues were CHF 280 million compared with CHF 910 million. Advisory revenues decreased 4% to CHF 254 million from CHF 264 million. Capital market revenues were CHF 268 million compared with CHF 757 million due to reduced capital market activity. Securities revenues decreased 19% to CHF 1,518 million from CHF 1,884 million in the fourth quarter of 2010. Equities revenues decreased 26% to CHF 704 million from CHF 945 million. Fixed income, currencies and commodities (FICC) revenues decreased 13% to CHF 814 million from CHF 939 million in the fourth quarter of 2010. Instability in the eurozone, weak economic data and lack of liquidity continued to impact credit markets, while the macro businesses benefited from increased volatility and improved client activity. A strong performance in the macro business, with revenues more than doubling to CHF 851 million, was offset by lower revenues in other FICC and credit. The combined revenues from credit, macro and emerging markets increased 27% to CHF 1,260 million from CHF 991 million. Total operating expenses decreased 4% to CHF 1,986 million compared with CHF 2,078 million. During the fourth quarter of 2011, we continued to actively reduce risk-weighted assets, particularly in our FICC business. Risk-weighted assets in the Investment Bank on a Basel 2.5 basis decreased to CHF 156 billion at the end of the fourth quarter from CHF 198 billion at the end of the third quarter.

The Corporate Center’s pre-tax result in the fourth quarter of 2011 was a loss of CHF 273 million, compared with a loss of CHF 160 million in the previous quarter. This result was primarily due to a decline in the value of the option to acquire the SNB StabFund's equity. The third quarter also included a gain of CHF 78 million on the sale of a property in Switzerland.

Results by reporting segment

Capital position and balance sheet

Our Basel II tier 1 capital ratio improved from 18.4% at the end of the third quarter to 19.7% at the end of the fourth quarter. From 31 December 2011 UBS capital disclosures fall under the revised Basel II market risk framework referred to as Basel 2.5. Our Basel 2.5 tier 1 capital increased by CHF 0.9 billion from the prior quarter-end and our Basel 2.5 risk-weighted assets dropped by CHF 42.9 billion to CHF 241 billion as of 31 December 2011. As a result, our Basel 2.5 tier 1 capital ratio improved to 16.0% from 13.2% on 30 September 2011. On 31 December 2011, our balance sheet assets stood at CHF 1,419 billion, CHF 28 billion lower than on 30 September 2011, mainly due to lower positive replacement values.

Invested assets

Invested assets were CHF 2,167 billion as of 31 December 2011 compared with CHF 2,025 billion as of 30 September 2011. This increase was primarily attributable to positive market performance, as well as the appreciation of the US dollar against the Swiss franc. Of the invested assets, CHF 750 billion were attributable to Wealth Management, CHF 134 billion were attributable to Retail & Corporate; CHF 709 billion were attributable to Wealth Management Americas; and CHF 574 billion were attributable to Global Asset Management.

Cost management

Total operating expenses for 2011 were reduced by CHF 2.1 billion on the prior year to CHF 22.4 billion. In the fourth quarter, UBS continued to make progress delivering its previously announced cost reduction program, with headcount down by 1,101 on the prior quarter. More benefits as a result of these measures are expected to come through in 2012. Capacity for further tactical cost-cutting measures is limited and so future programs will focus on strategic changes in the firm's organizational design and structures. UBS will continue to seek additional efficiencies by exploring opportunities to lower the structural cost base of the firm. In addition, if market conditions deteriorate materially, UBS will take further measures to reduce its cost base.

UBS Pension Fund in Switzerland

The UBS Pension Fund in Switzerland is implementing various changes: in addition to using updated actuarial assumptions in 2011, including higher future life expectancy, with effect from 2013 the conversion rate used for the calculation of the pension at retirement will be reduced and the regular retirement age will be raised by two years. These measures have differing accounting effects for UBS. Mainly as a result of the updated actuarial assumptions, UBS’s defined benefit obligation for the Swiss pension fund increased by CHF 1.5 billion in the fourth quarter of 2011, generating an actuarial loss. Under current IFRS accounting requirements, this loss is largely deferred, but will be deducted from the firm's IFRS equity upon adoption of the revised IFRS standard (IAS 19R), together with all other unrecognized actuarial losses from previous years. The plan changes to the Swiss pension fund are accounted for differently. They will result in a one-off pre-tax gain of approximately CHF 485 million in the first quarter of 2012 and a benefit to equity of approximately CHF 245 million upon adoption of IAS 19R.2

Outlook

As in the fourth quarter of 2011, ongoing concerns surrounding eurozone sovereign debt, the European banking system and US federal budget deficit issues, as well as continued uncertainty about the global economic outlook in general, appear likely to have a negative influence on client activity levels in the first quarter of 2012. Such circumstances would make sustained and material improvements in prevailing market conditions unlikely and would have the potential to generate headwinds for revenue growth, net interest margins and net new money. In light of the above, traditional improvements in first quarter activity levels and trading volumes may fail to materialize fully, which would weigh on overall results for the coming quarter, most notably in the Investment Bank. Nevertheless, we believe our asset-gathering businesses as a whole will continue to attract net new money as our clients recognize our efforts and continue to entrust us with their assets. We are confident that the coming quarters will present additional opportunities for us to strengthen our position as one of the best capitalized banks in the world, and we will continue to focus on reducing our Basel III risk-weighted assets and building our capital ratios. We continue to have the utmost confidence in our firm's future.

Media release available at www.ubs.com/media and www.ubs.com/investors.

Further information on UBS’s quarterly results is available at www.ubs.com/investors:

• Forth quarter 2011 financial report

• Forth quarter 2011 results slide presentation

• Letter to shareholders (English, German, French and Italian)

Webcast

The results presentation, with Sergio P. Ermotti, Group Chief Executive Officer, Tom Naratil, Group Chief Financial Officer, and Caroline Stewart, Global Head of Investor Relations, will be webcast live on www.ubs.com/media at the following time on 7 February 2012:

* 0900 CEST

* 0800 BST

* 0300 US EST

Webcast playback will be available from 1400 CET on 7 February 2012.

UBS AG

Media contact

Switzerland: +41-44-234-85 00

UK: +44-207-567 47 14

Americas: +1-212-882 58 57

APAC: +852-297-1 82 00

www.ubs.com