Macro thoughts and portfolio themes

Macro thoughts and portfolio themes

With persistent inflation and US employment data remaining resilient, markets appear to be pricing in a higher terminal Fed Funds rate for this hiking cycle.

For many quarters now, we described the long-term factors contributing to higher prices across much of the economy; however, signs of cooling are starting to appear. Since reaching a peak in the summer, home prices are declining and forecasts of recession for the US and other developed markets are becoming increasingly more consensus. Several emerging market countries are grappling with a strong US dollar and balance-of-payments crises as energy and food importation costs soar and take a toll on foreign exchange reserves.

Europe likely faces a challenging winter with a potential energy shortage, escalating geopolitical threats and hawkish central bank policy. In the UK, an introduction and quick reversal on controversial fiscal policy resulted in material volatility in gilts and the sterling, leading to a major liquidity crisis that was only averted by the Bank of England’s emergency action. This revealed a heighted risk of leverage utilization by many UK pensions with LDI approaches, something that became apparent as financial conditions tightened. While the subsequent fire sales (usually of liquid assets) to meet margin calls have abated, the shock has started a quieter and longer process of allocators to re-evaluating their portfolio liquidity and asset quality. Investors remain on heightened alert for the appearance of potential unforeseen market fragility as rates increase and spreads widen in tandem. Quantitative tightening is exacerbating the problem; leverage will come out of the system and with it, assets are expected to be sold.

While the US consumer continues to be relatively well positioned, corporate fundamentals and earnings remain in focus as wage inflation and margin compression impairs profitability. Corporations’ ability to borrow will be scrutinized as we approach a period of downgrades in the credit cycle. The path of inflation remains difficult to project, as does central banks’ policy response. The distribution of outcomes has become increasingly wide and episodic mis-pricings are also becoming more common. Moreover, as the Fed removes liquidity, more market participants appear to have decreasing confidence in the Fed’s reaction function, and ability or willingness to rescue markets in the event of a systematic shock.

Portfolio positioning

Portfolio positioning

At HFS, we have been preparing our portfolios for this new regime of higher inflation and lower growth and we expect risk assets to remain volatile.

As such, we remain defensively positioned with beta to equity and credit markets at historically low levels, while raising the bar for suitable opportunistic investments.

We generally have a less favorable outlook on strategies that rely on fundamentals and buy-and-hold styles. In contrast, we are playing offense in strategies we believe can monetize the higher volatility across asset classes, including FIRV, macro, commodities and trading-oriented credit long / short. We also favor tactical managers that can lean net short or trade quickly to seek to take profits or minimize losses.

Lastly, as market stress remains elevated, preserving our liquidity profile will give us dry powder as we attempt to take advantage of recurring market dislocations.

Corporations’ ability to borrow will be scrutinized as we approach a period of downgrades in the credit cycle.

Equity Hedged

Sub-strategy | Sub-strategy | Q4 2022 | Q4 2022 |

|---|---|---|---|

Sub-strategy | Fundamental | Q4 2022 | 12 - |

Sub-strategy | Equity Event | Q4 2022 | 14 |

Sub-strategy | Opportunistic Trading | Q4 2022 | 4 - |

Sub-strategy | Equity Hedged Total | Q4 2022 | 30 - |

Credit/Income

Sub-strategy | Sub-strategy | Q4 2022 | Q4 2022 |

|---|---|---|---|

Sub-strategy | Distressed | Q4 2022 | 1 |

Sub-strategy | Corporate Long/Short | Q4 2022 | 9 |

Sub-strategy | Reinsurance / ILS | Q4 2022 | 1 |

Sub-strategy | Asset Backed | Q4 2022 | 3 - |

Sub-strategy | Other Income | Q4 2022 | 2 + |

Sub-strategy | Credit/Income total | Q4 2022 | 16 |

Relative Value

Sub-strategy | Sub-strategy | Q4 2022 | Q4 2022 |

|---|---|---|---|

Sub-strategy | Quantitative Equity | Q4 2022 | 7 + |

Sub-strategy | Merger Arbitrage | Q4 2022 | 1 |

Sub-strategy | Cap Structure/Vol Arb | Q4 2022 | 4 |

Sub-strategy | Fixed Income Relative Value | Q4 2022 | 12 + |

Sub-strategy | Agency MBS | Q4 2022 | 3 |

Sub-strategy | Relative Value | Q4 2022 | 27 |

Trading

Sub-strategy | Sub-strategy | Q4 2022 | Q4 2022 |

|---|---|---|---|

Sub-strategy | Systematic | Q4 2022 | 3 |

Sub-strategy | Discretionary | Q4 2022 | 13 |

Sub-strategy | Commodities | Q4 2022 | 10 |

Sub-strategy | Trading | Q4 2022 | 26 + |

Niche & other

Sub-strategy | Sub-strategy | Q4 2022 | Q4 2022 |

|---|---|---|---|

Sub-strategy | Niche Liquidating/Side Pockets | Q4 2022 | 1 |

Sub-strategy | Niche & other | Q4 2022 | 100 + |

Equity Hedged -

Equity Hedged -

- Allocations to Equity Hedged will likely be reduced as we continue to build balanced portfolios around lower net managers and actively limit equity beta. We are most active in trimming event-oriented approaches as the duration of catalyst-driven trades tends to naturally extend in current market conditions.

- Portfolio exposures to Asia have been reduced, both in China and, to a lesser degree, in Japan.

Asset Backed -

Asset Backed -

- Exposure has been reduced after a period of outperformance; remaining exposure is focused on high quality collateral seeking to provide consistent and attractive income.

Fixed Income Relative Value +

Fixed Income Relative Value +

- HFS maintains a positive outlook on FIRV due to increased rates volatility, higher yields, higher inflation and monetary policy normalization. Our more constructive thesis, expressed in the last four quarters, has typically been rewarded with generally positive performance year-to-date. We have increased our allocation target in portfolios.

Trading +

Trading +

- HFS maintains a positive outlook on the discretionary trading strategy, as reflected in our relatively full target allocations. The opportunity set remains broad-based with a diversity of global themes and trends.

- In commodities, we are focused on managers who can trade both directionally and relative value, seeking alpha and tactical beta, with a disciplined risk framework. We intend to add opportunistically where we find strong managers or when specific themes come into play.

- Our outlook for systematic trading continues to be positive as we transition to a regime with more frequent and pronounced trends across major asset classes.

Strategies

Strategies

Trading

HFS maintains a positive outlook on the discretionary trading strategy, as reflected in our relatively full target allocations.

The opportunity set remains broad-based with a diversity of global themes and trends. We continue to focus on managers who can trade nimbly across a wide range of markets and asset classes, as well as construct convex portfolios and sustain a robust risk management discipline.

In commodities, we are focused on managers who can trade both directionally and relative value, seeking alpha and tactical beta, with a disciplined risk framework. We intend to add opportunistically where we find strong managers or when specific themes come into play. Our outlook for systematic trading continues to be positive as we transition to a regime with more frequent and pronounced trends across major asset classes.

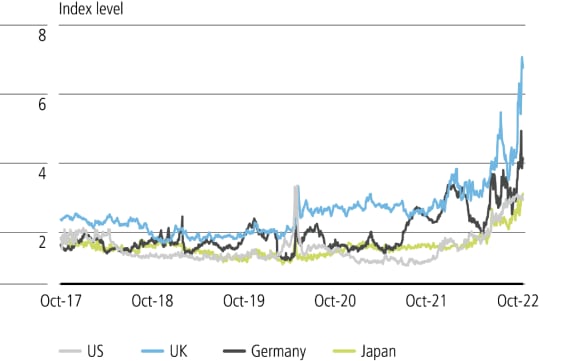

Sovereign Bond Liquidity Conditions

Relative Value (RV)

Relative Value (RV)

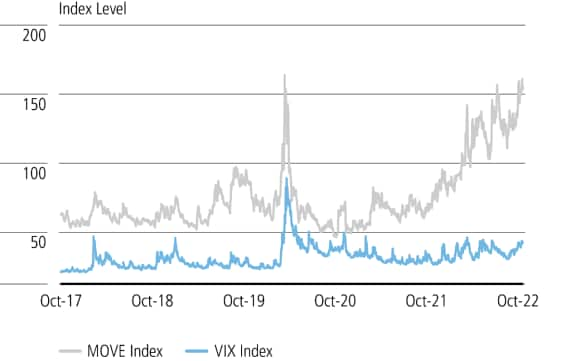

HFS maintains a positive outlook on FIRV due to increased rates volatility, higher yields, higher inflation and monetary policy normalization.

We have increased our allocation target in portfolios. Elsewhere in Relative Value, our outlook for capital structure / volatility arbitrage is cautious. For this part of the cycle, we prefer managers that target shorter duration, lower premium, and higher dollar priced / higher delta convertibles, while avoiding credit-sensitive convertibles. We have a modest allocation to merger arbitrage. Ongoing macro uncertainty and geopolitical volatility, higher levels of buyer’s remorse, increased deal break downside levels, and a larger portion of non-strategic M&A volume continues to be concerning. As such, we remain cautious in this strategy despite wider spread levels.

Lastly, we are positive on quantitative equity, but remain highly selective and acknowledge both the limited capacity in this space and difficulty in launching new standalone hedge funds.

Market Volatility

Equity Hedged (EH)

Equity Hedged (EH)

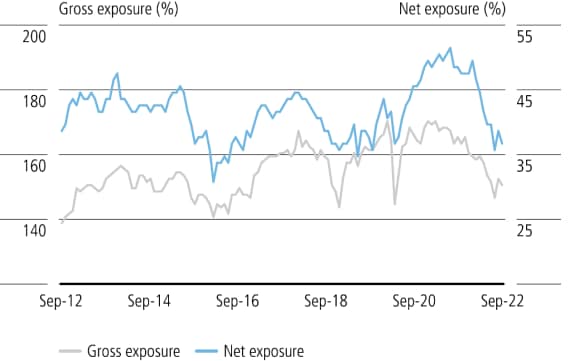

Allocations to Equity Hedged will likely be reduced as we continue to build balanced portfolios around lower net managers and actively limit equity beta. We are most active in trimming event-oriented approaches as the duration of catalyst-driven trades tends to naturally extend in current marketconditions. In contrast, we expect multi-PM platforms, which typically employ a tighter portfolio construction approach, to continue performing well. We are also working with managers to sift through the dislocations and capital flight from several areas, such as the biotechnology sector. While Europe is relatively cheap by historical standards, macroeconomic and geopolitical risks remain uncomfortably high. In China, although the market has now digested the impacts of Common Prosperity policies, a combination of housing market concerns, COVID controls and geopolitical tension still challenge fundamental approaches. In Japan, we plan on reducing event exposure due to a slowdown in capital market activities.

Average Gross and Net exposure

Credit / Income

Credit / Income

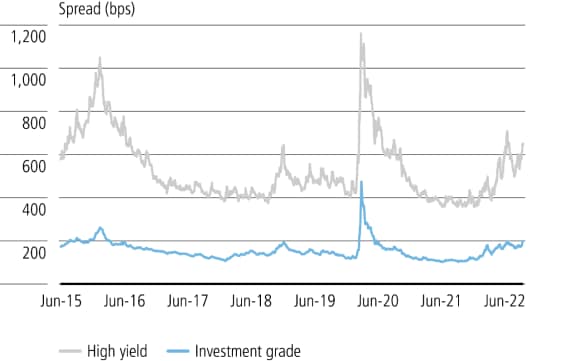

For our Credit / Income strategy, we maintain core allocations in agency MBS and corporate long / short sub-strategies.

Within asset-backed, exposure has been reduced after a period of outperformance; remaining exposure is focused on high quality collateral seeking to provide consistent and attractive income.

Agency MBS also provides carry, while near-term market volatility provides relative value trading opportunities and slowing prepayments may provide upside from spread tightening in the long-term.

HFS continues to focus our research efforts on tactical, low net long / short managers focused on European credit markets.

Across the platform, we are starting to see an increasing volume of high quality, asymmetric, one-off credit opportunities where selective capital might be deployed. It is still early, but eventually there will come a time to lean into the opportunities and increase risk levels.

Investment grade and high yield cash spreads

Endnotes

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.