Our UBS Capital Markets team is here to help you trade UBS ETFs, and can offer advice on topics such as trading, liquidity, fund wrappers and prices. Explore our FAQs below or get in touch to see how we can help.

Explaining the ecosystem

Explaining the ecosystem

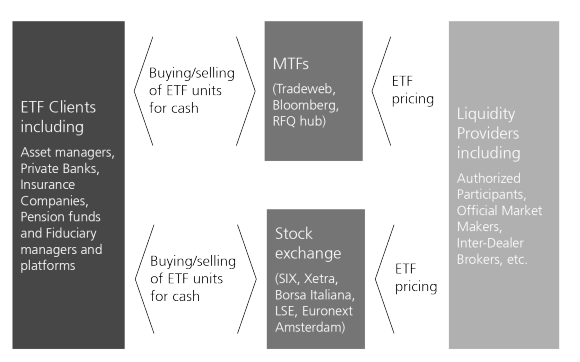

We provide support to clients on topics related to the ETF trading ecosystem (i.e. how, when and with whom they should trade UBS ETFs). We work in parallel with our Distribution colleagues so that clients of UBS ETFs have a positive experience trading our products.

Improving the trading architecture

Improving the trading architecture

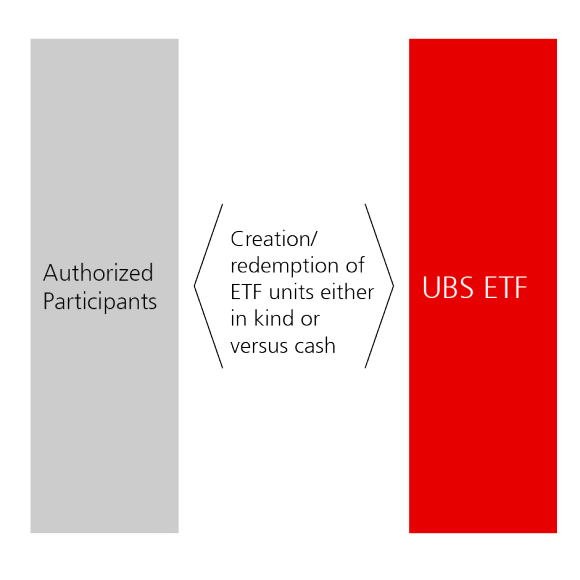

We partner with our colleagues in Product Development and Portfolio Management to continuously improve the trading architecture of UBS ETFs. This enables our partners in the ETF trading ecosystem to quote tight bid ask prices to our clients and thus reduce the Total Cost of Ownership related to our products.

Recognition

Recognition

Our ranking as Passive Manager of the Year 2021 at the Insurance Asset Risk EMEA Awards was the latest in a stream of awards for our ETF capabilities over recent years.

UBS ETF Capital Markets Weekly

Have a look at our ETF Capital Markets Weekly. The document highlights primary market activities relevant for UBS ETFs, the largest secondary market trades, a market review as well as a look at the week ahead. Enjoy reading and share your comments.

Whether you have a question or a request, we will be happy to get in touch with you.

-

Florian Cisana

Head UBS ETF & Index Fund Sales Nordics, France and Israel

-

Gerald Daepp

UBS ETF & Index Fund Sales Nordics, France and Israel