Webinar: Climate Aware Passive Investing

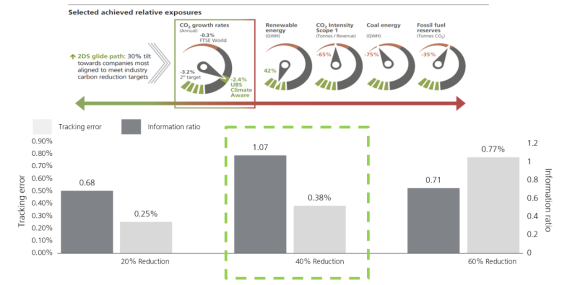

Index investors can tilt their portfolio to align with a lower carbon future

Sustainable investing is a strategic priority for UBS Asset Management. We have over 20 years of experience in Sustainable Investing experience, and a dedicated framework for assessing climate-related risks in investment portfolios. We proudly take a leading position on environmental issues with a commitment that began back in 2000 when we became a part of the UN Global Compact and later became one of the first signatories to the UN Environment Programme. More recently, we have become active members of Climate Action 100+ initiative and are currently leading on 8 company engagements.

Amy Farrell, Senior Investment Specialist for the Sustainable and Impact Investing team, Francis Condon, Sustainable and Impact Investing Research Analyst, and Rodrigo Dupleich Ulloa, Senior Quantitative Analyst, discuss their framework for climate-aware passive equity investing.

Key webinar takeaways

Key webinar takeaways

- Institutional investors globally have recognized the benefits of climate-smart investing and how it aligns with their fiduciary duties to safeguard their beneficiaries’ investments by understanding the climate-related risks in their portfolios.

- An estimated $26 trillion in economic opportunities will be generated by the transition to a low-carbon economy, including opportunities in renewable energy1

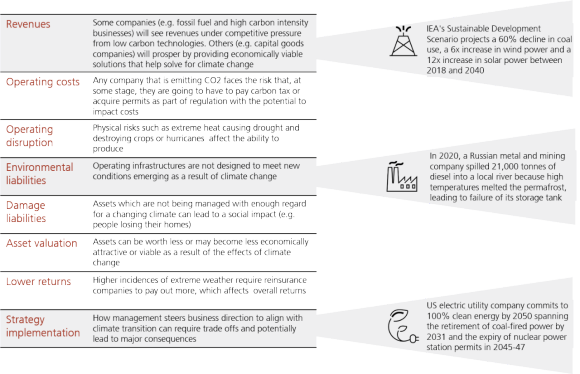

- Practically all sectors face specific climate-related opportunities and risks, and companies that focus on understanding how climate change affects their business models, are managing their carbon footprints, and communicating to investors benefit from demonstrating a reduced risk profile or exposure to demand for climate solutions

Q&A:

Q&A: