Asia fixed income: a stand-out market

Hayden Briscoe, Head of Fixed Income, Asia Pacific gives his outlook for Asia fixed income markets

Asia fixed income: a stand-out market – key takeaways

Asia fixed income: a stand-out market – key takeaways

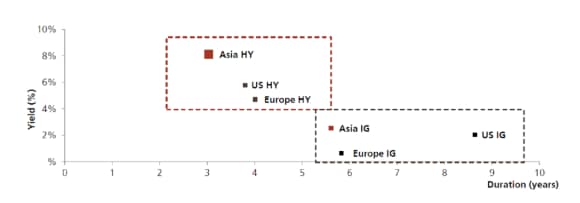

- Both Asia High Yield (AHY) and Investment Grade (AIG) fixed income categories offer attractive yields and duration compared to the US and EU;

- High spreads in both the AHY and AIG categories will likely close in the coming 12 months;

- Recent policy changes in the China property sector have opened up a rerating process, which is a major opportunity for bond investors.

Both Asia High Yield (AHY) and Investment Grade (AIG) fixed income categories offer attractive yields and duration compared to the US and EU because we haven’t had a central bank buying paper in the market in Asia, which explains why we haven’t really had the catch-up phase seen in Europe and the US.

Yield/Duration ratio for high yield (HY) and investment grade (IG) bonds

Yield/Duration ratio for high yield (HY) and investment grade (IG) bonds

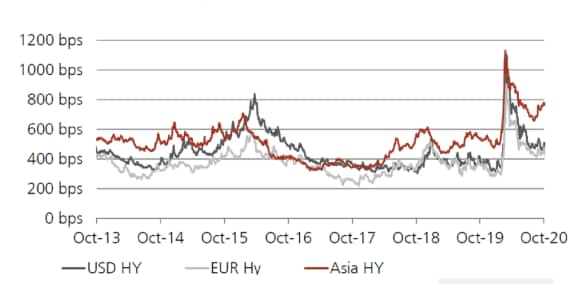

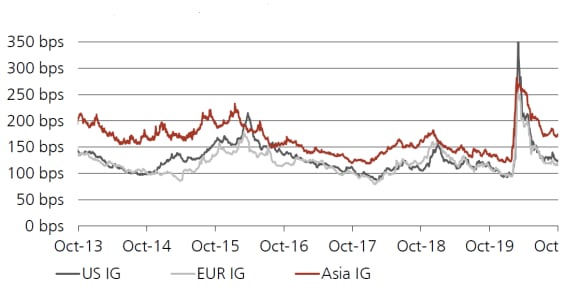

From a historical perspective, spreads in both the AHY and AIG categories are high, and particularly for AHY, and we expect that those gaps will close in the coming 12 months, particularly if growth starts to slow and further rate cuts come toward the end of the first half of 1H21.

High Yield Credit Market: Spreads

High Yield Credit Market: Spreads

Investment Grade Credit Market: Spreads

Investment Grade Credit Market: Spreads

Turning to China’s property sector, a key one in the Asia high yield universe, there are a series of supportive trends for the sector, including industry consolidation, steady price appreciation, as well as growing sales.

Continuing on the property theme, recent policy changes offer a key opportunity.

The Chinese government’s ‘three red lines’ policy approach subjects developers to lower balance sheet leverage ratios and limits non-compliant companies from expanding their balance sheets.

We believe that this marks the start of a major rerating, which opens up big opportunities for active investors in the sector.