China's silver economy

Greying China is a golden opportunity, but why?

China's silver economy – in 60 seconds

China's silver economy – in 60 seconds

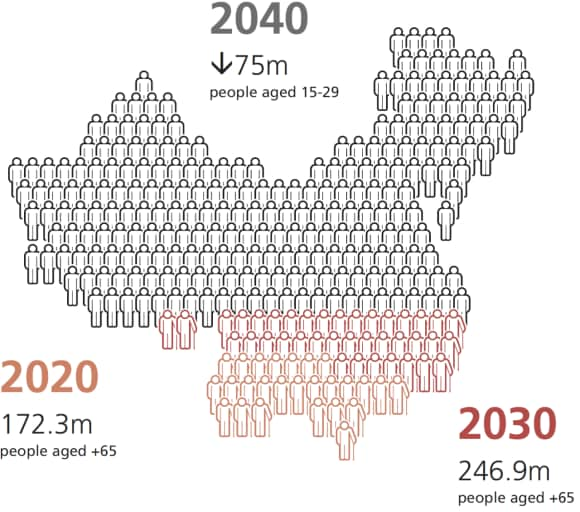

- China's population of people aged over 65 will reach 172.3m in 2020, and is expected to grow to 246.9m by 2030;

- For many, China's rapidly aging population is a weight on the economy, but for investors there are significant opportunities;

- Consumer, healthcare sectors have strong growth prospects based on China's expanding aged population;

- Companies able to develop the products, treatments and services demanded by China's aged population have a good springboard for global growth, since ageing populations are also a global problem.

Ikea has had a successful time in China, but it is having a tough time in some of its canteens.

That's because they are being invaded.

Specifically, by thousands of old people who turn up early in the day, buy a cup of coffee (with free refills), and then stay all day camped out in the cafeterias.

These aged visitors come to Ikea to socialize, mainly because their ranks are growing in such number that China's social services and elderly support services aren't sufficient to look after them.

Aging China: by the numbers

Aging China: by the numbers

While that's a worry for Ikea, the numbers associated with China's aging population are truly staggering:

- 172.3 million people aged 65+ in 2020, according to United Nations data;

- 246.9 million people aged 65+ in 2030, according to United Nations data1;

- The total number of people in the 15-29 age bracket will fall by 75 million by 20402;

- State pension expenditure will grow, and there will be a projected funding deficit of RMB 890bn (USD 126.5bn) by 20203;

China is all too aware of the implications for the economy, so it has removed the one-child policy, invested in old age care, raised taxes to fund pensions, eased immigration rules, and promoted less labor intensive, higher-value manufacturing.

The results of these policies will take time to show a noticeable effect. However, for investors the focus should be on what implications this has now.

While the example of Ikea shows a dilemma, China's ageing, greying population has the potential to amount to a golden opportunity, and enterprising entrepreneurs in China are looking at ways to capture it.

Silver Foxes and Old Fresh Meat

Silver Foxes and Old Fresh Meat

When Wang Deshun strode down the catwalk at China Fashion Week in 2015 he caused quite a stir.

It wasn't that he was clad in an outrageous design, it was that he was 80 years-old, bare-chested and dressed in a modest pair of branded trousers.

An ex-bus conductor, Wang became an internet sensation, earning the nicknames 'silver fox,' 'old fresh meat,' and 'hot grandpa' as well as further high-profile appearances with international brands.

While this appearance might have caused a flurry with fashionistas, it made perfect sense for the companies engaging Wang.

Why? Because it gave them an entry point into a large and potentially lucrative market segment, namely, China's rising population of elderly consumers.

Wang and other 'silver foxes,' like Huang Yanzhen, have emerged as influencers for China's elder generation and now have sizeable online followings.

Greying China is a goldmine

Greying China is a goldmine

This demographic, already significant in number, is catching up with behaviors of the younger generation: WeChat had 61 million elderly users aged between 55 and 70 years old at the end of 2018, and 7.5 million users registered on TMall, China's most popular online sales platform.

And tech firms are adapting to suit them, with Alibaba releasing a new version of its Taobao e-commerce app specifically for older users. The new app features simplified functions and also has links to users' children's payment accounts.

More than consumer goods, older age Chinese are a sizeable source of demand for overseas travel, particularly for tour groups and other tailored tourist experiences.

WeChat had 61 million elderly users aged between 55 and 70 years old at the end of 2018, and 7.5 million users registered on TMall, China's most popular online sales platform.

But China's massive elderly population is also a potential goldmine for healthcare companies, and one reason is because it is a huge source of medical data.

That's why medtech companies are travelling China's rural areas and offering free medical tests, like blood tests, heart checks, x-rays. Linked with hospitals in urban areas, elderly people can then have their results reviewed by doctors in big cities.

The world's largest old age dataset

The world's largest old age dataset

The benefits for patients are obvious, including both easier access and better quality care than may be available in rural China.

But for the companies themselves, the benefit is one of data, and lots of it. The sheer volume of data such testing provides is a goldmine for healthcare companies.

That's because that data on millions of health conditions is valuable testing data which companies can use to detect changes in health conditions, treatments and responses to drugs, and use them to create ever-more effective drugs and treatment.

And that's going to be a highly lucrative dataset as the 65+ demographic grows and see more cases of age-associated conditions, such as mobility, vision, and hearing impairment, plus a greater number of chronic disease cases, such as diabetes and hypertension.

Watch Bin Shi talk about China's healthcare sector here

Final Thoughts

Final Thoughts

So, while China's rapidly greying economy is a challenge for the government, it can be a golden opportunity for investors focusing on the right industries.

Both now and in the future, the demographic group of elderly citizens is likely to be a huge source of demand for sectors like healthcare, consumer services, and insurance.