Turning off autopilot

The case for going Global and Active in fixed income allocations

By: Alexander Wise, Investment Specialist, UBS Asset Management

The rise of passive investment since the beginning of this decade has encouraged the debate as to whether active portfolio management adds value.

Whilst we believe there is no “one size fits all” approach for all investors, on the following pages, we outline why we think going Global and Active in your Fixed Income allocation can add value.

Setting the scene – current environment and concerns

Setting the scene – current environment and concerns

The US economy is arguably in the later stages of the economic cycle, which has been markedly extended by ultra-loose central bank policy post the financial crisis. Other central banks have followed a similar policy path, but with varying success. Countries are now at different points of the cycle, but with uniformly low rates, which brings a unique combination of risks for bond investors.

Sudden bouts of volatility in asset prices, such as those experienced by investors since late 2018 are not uncommon at different stages of the economic cycle, but the causes may vary. Since the end of the Great Financial Crisis (GFC) three broad themes have converged posing challenges for bond investors and contribute to the potential for higher volatility today. First and foremost the most obvious consequence of policy responses to the GFC by many developed market central banks was to force bond yields dramatically lower.

Sovereign issuers and corporates have subsequently taken advantage of a prolonged period of low rates to increase borrowing, while paying historically very low yields to invet- sors. Finally and more recently, rising tensions in global trade and, in many countries, a shift in political stance away from the center ground is creating heightened uncertainty over the outlook for global growth.

If these growing risks were to be reflected in rising bond yields, the immediate consequences for investors could be significant. Certainly, the scale of downside risks that would be posed by higher yields has shifted in the last decade.

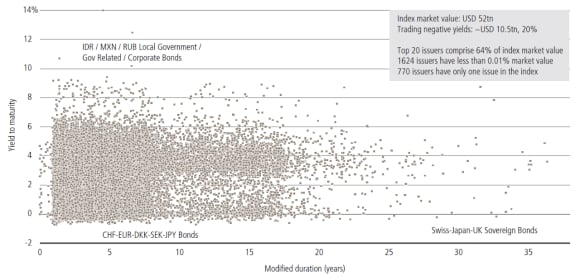

To understand this a little better, we can consider the impact of higher yields on the overall global investment grade fixed income universe (as represented by the Bloomberg Barclays Global Aggregate Index, which is a common bond index tracked by investors).

As the chart in exhibit 1 illustrates, the effect of asset purchas- es conducted by central banks and investor demand for income have combined to depress yields close to all-time lows. Meanwhile, the interest rate sensitivity of the overall bond universe (duration) is at an all-time high, again driven by low policy rates, but also a shift to longer dated issuance by many borrowers since the financial crisis. The danger for investors, particularly those passively tracking a broad bond index is that a given move higher in bond yields would generate higher losses than would have been the case for the same move in prior years.

Exhibit 1: Low yields – high duration

Other factors for consideration

Other factors for consideration

Fixed income is the biggest asset class in terms of invested capital but this can create challenges for investors.

Technical factors to consider:

Different actors, different motives

- It is important to note that different actors in the bond market are driven by different motives, creating market dislocations where active managers can add value. For example central banks are active in bond markets often to manage liquidity needs or as an explicit part of managing their inflation mandate, (as mentioned above). And then there are liability driven investors that have a focus purely on duration matching. Investor preferences and behavioral factors can also play a significant role, for example when investors are forced to sell bonds that are downgraded below a certain rating. The one thing all these investors have in common is that they tend to be insensitive to pricing or measures of fair value. This adds an extra dimension of market dislocations where active investors can add value, actively navigating the market structure.

Dangers in market-value weighted indices

- Owning debt is different to owning equity. While debt owners may be higher on the subordination scale (and bene- fit from certain protections), the return profile of bonds is highly asymmetric meaning a limited upside but potentially significant downside. The majority of fixed income indices are constructed on a market value basis

- which gives the largest borrowers the largest access to capital. This means index investors naturally have the biggest exposure to the most indebted companies or countries, which may not be appropriate. Clearly this is inefficient from an economic perspective and may encourage the build-up of credit bubbles. Given the extremely loose monetary policy seen post credit crisis, being “flexible” and “selective” is key.

- During times of market stress, when certain more liquid issues may underperform the broad market, investors tend to “head for the doors” indiscriminately selling what they can. This provides an opportunity for active investors, who can selectively act as liquidity providers, seizing the opportunity

Exhibit 2: Analysis of bond indices

Beyond Duration

As well as a longer duration there are other changes in global bond market composition that add to downside risks for investors. A more granular analysis of the Global Aggregate Bond Index shown in exhibit 2, highlights two further important points to consider:

- Negative Yields

In several countries central banks have been prepared to take policy rates into negative territory as a tool to help them meet their inflation targets or to prevent an undesired strengthening of their currencies relative to others. Europe and Japan are prime examples of the former with countries like Switzerland and Sweden in the latter camp. This has a knock-on effect of pulling bond yields in those countries into negative territory, particularly in short and intermediate maturity bonds. As a consequence today roughly 20% of the Bloomberg Barclays Global Aggregate Index is trading at negative yields. It is possible this ratio might even increase in coming months, as some central banks wrestle with inflation running some way below target. Investors owning such bonds to maturity will be guaranteed negative nominal returns and so decisions to allocate cash to these markets require careful consideration. Active managers will be very selective in choosing which of such bonds to own and only have significant holdings when they offer good value relative to other markets. - Credit Quality

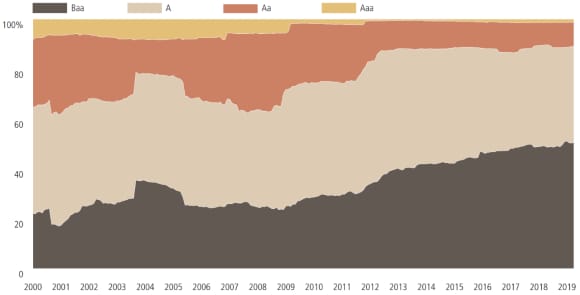

The deterioration in average credit quality of major global bond indices also poses a challenge for investors. Consider the Barclays Global Aggregate Corporate index shown below. Since 2000 the share of companies rated BBB (the lowest rating in the investment grade spectrum) has more than doubled from 22% to 51%. In many ways this is to be expected, because years of falling bond yields have allowed companies to refinance cheaply, often funding share buy-backs with debt and generally increase leverage (now reflected in the lower ratings). It is still the case that the default rate implied by the level of credit spreads today is higher than the historical realized default rate giving skilled managers an opportunity to earn excess returns in their credit allocation. However, the challenge going forward will be that any disruption to the global growth outlook might trigger a wave of credit downgrades that will be unprecedented compared with previous cycles. Active investors at least will have the flexibility to avoid exposures to those companies which they consider most at risk.

Exhibit 3: Global Aggregate Corporates Bond Index historical rating distribution

The case for going Global and Active

The case for going Global and Active

Active strategies can add value where managed by experienced portfolio managers who have previously navigated all stages of the economic cycle.

Beta has been a key return driver in the post financial crisis recovery, as central banks stepped in and provided support in the form of liquidity and outright asset purchases. Since the GFC bond yields have generally fallen and credit spreads tightened delivering positive returns for investors. However as highlighted above, investors today need to be more careful and selective with their portfolios.

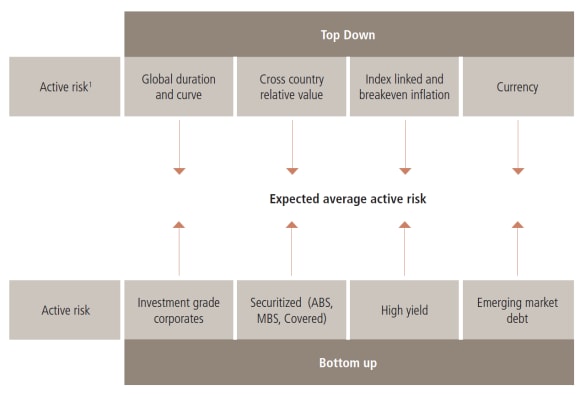

In fixed income, Global active managers, have a large opportunity set creating multiple return drivers for outperforming the index. In particular there are many ways to drive returns in fixed income, actively managing decisions such as duration, curve, market, sector, rating, subordination and coupon type to name a few. This gives active managers the flexibility to manage around the structural changes in duration, negative yields and BBB allocations that have been a feature of the major bond indices over the last few years.

Exhibit 4: Combined top down and bottom up approach

Risk budgeting and potential sources of return

The UBS Asset Management Global Bond Team is well placed to take advantage of the idiosyncratic risks and opportunities across the global fixed income spectrum to help investors achieve their goals.

Exhibit 5: Global Fixed Income Investment Management Team

Team leaders | Team leaders | Portfolio Managers + Investment Specialists | Portfolio Managers + Investment Specialists | AM Global Fixed Income platform | AM Global Fixed Income platform |

|---|---|---|---|---|---|

Team leaders | Jonathan Gregory | Portfolio Managers + Investment Specialists | Vivek Acharya Gordon Harding | AM Global Fixed Income platform | "100+ Investment professionals with expertise across a range of markets and security types allowing for the following sources of alpha:

|

Team leaders | Kevin Zhao | Portfolio Managers + Investment Specialists | Jerry Jones Iwan Marals Lionel Oster Alex Wise | AM Global Fixed Income platform | "Research platform of +25 dedicated career credit analysts

|

Proof of concept

Proof of concept

Structural changes in bond markets over the last few years mean that, over medium term horizons and beyond, skilled managers should be able to generate higher returns than typical global bond indices.

In exhibit 6 we have created a simple comparison of alpha generated by our flagship global active funds versus their passive counterparts, net of fees. Over a typical investment time horizon, of 3-5 years it is clear that the passive investors have lost out on a sizable return, even after fee adjustment.

Active products with sensible investment guidelines and degrees of flexibility add value to private portfolios in the long term.

Exhibit 6: Active bond strategies adding value

Performance of the Active Global Bond strategies versus passive equivalents to 31st March 2019

Global Dynamic Bond (in %) | Global Dynamic Bond (in %) | 1 Year | 1 Year | 3 Years | 3 Years | 5 Years | 5 Years |

|---|---|---|---|---|---|---|---|

Global Dynamic Bond (in %) | Global Dynamic Bond2 | 1 Year | 6.12 | 3 Years | 6.63 | 5 Years | 4.17 |

Global Dynamic Bond (in %) | Bloomberg Barclays Global Aggregate Index (USD Hedged) | 1 Year | 4.93 | 3 Years | 2.82 | 5 Years | 3.64 |

Global Dynamic Bond (in %) | Outperformance (gross of fees) | 1 Year | 1.19 | 3 Years | 3.81 | 5 Years | 0.53 |

Global Dynamic Bond (in %) | Outperformance (net of fees)1 | 1 Year | 0.74 | 3 Years | 3.36 | 5 Years | 0.08 |

Global Flexible (in %) | Global Flexible (in %) | 1 Year | 1 Year | 3 Years | 3 Years | 5 Years | 5 Years |

|---|---|---|---|---|---|---|---|

Global Flexible (in %) | Global Flexible | 1 Year | 2.68 | 3 Years | I .84 | 5 Years | - |

Global Flexible (in %) | Representative Global Aggregate Index strategy (CHF) | 1 Year | I .49 | 3 Years | -0.01 | 5 Years | - |

Global Flexible (in %) | Outperformance (gross of fees) | 1 Year | 1.19 | 3 Years | 1.85 | 5 Years | - |

Global Flexible (in %) | Outperformance (net of fees)1 | 1 Year | 0.99 | 3 Years | 1.65 | 5 Years | - |

Aggregate (in %) | Aggregate (in %) | 1 Year | 1 Year | 3 Years | 3 Years | 5 Years | 5 Years |

|---|---|---|---|---|---|---|---|

Aggregate (in %) | Representative Active Global Aggregate Strategy (CHF) | 1 Year | I .53 | 3 Years | 0.46 | 5 Years | 1.78 |

Aggregate (in %) | Representative Global Aggregate Index strategy (CHF) | 1 Year | 1.49 | 3 Years | -0.01 | 5 Years | 1.47 |

Aggregate (in %) | Outperformance (gross of fees) | 1 Year | 0.04 | 3 Years | 0.47 | 5 Years | 0.31 |

Aggregate (in %) | Outperformance (net of fees)1 | 1 Year | -0.05 | 3 Years | 0.38 | 5 Years | 0.22 |

Corporate (in %) | Corporate (in %) | 1 Year | 1 Year | 3 Years | 3 Years | 5 Years | 5 Years |

|---|---|---|---|---|---|---|---|

Corporate (in %) | Global Corporate Bond (USD) vs. BM | 1 Year | 0.1 | 3 Years | 0.6 | 5 Years | 0.29 |

Corporate (in %) | Representative Global Corporate Index strategy (USD) | 1 Year | 0.16 | 3 Years | 0.01 | 5 Years | 0.12 |

Corporate (in %) | Outperformance (gross of fees) | 1 Year | -0.06 | 3 Years | 0.59 | 5 Years | 0.17 |

Corporate (in %) | Outperformance (net of fees)1 | 1 Year | -0.14 | 3 Years | 0.51 | 5 Years | 0.09 |

Sovereign (in %) | Sovereign (in %) | 1 Year | 1 Year | 3 Years | 3 Years | 5 Years | 5 Years |

|---|---|---|---|---|---|---|---|

Sovereign (in %) | Global Sovereign Bond | 1 Year | 3.22 | 3 Years | 2.87 | 5 Years | 3.77 |

Sovereign (in %) | Representative Global Sovereign Index strategy (CHF) | 1 Year | 2.35 | 3 Years | 2.24 | 5 Years | 3.01 |

Sovereign (in %) | Outperformance (gross of fees) | 1 Year | 0.87 | 3 Years | 0.63 | 5 Years | 0.76 |

Sovereign (in %) | Outperformance (net of fees)1 | 1 Year | 0.79 | 3 Years | 0.55 | 5 Years | 0.68 |

Our active global fixed income solutions

Our active global fixed income solutions

Investors in our global strategies benefit from:

- Independent portfolio construction utilizing local market insights. A dedicated global bond team drawing on the local market and sector expertise across our Fixed Income business.

- Independent and non-correlated sources of alpha that exploits the full opportunity set of duration, curve, country, currency, sector and security allocations.

A team of more than 25 career analysts with sufficient scale to offer comprehensive coverage of opportunities across global credit markets, whilst allowing analysts to focus on the areas of the universe that can add value to client portfolios.

Exhibit 7: Unique value proposition across Global Strategies – A strategy for each investment style

Active Global Bond Solutions

Investment Style | Investment Style | Benchmark | Benchmark | Target Alpha (p.a.) | Target Alpha (p.a.) | Portfolio Construction | Portfolio Construction | Liquidity | Liquidity | Use of derivatives | Use of derivatives | Correlation of returns to fixed income markets | Correlation of returns to fixed income markets | High Transparency | High Transparency | Inception Date | Inception Date |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Investment Style | Global Dynamic Bond | Benchmark | None | Target Alpha (p.a.) | Maximise total return | Portfolio Construction | Flexible, benchmark agnostic, global bond fund | Liquidity | High | Use of derivatives | Medium | Correlation of returns to fixed income markets | Very Low | High Transparency | Yes | Inception Date | 31st May 2013 |

Investment Style | Global Flexible | Benchmark | Global Aggregate | Target Alpha (p.a.) | +150bps | Portfolio Construction | Benchmark and off-benchmark positions | Liquidity | High | Use of derivatives | Medium | Correlation of returns to fixed income markets | High | High Transparency | Yes | Inception Date | 31st Dec.2015 |

Investment Style | Global Short Term Flexible | Benchmark | Global Aggregate (1-3y) | Target Alpha (p.a.) | +100bps | Portfolio Construction | Benchmark and off-benchmark positions | Liquidity | High | Use of derivatives | Medium | Correlation of returns to fixed income markets | High | High Transparency | Yes | Inception Date | 30th Nov.2018 |

Investment Style | Global Aggregate Bond | Benchmark | Global Aggregate | Target Alpha (p.a.) | +65bps | Portfolio Construction | Benchmark with limited flexibility | Liquidity | High | Use of derivatives | Low | Correlation of returns to fixed income markets | Very high | High Transparency | Yes | Inception Date | 31st Mar.2008 |

Investment Style | Global Corporate Bond | Benchmark | Global Corporate | Target Alpha (p.a.) | +60bps | Portfolio Construction | Benchmark with limited flexibility | Liquidity | High | Use of derivatives | Low | Correlation of returns to fixed income markets | Very high | High Transparency | Yes | Inception Date | 30th Jun 2009 |

Investment Style | Global Sovereign Bond | Benchmark | Global Sovereign | Target Alpha (p.a.) | +50bps | Portfolio Construction | Benchmark with limited flexibility | Liquidity | High | Use of derivatives | Low | Correlation of returns to fixed income markets | Very high | High Transparency | Yes | Inception Date | 31st Dec 2009 |

Fixed Income capabilities

Fixed Income capabilities