Macro Monthly Four investing lessons from China’s recovery

China’s recent experiences of economic recovery and relative asset price performance provide useful insights into how the path for other countries and global markets may unfold.

Highlights

Highlights

- China was the first to recover output losses from the pandemic. The evolution of its economy and financial assets are useful leading indicators for global market activity.

- Chinese stocks are lagging year to date after leading in 2020, bolstering our conviction to stay in early-cycle geographies.

- Manufacturing output and exports remain resilient in China, a reminder that investors should focus risk exposures in markets levered to the continued strength in goods.

- There is no abrupt turn in Chinese policy support. Globally, policy is also slated to stay stimulative. As such, we favor equities over credit, and remain positioned for steeper yield curves.

- However, China also shows us that policy risks will become more two-sided as economies fully heal. This supports our preference for ex-US equities.

Right now, investors are working from a common set of assumptions: Global activity is poised to meaningfully accelerate as vaccinations allow for a durable economic reopening. The US economy will lead the way, thanks to above-average progress on vaccinations and potent fiscal stimulus. Recoveries will be uneven across geographies due to disparities in vaccine access. In some countries, and for some high-touch services sectors, the ongoing persistence of the pandemic will prevent a return to full health for a prolonged period.

This conventional wisdom does not make asset allocation any easier. To the contrary, the extent to which these consensus opinions are embedded in market prices may make deciding where and how to take risk a more difficult endeavor.

Identifying leading indicators that may shed light on how activity and asset prices will unfold is an essential tool for investors seeking to prudently navigate current market conditions. One year ago, we examined what China’s nascent economic reopening foretold for the rest of the world. Now, with its economy in a much more advanced stage than its global peers, we are engaging in another China-centric analysis to highlight actionable lessons that inform our positioning. Our key takeaways are that investors should continue to focus risk exposures in regions that are still early cycle and have elevated exposure to manufacturing activity, which is poised to remain robust. China’s macro policy also reaffirms our conviction that fiscal and monetary support will continue to underpin the economic expansion, though at a lesser pace. In addition, the more economies are able to repair the damage from the COVID-19 crisis, the more that policy risks will become two-sided.

Lesson #1: Stay in early cycle regions

Chinese equities were standout performers among major global indexes in 2020. That is fitting: the nation was unique in its ability to post economic growth for the year, despite the pandemic. For a time, it was the world’s lone manufacturing hub amid its relatively more effective mitigation of domestic COVID-19 outbreaks and aforementioned earlier exit from the most turbulent phase of the pandemic.

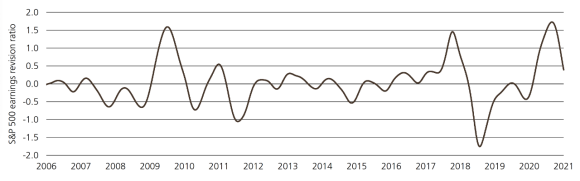

But throughout 2021, Chinese activity will likely be decelerating. This relative lack of momentum is reflected in the divergence in earnings revisions between Chinese and global equities. Calendar year 2021 earnings per share estimates for the MSCI All Country World Index have been upgraded by 10% since the start of the year. Meanwhile, profit forecasts for the MSCI China Index have been trimmed by nearly 3%. That has contributed to Chinese equities underperforming all other major regions year to date, a reversal of last year’s leadership.

This experience for Chinese equities may be a prologue to what awaits their American counterparts. Investors are in the midst of grappling with an imminent peak in US growth rates to a still substantial but less robust pace. The rate of US earnings upgrades relative to downgrades also appears to have peaked. A turn in the second derivative, in this case meaning economic conditions remaining positive but somewhat less so, is often associated with near-term volatility and softness in domestic equities. So far, US indexes have displayed resilience during this reporting period. But the reaction in individual companies that report better than expected profits has been underwhelming. This supports our view that much of the good news is already priced in. Given the heavy weighting that US equities have in global benchmarks, this dynamic backs up our view that relative value opportunities within equities are more attractive than outright beta exposures. We expect that value stocks as well as European and Japanese equities will outperform global equities.

Lesson #2: Don’t fade the factory boom too soon

Global demand for goods is transitioning from “needs” to “wants” as the worst phase of the COVID-19 crisis fades from view in advanced economies, with well-supported consumers ready to keep spending.

Though China is no longer on the leading edge of the improvement in factory activity, it continues to display strength and provide evidence of this shift in the nature of foreign demand.

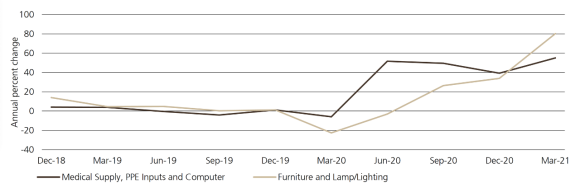

Chinese exports rose 49% year on year in Q1, with the official reading of new export orders for the manufacturing purchasing managers’ index returning to growth in March. Appetite for consumer goods, and in particular housing-related items, is growing at a faster clip than health care items and equipment for the work-from-home environment, which were key drivers of growth in shipments abroad during 2020.

Momentum in goods goes far beyond China. The flash readings of manufacturing purchasing’ managers indexes posted fresh cycle highs in the eurozone, US, UK, Australia, and Japan – which all are indicating faster rates of growth in factory activity than China. Vaccinations that enable a rebound in services sector activity will be adding another pillar to the global growth outlook, which is slated to stay well-buttressed by solid manufacturing production.

Having two engines to power global growth should help drive steeper yield curves and further upside in longer-term sovereign borrowing costs. In equities, this backdrop also reinforces our preference for regions like Europe and Japan that are more levered to global industrial production compared to China and the US, two countries in which stay-at-home beneficiaries like internet companies and technology stocks have a relatively elevated footprint in domestic indexes. Within US stocks, we therefore favor an equal weight index vs. market cap. We believe that emerging market currencies, which enjoy tailwinds from the cyclical upturn and firming commodity prices, also stand to gain in this environment. The deceleration in Chinese activity may be offset by the broader global acceleration, particularly in the US, where demand is already supporting the rest of the world in the form of a record trade deficit for the month of March.

Exhibit 1: The earnings revision ratio for US stocks has rolled over, but is still positive

Exhibit 1: The earnings revision ratio for US stocks has rolled over, but is still positive

Exhibit 2: Housing-linked Chinese exports growing at a faster pace than pandemic-oriented products

Exhibit 2: Housing-linked Chinese exports growing at a faster pace than pandemic-oriented products

Lesson #3: Policy will likely be less stimulative, but nowhere near tight

The chief risk to procyclical positions is if policymakers – particularly those on the fiscal side – prematurely withdraw stimulus and jeopardize the recovery. China is where this threat could materialize more expediently compared to other regions, given its expansion is in a more advanced stage. The potential negative ramifications could be large and wide-ranging in such an adverse scenario, in light of its size and importance to commodity demand.

However, Beijing has pledged to avoid an abrupt turn in policy from stimulus to tightening – even as it adjusts the magnitude of its support – and outlined a course of action aligned with this commitment. Policy support is being more targeted towards small and medium-sized enterprises, with an eye on increasing employment and consumption, as well as making progress on medium-term economic development goals. The government is on track for only a modest fiscal consolidation, and is aiming to only stabilize, rather than decrease, China’s aggregate macro leverage.

Exhibit 3: China’s key economic objectives for 2021

Objectives | Objectives | 2020 | 2020 | 2021 Target | 2021 Target |

|---|---|---|---|---|---|

Objectives | GDP growth | 2020 | 2.3% | 2021 Target | >6% |

Objectives | General budget balance, % of GDP (accrual) | 2020 | -3.7% | 2021 Target | -3.2% |

Objectives | Total social financing growth | 2020 | 13.3% | 2021 Target | In line with nom- inal GDP growth |

Objectives | Non-financial sector debt to GDP | 2020 | 297% | 2021 Target | Largely stable |

Objectives | Urban new employment | 2020 | 11.86M | 2021 Target | >11M |

Objectives | New special local government bond quota | 2020 | 3.75T | 2021 Target | 3.65T |

There are well-publicized worries about the financial health of the nation’s largest state-owned distressed asset manager. In our view, Beijing is unlikely to allow this issue or any others within its purview to metastasize into a threat to financial stability that would threaten the economic expansion.

Central banks in advanced economies are remaining patient, largely signaling a continuation of extraordinary accommodation even as activity improves. This enduring commitment from policymakers – on both the monetary and fiscal side, in China as well as the rest of the world – to act as stewards of the expansion supports risk assets relative to developed market sovereign bonds as well as our procyclical relative value trade set.

Lesson #4: Policy risks are two-sided

That being said, the extent of the economic recovery means that policymakers in China no longer need to have a single-minded focus on supporting activity. Their policy agenda reveals that, as well: Modest fiscal consolidation is still consolidation.

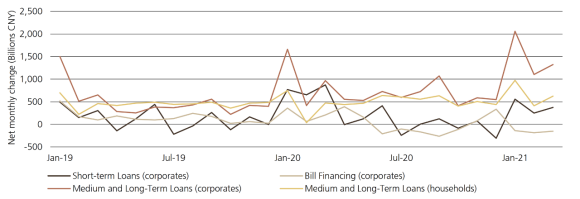

China’s credit impulse – the annual change in new credit as a share of GDP – has peaked, and is poised to slow further and turn negative. Since the global financial crisis, pullbacks in Chinese credit growth have coincided with an contributed to softness in global goods activity and weakness in equites, with long and variable lags. But these lags have been getting shorter as market participants have a thorough understanding of China’s importance to the global industrial cycle.

In this instance, we believe the turn in Chinese credit will not herald a broad loss of economic momentum, because of the magnitude of US fiscal stimulus, the strong state of household balance sheets, and a drawn-out global inventory restocking cycle due to lingering supply shortages and shipping delays. The present deceleration in Chinese credit growth is partially attributable to a decreased need for short-term liquidity in light of the improving outlook, and is also a function of rising nominal growth more so than slowing credit growth. As such, it is a relatively benign development for overall activity, and heralds a resurgence of business capital expenditures.

Exhibit 4: Chinese credit data suggest robust capex outlook, stability in housing

Exhibit 4: Chinese credit data suggest robust capex outlook, stability in housing

However, some credit-intensive segments, particularly real estate, may face tighter access to credit and see activity soften somewhat. Even with an ensuing slowdown in demand from China, activity in advanced economies should be more than sufficient to contribute to a continuing tightening of commodity markets. Concerns about excessive investment, particularly in the property sector, are more China-centric than widespread. China is also showing a greater tolerance for corporate defaults, including of state-owned enterprises. To have these issues reclaim prominence in policy developments is proof that the country has firmly moved out of the throes of the crisis, in which all actions were geared to cushion the economic damage from the pandemic. Nonetheless, we retain a preference for Asian high-yield credit. In our view, any slowdown in the property market will be measured, and investors are being well compensated for these risks.

More broadly, as the legacy of fiscal actions during the pandemic continues to provide a foundation for underlying economic activity, policymakers may be less sensitive and beholden to financial markets. This ties into one primary source of Chinese equity underperformance in 2021: the enhanced regulatory scrutiny and probes into the market power of leading internet companies. In the US, a shift to less market-friendly fiscal policy is also on the horizon. More infrastructure spending is also likely to be accompanied by higher corporate tax rates, measures to raise the tax burden for multinationals, and potentially an increased levy on capital gains, as well.

This suite of possible measures would bolster our preference for non-US equities and add fuel to the rotation from growth to value. Higher corporate tax rates would reduce the earnings power of US firms relative to the rest of the world. Some of the additional tax hikes under consideration – such as GILTI (a tax on income generated by intangible assets held abroad) and a minimum tax on book income – would disproportionately hit the technology and communication services sectors (growth stocks) and health care (defensive stocks). Growth stocks in the technology and consumer discretionary sectors have been the biggest source of capital gains over the past three, five, and 10 years, and so would also likely face the largest near-term selling pressures if such a levy were to be pursued.

Conclusion

China’s recent experiences of economic recovery and relative asset price performance provide useful insights into how the path for other countries and global markets may unfold. Our view is that these lessons from China corroborate our current procyclical positions. Bearish positions in the US dollar and global duration are warranted in light of the major upswing in global economic activity underway. The most attractive risk exposures remain in regions and styles most tightly levered to continuing firmness in global industrial production, like European, Japanese, and value stocks as well as emerging market currencies.

As more and more economies experience the same degree of economic healing as China, the challenges facing asset allocators will increase. But so too will this evolution enhance the appeal of globally-diversified multi-asset portfolios that allow investors to be nimble in adapting to changes in the macroeconomic environment.

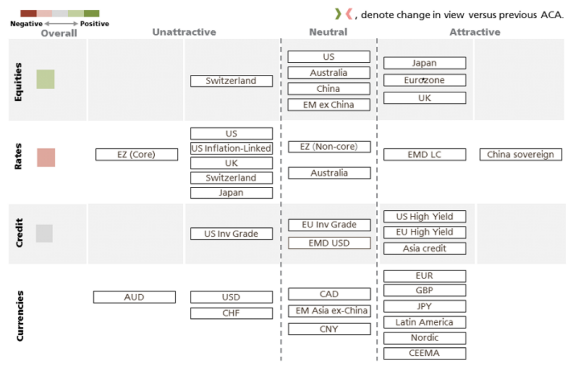

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 29 April 2021.

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 149.1 billion (as of 31 March 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.