Confíe en uno de los gestores de ETF de más rápido crecimiento del mundo, con la experiencia adquirida durante más de 30 años de excelencia y los conocimientos para ofrecer una gran variedad de soluciones que satisfagan sus necesidades.

¿Quieres más información?

¿Quieres más información?

Suscríbase para recibir las últimas perspectivas e información de los mercados privados en todos los sectores directamente en su bandeja de entrada.

Elección

Con una sola operación, los inversores tienen acceso a varios mercados gracias a nuestra gran selección de ETF de renta variable, renta fija, commodities, metales preciosos y activos Real Estate.

Experiencia

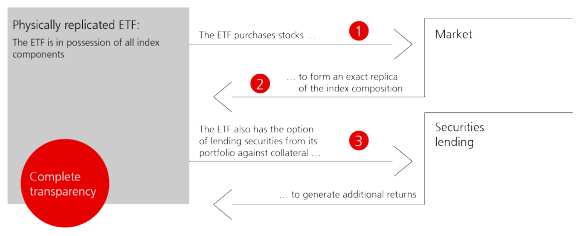

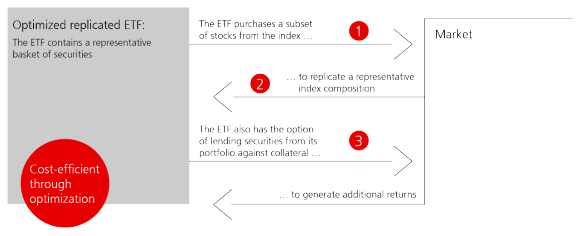

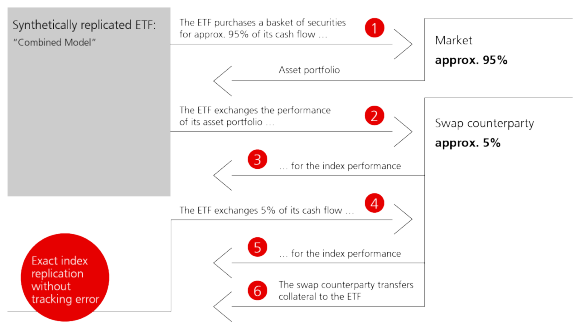

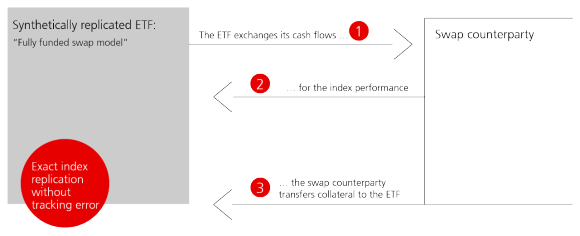

Se beneficiará de nuestra condición de ser uno de los proveedores de ETF con más experiencia en Europa. Ofrecemos Alta calidad de replica de indices, respaldadas por un equipo de gestores experimentado y capacitado.

Reconocimiento

El premio al mejor gestor indexado del año 2021 en los Insurance Asset Risk EMEA Awards es el más reciente de una serie de galardones otorgados a nuestras soluciones de ETF en los últimos años.

Renta variable

Acceda a los principales mercados de renta variable en una sola operación gracias a la amplia gama de ETF de renta variable de UBS.

Renta fija

Invierta en segmentos de mercado de renta fija líquidos y bien diversificados, como la deuda corporativa, soberana o de mercados emergentes.

Cobertura de divisas

Proteja su cartera contra las fluctuaciones de los tipos de cambio con nuestra extensa gama de UBS ETF con cobertura de divisas.

Commodities

Diversifique su cartera con nuestros ETF competitivos y líquidos sobre materias primas.

Beta alternativa

Céntrese en los índices de estrategias factoriales sistemáticas para seguir la evolución de los mercados de una manera más sofisticada que la de simplemente seguir la capitalización del mercado, al tiempo que busca beneficiarse de la diversificación.

Soluciones climáticas

Reduzca la exposición a las emisiones de carbono y oriente su cartera hacia un futuro de emisiones netas cero con nuestros ETF MSCI Climate Paris-Aligned y Climate Aware.

Inversión sostenible

Nuestra trayectoria sostenible comenzó en 2011 con el lanzamiento de nuestros primeros cuatro ETF de inversión socialmente responsable (SRI). Como pioneros en este espacio, ofrecemos un amplio abanico de soluciones para ayudarle a cumplir sus objetivos ESG.

UBS ETF Capital Markets Weekly

UBS ETF Capital Markets Weekly

Eche un vistazo a nuestro ETF Capital Markets Weekly. El documento destaca las actividades del mercado primario relevantes para los ETFs de UBS, las mayores operaciones del mercado secundario, una revisión del mercado así como una mirada a la semana que se avecina. Disfrute de la lectura y comparta sus comentarios.

ETF trading

UBS ETF Capital Markets

El equipo de ETF Capital Markets asiste a los clientes en su proceso de comprensión de la operativa con ETF, y demuestra quela competencia es clave para la mejor ejecución. La operativa ineficiente de un ETF puede resultar en mayores costes y neutralizar las ventajas que ofrece un ETF en términos de transparencia, liquidez y certeza en la ejecución.

Más información sobre el trading con ETF

El equipo de ETF de UBS busca mantenerse a la vanguardia y ser proactivo a la hora de aportar nuevas soluciones pasivas que se ajusten a la variedad de preferencias de los inversores .

Clemens Reuter, Responsable Global de ETF & Index Fund Client Coverage

Ya sea que tenga una pregunta o una solicitud, estaremos encantados de ponernos en contacto con usted.

-

Nina Petrini

Head ETF & Index Fund Sales Spain

-