Macro Quarterly Bend, don't break

In this edition of Macro Quarterly, we review the five macro market themes which serve as our core views and examples of case studies associated with them.

Highlights

Highlights

- We expect the global economy will ultimately stabilize around its long-term trend rate, but geopolitical risks have clouded the outlook.

- Policy actions taken in the US and China, both in trade and monetary policy, are crucial to the global economy and markets. These actions and resilient labor markets should be able to prevent a hard landing in the global economy, but the risks around this view have risen.

- Position on fundamentals; hedge the politics. We describe how our theme-based approach to investing provides balance and diversification across our strategies.

Geopolitical developments have always played a part in markets but their impact on economic fundamentals and investment outcomes is only growing. This reality demands an ability to be open-minded about political and economic possibilities that do not have an obvious historical analogue. It also demands a certain humility that we cannot predict the future, and the need to hedge our portfolios where possible against specific outcomes that lie outside of our base case. We have therefore built our investment process around key themes, or hypotheses, that we monitor for confirmation. Themes serve as our 'North Stars'—core views that we build trades around to express them. In each Macro Quarterly we discuss these themes and examples of case studies associated with them. The first three themes capture the macroeconomic and policy outlook which form the basis for our core portfolio positions. The last two themes, focused on geopolitics and volatility, form the views used to diversify and hedge our portfolios to account for the unexpected.

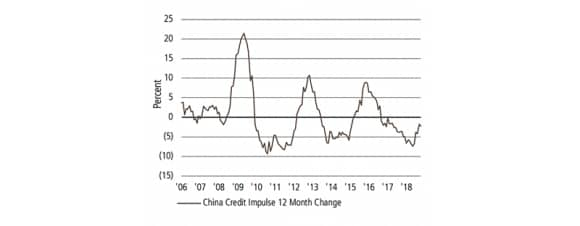

Global growth to steady around trend

We have taken a round trip in global growth over the last three years. Led by China stimulus and an accommodative Fed, global economic growth accelerated from mid-2016 through 2017 only to decelerate sharply in 2018 and to start 2019. Now we are back, with a more dovish Fed and China stimulus again providing support for the economy. The difference between now and back then is the 'muscle' of the stimulus—three years ago China's support for growth was powerful and broad-based and the Fed was still close to its zero bound. Today, US rates are close to neutral and China's stimulus is more targeted in nature and with less global spillover. Thus we are looking for growth stabilization as opposed to reacceleration, best visualized by the Purchasing Manager Indexes (PMIs). With crucial policy support, we suspect the PMIs will settle around the global economy's average over the period (deep red line) and above the 50 line which separates expansion from contraction. Essentially, this represents a soft landing for the global economy. Our assessment is based on the view that while there has been pronounced weakness in the manufacturing and goods sectors, global services sectors have remained generally resilient. This underlying durability is linked to ongoing strength in developed economy household income growth, supporting consumption. While recent trade escalation between the US and China/Mexico skews the risks towards a move below trend economic growth, incremental policy support will prevent a recession, in our base case.

Case study: Long EAFE vs US Equities

EAFE, or major developed ex-US stock markets, underperformed the US for much of last year. But these markets are pricing a much gloomier outlook than the US, and by some measures relative valuations are near tech bubble extremes. As economic growth in the US moderates but the global economy ultimately achieves a soft landing, these markets have room to outperform.

China finding a cyclical bottom

As the world's second largest economy and the integral anchor in the global supply chain, China's economic health is crucial not only to the overall dynamics of the global economy but to its relative balance with the United States.

An imbalanced global economy, driven primarily by the US, can create destabilizing forces via dollar strength which stress indebted emerging markets and create negative feedback loops. With the US fiscal stimulus fading over the rest of the year and into 2020, China's growth stabilization is critical to provide support and balance to the global economy. We believe that China's easing of monetary, fiscal and regulatory policy is beginning to take hold, although again the results are consistent with stabilization as opposed to a sharp rebound. Credit growth has risen and infrastructure investment is showing signs of life. Moreover, we do not doubt China's willingness and ability to provide additional stimulus should trade tensions or other headwinds create the need.

Case study: Long Asia hard currency debt

An environment with steadying, rather than accelerating or sharply deteriorating Chinese growth, is positive for carry. As we look for higher-yielding assets across the globe, we find Asian hard currency debt quite attractive compared to the low yields on offer in developed markets. Heavily weighted towards China's property sector, we believe that ongoing policy support for the labor market and household income is supportive of this view.

Central banks to extend the cycle

With this US economic expansion now the longest on record, it is unsurprising that investors are increasingly cautious on how long it can possibly go on. But a confluence of developments have materialized that suggest this economic expansion can continue well into 2020 and probably beyond.

Having pivoted amid the sharp tightening in financial conditions late last year, the Fed has now shifted its focus to the stubborn downside inflation misses vs. its 2% target (Exhibit 3). This has led to increasing discussion of the Fed's strategic framework and whether the central bank needs to think about erring on the side of more accommodative policy in order to sustainably bring inflation and inflation expectations to its goal. Moreover, the downside risks to growth related to trade conflict may ultimately drive the Fed into some easing.

Other central banks across the globe have almost uniformly moved in a similar direction, with the European Central Bank and the Bank of Japan pushing out expectations for tightening and the Reserve Bank of Australia shifting towards outright easing. If there is one lesson from the post-crisis period, it is to not bet against central banks finding creative ways to provide the necessary accommodation to cushion economic growth. And the synchronized fall in long-term yields is providing an important automatic stabilizer against trade uncertainty and other headwinds. In the meantime, productivity is genuinely picking up in the United States, suggesting the cycle, despite its length, still has legs.

Case study: Long China Agg FX hedged

We once again stick with China, which continues to offer a rich set of opportunities in the current environment. In short, policymakers are determined to engineer a soft landing. The People's Bank of China (PBOC) is unlikely to raise rates anytime soon, with policymakers committed to keeping policy steady enough to support the economy against external headwinds. We believe that China's sovereign debt offers attractive yields compared to developed economy counterparts on both a nominal and inflation-adjusted basis. And ongoing opening of China's financial markets and index inclusion should encourage inflows and boost liquidity.

Geopolitics and protectionism

The reignition of the US-China trade war, and more recently the administration's potential opening of a new front with Mexico, creates direct global economic headwinds in the form of export disruption, crimped corporate margins and higher consumer prices. But it also has indirect consequences for the global economy, via uncertainty which weighs on business confidence and ultimately investment. Moreover, the trade wars are just part of the story.

Ongoing strategic competition and conflict on technology between the US and China is disrupting supply chains and slowing globalization. Meanwhile, the threat of auto tariffs on Europe and Japan still unresolved Brexit all act as suppressors of global economic confidence and investment.

While these conflicts will blow hot and cold over time, they are just part of an ongoing trend towards deglobalization which acts as a structural headwind to economic dynamism.

Case study: Long JPYKRW

As part of our investment process, we use scenario analysis to identify potential outcomes and their impact on markets. But ultimately there are limitations to predicting geopolitical events, and we prefer to use utility trades which we believe will provide us with an attractive risk-reward in periods of escalation. One such view is long the safe haven and undervalued JPY against the KRW, which has and may be likely to depreciate further if tensions between the US and China continue to deteriorate. Korea plays a crucial role in the Asian technology supply chain and its currency should offer a liquid hedge against further US-China trade disruption.

A higher volatility regime

Geopolitical tension clearly has contributed to market volatility, but there are other factors that are likely to drive volatility structurally higher than average levels in the post-crisis period. While we do see room for this cycle to extend, there is no doubting that the longer an economic cycle goes, the more uncertainty there is about economic and policy outcomes. How stable is the global growth trajectory? Has the Fed tightened too much? Or are markets too complacent that we will never see inflation, just as labor markets hit capacity, output gaps close, and de-globalization boosts consumer prices? These are the questions which markets will debate on and off, and it will likely be reflected in financial assets.

Case study: Short AUDUSD

Short AUDUSD is a view that may benefit from a number of volatility-inducing developments. If global growth deteriorates, due to trade tension or otherwise, the high beta AUD will likely suffer. But Australia also has a net external liability, and if US rates were to suddenly pick up from suppressed levels, AUDUSD would likely also weaken. We believe that this along with ongoing domestic uncertainties on the housing market and a dovish central bank makes the currency an attractive short against USD.

The bottom line: Asset allocation:

Position on fundamentals; hedge on geopolitics. That is the approach we strive to take across strategies in Investment Solutions. The second half of the year is likely to be eventful for markets, as tensions between an OK economic environment, a supportive policy cushion but a cloudy geopolitical outlook all combine to push and pull investors in different directions. Still, we suspect this economic expansion will bend and not break, creating opportunities for adding additional risk when the smoke clears. We continue to use our theme-based approach and rigorous monitoring of the macro outlook as our anchor as we manage through the volatility to come.

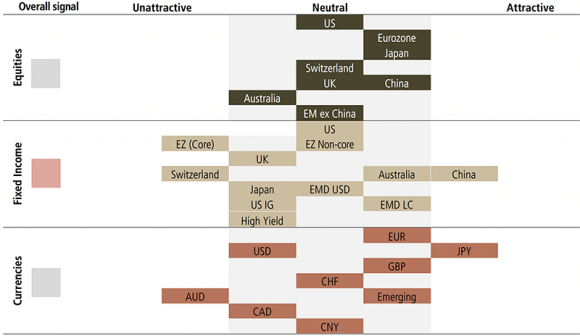

Asset class attractiveness

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 31 May 2019.

US Bonds | US Bonds | Overall signal | Overall signal | UBS Asset Management's viewpoint | UBS Asset Management's viewpoint |

|---|---|---|---|---|---|

US Bonds | Global Equities | Overall signal | Neutral Slightly negative

| UBS Asset Management's viewpoint |

|

US Bonds | US Equities | Overall signal | Neutral | UBS Asset Management's viewpoint |

|

US Bonds | Global (Ex-US) Equities | Overall signal | Neutral

| UBS Asset Management's viewpoint |

|

US Bonds | Emerging Markets (EM) Equities including China | Overall signal | Neutral

| UBS Asset Management's viewpoint |

|

US Bonds | Currency | Overall signal |

| UBS Asset Management's viewpoint |

|

US Bonds | US Bonds | Overall signal | Neutral

| UBS Asset Management's viewpoint |

|

US Bonds | Global (Ex-US) Bonds | Overall signal | Slightly negative | UBS Asset Management's viewpoint |

|

US Bonds | US Investment Grade (IG) Corporate Debt | Overall signal | Neutral | UBS Asset Management's viewpoint |

|

US Bonds | US High Yield Bonds | Overall signal | Neutral | UBS Asset Management's viewpoint |

|

US Bonds | Emerging Markets Debt US dollar Local currency | Overall signal | Neutral Neutral

| UBS Asset Management's viewpoint |

|

US Bonds | Chinese Bonds | Overall signal | Slightly positive | UBS Asset Management's viewpoint |

|