Navigating fixed income liquidity in a challenging environment

Views from our fixed income team

Highlights

- There are several indications that fixed income markets are facing severe liquidity challenges due to the COVID-19 pandemic, while policymakers across the globe have implemented measures aimed at tackling this issue. We view these measures as an important first step in the effort to prevent credit markets from seizing up completely.

- In this volatile environment we are primarily focused on managing liquidity in our strategies.

- While we note meaningful dislocations in different markets, we are being highly selective and patient in how and where we deploy capital. In Asia for instance, we have become constructive on the current opportunity set for our high yield (HY) strategy and look to close our underweight positioning, while in regions like Europe and the US we believe spreads may not have bottomed out yet and are very difficult to forecast. In money markets our focus has been on liquidity preservation in all of our funds.

- In US Investment Grade, we are targeting selective opportunities in the primary market at the front end of the yield curve.

- In all our HY strategies, we are focused on maintaining adequate cash.

- In our Emerging Market Debt (EMD) strategies we manage with a keen eye on the liquidity demands of our portfolios.

- In our flexible strategies we are also focused on new opportunities in investment grade corporates while maintaining our existing allocations to inflation linked government bonds and some emerging markets.

The COVID-19 pandemic continues to spread rapidly across the globe with devastating effects on human life and economic activity.

In an effort to combat the spread of the virus, many countries around the world have taken aggressive measures that include the closure of land borders, temporary shutdown of businesses and in some cases lockdowns that severely restrict the movement of people.

Business activity has come to a virtual standstill, with simultaneous shocks to demand and supply. There is a growing likelihood that global corporate defaults especially within the sub-investment grade market could well match or even eclipse levels experienced during the Great Financial Crisis (GFC). The impact of COVID-19 has also prompted several economists at major banks to sharply downgrade their expectations for global growth this year.

Impact on financial markets

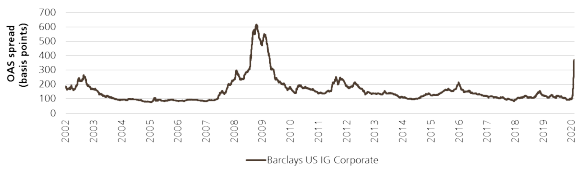

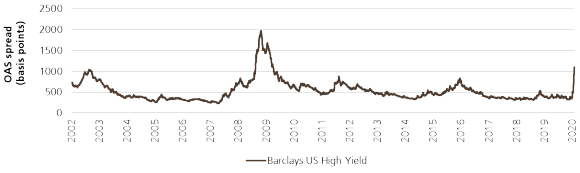

The massive disruption to the real economy has also impacted financial markets, with equities down significantly from their 19 February peaks and credit spreads widening to levels not seen since the GFC. Indeed the velocity of movement in spreads in asset classes such as investment grade (IG) currently outpaces the trajectory observed in 2008/09. The charts below show option adjusted spreads (OAS) for IG and HY through 20 March 2020.

IG OAS

HY OAS

What has this volatility meant for FI Liquidity?

What has this volatility meant for FI Liquidity?

Amid elevated levels of volatility and uncertainty, investors withdrew billions of dollars from funds across virtually all asset classes with the US Treasury and Government money market funds being the only exceptions. According to data from Lipper, a record USD 55bn came out of taxable bond funds for the week ended 18 March 2020. The largest casualties were US IG which saw a record USD 35bn outflows—dwarfing the previous record of USD 7.3bn set the prior week, and EMD which saw USD 18.8bn leave—another weekly record. Even prime money market funds were not spared as investors headed for the exit on concerns over exposure to A2/P2 commercial paper. Government money market funds were the ultimate beneficiaries, bringing in USD 249bn of new money over the period.

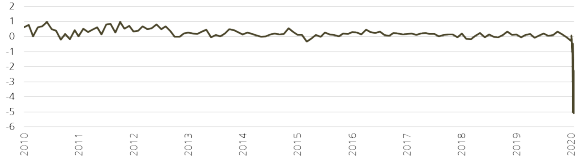

There are several indications that fixed income markets are facing severe liquidity challenges as a result of continued investor risk aversion and retrenchment. In IG we see clear signs of lower liquidity. A number of major credit Exchange Traded Funds (ETF) across investment grade credit and high yield trade at deep discounts to their Net Asset Values (NAV). ETF discounts persist when arbitragers, who would otherwise look to exploit the pricing gap between an ETF's NAV and the price of the underlying bonds, sit on the sideline unsure of market directionality. Although some of these ETFs have rebounded recently, the degree to which the price of underlying bonds deviated from NAVs as a result of large redemptions is a reminder of how quickly liquidity can dry up in markets.

ETF NAV Discounts relative to history

Symbol | Symbol | 10-year average premium / discount | 10-year average premium / discount | Lowest monthly premium discount (10-year) | Lowest monthly premium discount (10-year) | Premium / discount as of March 20 | Premium / discount as of March 20 |

|---|---|---|---|---|---|---|---|

Symbol | LQD | 10-year average premium / discount | 0.23 | Lowest monthly premium discount (10-year) | -0.33 | Premium / discount as of March 20 | -2.78 |

Symbol | HYG | 10-year average premium / discount | 0.37 | Lowest monthly premium discount (10-year) | -1.13 | Premium / discount as of March 20 | -1.27 |

Symbol | JNK | 10-year average premium / discount | 0.25 | Lowest monthly premium discount (10-year) | -0.81 | Premium / discount as of March 20 | -1.60 |

Symbol | VCIT | 10-year average premium / discount | 0.30 | Lowest monthly premium discount (10-year) | -0.31 | Premium / discount as of March 20 | -4.34 |

Symbol | VCSH | 10-year average premium / discount | 0.20 | Lowest monthly premium discount (10-year) | -0.06 | Premium / discount as of March 20 | -4.48 |

Symbol | IGIB | 10-year average premium / discount | 0.17 | Lowest monthly premium discount (10-year) | -0.13 | Premium / discount as of March 20 | -2.53 |

LQD1 Discount to NAV

In addition to trends in ETFs, we have seen quoted IG bid-ask spreads that are double those observed just a few weeks ago. A similar pattern exists in other segments of the bond market. For instance in securitized assets, demand for liquidity amid limited dealer balance sheet capacity has resulted in bid-ask quoted spreads that are 1/32 to 8/32 for Agency Mortgage Backed Securities (MBS), and 50bps for AAA Commercial Mortgage Backed Securities (CMBS)— both wider than normal levels. In reality, CMBS has seen very limited dealer ability to bid making the true width of the bid-ask harder to gauge and therefore liquidity even less transparent. Emerging Market Debt faces similar challenges with transactional bids that are several percentage points below quoted bids and ETFs that trade at meaningful discounts to NAV.

In summary, it appears executable bid prices are frequently substantially below valuations shown on broker screens.

What are policymakers doing to tackle illiquidity?

What are policymakers doing to tackle illiquidity?

In response to the considerable strain placed on funding markets and the general illiquidity resulting from this crisis, policy makers across the globe have implemented certain measures aimed directly at tackling this issue.

Eurozone

- The European Central Bank (ECB) massively stepped up its stimulus package in the form of a EUR 750bn "Pandemic Emergency Purchase Programme" (PEPP). The facility will buy public and private-sector securities eligible under the existing Asset Purchase Program and has been extended to cover previously excluded Greece. PEPP should provide some downward pressure on intra-regional spreads.

- European finance ministers recently agreed to use the "general escape clause" of the Stability and Growth Pact which opens the door for larger budget deficits of member countries to counteract severe economic headwinds with further discretionary stimulus.

- Germany, Italy, Spain and France each announced large spending packages ranging anywhere from 1.4% (Italy) to 4% (Germany) of their respective GDPs. The spending generally targeted individuals and business alike. Each of these countries also announced loan guarantee programs worth several hundred billion EUR combined.

United Kingdom

- The UK government said recently it would make available GBP 30bn (1.5% of GDP) to support businesses. This would be in addition to another GBP 330bn in loan guarantees to businesses of all sizes.

- The Bank of England announced an extra GBP 200bn in Quantitative Easing , in mostly Gilts and some Corporate Credit.

- Earlier last week, a COVID-19 Corporate Financing Facility (CCFF) was announced which will purchase Commercial Paper issuance from non-financial businesses out to 1 year.

Asia-Pacific

- The Peoples Bank Of China (PBOC) injected 100bn yuan (USD 14.3bn) via the one-year medium term lending facility, keeping the rate unchanged at 3.15%. The bank also cut the amount of cash that banks have to set aside as reserves, effectively freeing up the equivalent of USD 79bn of funds into the economy starting March 16.

- In Japan, the Bank of Japan (BOJ) undertook a number of liquidity-enhancing operations including an emergency purchase of bonds on Monday to the tune of USD 1.3trn yen (USD 12bn) aimed at halting rising yields.

- The Reserve Bank of Australia (RBA) announced several sweeping measures including the pumping of record amounts of liquidity into short term lending markets in addition to the purchasing of bonds issued by state and federal issuers.

United States

- The US Senate approved a record USD 2trn stimulus package that includes direct payments to tax payers and billions in loans to businesses.

- The US Federal Reserve (Fed) took aggressive steps by rolling out a number of facilities to boost liquidity. These included an extension of the existing commitment to purchase Treasuries and agency mortgages to now cover eligible corporate bond issuance in both primary and secondary markets. Additionally, the introduction of credit facilities targeting money market mutual fund liquidity, commercial paper funding and the purchase of asset-backed mortgages as well as ETFs were all made public.

- While details on these facilities are still being agreed, the Fed has clearly signaled its intention to do whatever it takes to support the proper functioning of markets.

Admittedly, the solutions outlined above are primarily tailored towards high quality collateral. That said we still view these measures as an important first step in the effort to prevent credit markets from seizing up completely.

It is notable that the extreme market dislocation of early March, and the associated days of very weak liquidity, seem to have abated a little in the face of these extreme measures taken by policy makers. This has been crucial in restoring some order to markets in traditional safe haven assets such as government bonds and Treasury Inflation Protected Securities (TIPS). Furthermore, as a second order effect, liquidity in many other asset classes has at least stabilized. Whether this can be maintained remains to be seen but central banks have provided some comfort to investors that they will continue to act aggressively to support markets.

How we are navigating this environment in our FI Strategies

How we are navigating this environment in our FI Strategies

It is our view that a healthy dose of caution is warranted in order to successfully navigate this unprecedented period. Consequently, every marginal investment we make in this environment regardless of the specific strategy is first geared toward liquidity and quality management.

While we note meaningful dislocations in different markets, we are being highly selective and patient in how and where we deploy capital. In Asia for instance, we have become constructive on the current opportunity set for our HY strategy and look to close our current underweight positioning, while in regions like Europe and the US we believe spreads may not have bottomed out yet and are very difficult to forecast. We provide the below summary of how we are navigating risks and opportunities in our active strategies.

In our money market funds our focus has been on liquidity preservation in all of our funds. Within the US, in the current environment, our purchases of commercial paper space have been primarily focused on overnight maturities. The rest of our overnight exposure remains in repo and time deposits. In our European Money Market strategies, we have been building up cash buffers with a combination of maturing positions and flows. Broadly speaking, we believe UBS Money Market Funds globally are well positioned, and continue to be managed with a strong focus on safety and liquidity.

In US IG, we are focusing on the intermediate portion of the yield curve and de-emphasizing trading-related yield curve strategies due to the prohibitive cost associated with such trades in the current liquidity environment. Further, the inversion in credit curves caused by supply/demand imbalances at the front end has afforded us with opportunities to selectively add exposure in 1–5 year maturities of credits we like. Also, we are looking to take advantage of attractive new issue concessions in high conviction IG corporates where we can add positions in new cash bonds.

In HY, both in the US and Europe, we are focused on maintaining adequate levels of cash. Additionally, we have selectively added risk without sacrificing liquidity by investing in attractively priced new issues of bonds we like while hedging the associated market risk. Although there have been recent headlines concerning liquidity in certain Nordic HY funds, we believe that at this stage the situation is isolated and not representative of the broader HY market.

In Asian HY, we believe we are well positioned to navigate the current volatility and liquidity regime. Among other measures, we have increased our cash and short dated treasury holdings. We have recently become more constructive on our market and will look to close our current underweight relative to benchmark.

In our EMD strategies we manage with a keen eye on the liquidity demands on our portfolios. Our overall stance is one of caution as noted earlier. We believe there will be a moment where the market backdrop will be favorable for deploying risk back into the portfolio. A notable change we are making is the removal of certain hedges to benefit from the support announced by the Fed. However, we are still underweight risk overall.

Finally, in our global flexible strategies we are also focused on new opportunities in investment grade corporates while maintaining our existing allocations to inflation protected government bonds and some emerging market debt.

As stewards of clients' assets, we believe patience and a long-term orientation are virtues especially in times like this. Our dedicated professionals make investment decisions not based on the ebb and flow of markets on a given day but on the ability of each decision to stand the test of time. It is only in so doing that we believe that we can successfully navigate the vagaries of fixed income markets.