Our expertise

Partner with one of the world’s fastest growing ETF managers with the expertise to deliver a wide range of solutions to meet your needs, and experience earned from over 30 years of excellence.

What sets us apart

Choice

In just one transaction, investors can access numerous markets through our broad selection of ETFs across equity, fixed income, commodity, precious metal, and real estate asset classes.

Expertise

You can benefit from our status as one of the most experienced European ETF providers. We offer high quality index replication strategies, supported by a seasoned and skilled portfolio management team.

Recognition

Our ranking as Passive Manager of the Year 2021 at the Insurance Asset Risk EMEA Awards was the latest in a stream of awards for our ETF capabilities over recent years.

Our ETF capabilities

Equity

Access the major equity markets in a single transaction with our wide range of UBS Equity ETFs.

Fixed Income

Invest in liquid and well-diversified fixed income market segments such as corporates, sovereign or Emerging Markets debt.

Currency hedging

You can use our extensive range of currency-hedged UBS ETFs to help hedge your portfolio against exchange rate fluctuations.

Commodities

Diversify your portfolio with our cost-effective and liquid commodity focused ETFs.

Alternative Beta

Alternative Beta

Focus on systematic factor indices to track markets in a more sophisticated way than following market capitalization alone, while striving for diversification benefits.

Climate Solutions

Reduce your carbon exposure and drive your portfolio to a net-zero future with our cost-effective, rules-based MSCI Climate Paris-Aligned and Climate Aware ETF solutions.

Sustainable Investing

Our sustainable journey started in 2011 with the launch of our first four SRI ETFs. As a pioneer in this space, we offer a wide range of solutions to help you meet your ESG objectives.

UBS ETF Capital Markets Weekly

UBS ETF Capital Markets Weekly

Have a look at our ETF Capital Markets Weekly. The document highlights primary market activities relevant for UBS ETFs, the largest secondary market trades, a market review as well as a look at the week ahead. Enjoy reading and share your comments.

ETF trading

UBS ETF Capital Markets

The ETF Capital Markets team assists clients on their journey of understanding ETF trading and that competition is key to best execution. A poor ETF execution can be costly and negate the benefits of the ETF wrapper in terms of transparency, liquidity and certainty of execution.

Explore ETF trading

The UBS ETFs team seeks to remain at the cutting edge and to remain pro-active in bringing new passive solutions that fit the wide variety of modern investor preferences.

Clemens Reuter, Global Head of ETF & Index Fund Client Coverage

ETFs FAQs

Explore common questions

An exchange traded fund (ETF) is an investment fund that tracks the performance of its underlying index and can be bought and sold on the stock exchange. Like a traditional fund, an ETF is a mutual fund and thus unaffected by any insolvency of the ETF provider. It allows the benefits of a collective investment fund yet trades like a share.

ETF trading can be done on the stock exchange or over the counter at any time of the day. As ETFs are pegged to an underlying index, they are passive investment vehicles that merely replicate the performance of their underlying asset. In other words, when the underlying index increases in value, the value of the ETF increases likewise.

The first ETFs were listed in the US in 1993 and Europe from 1999. Since then, a steadily increasing number have become available. Traditionally, ETFs are passive index funds but actively managed ETFs have also come into play since their authorization in 2008 and require a portfolio management strategy.

UBS ETFs are available on a wide range of underlying asset classes such as equities, bonds, commodities, precious metals and real estate and offer investors access to numerous markets with just one transaction. Investors can also choose the replication method they prefer as UBS offers a wide spectrum of physically and synthetically replicated ETFs.

Diversification

ETFs provide you with the opportunity to diversify your portfolio in a very inexpensive and efficient manner by distributing risk across multiple risk carriers, allowing you to optimize the risk profile of your investment. Because ETFs track an index, you can cover an entire market with just a single transaction.

Flexibility

ETFs are easy to buy and sell - including on an intraday basis. Investors are able to act on market views within seconds. Due to these characteristics, ETFs can be used as part of an investment strategy in a variety of ways: for long-term growth, for short-term trading opportunities and for hedging part of a portfolio.

Transparency

ETFs are particularly transparent investment instruments because they match the performance of the underlying index, net of fees. All key trading and other information can be viewed on an intraday basis or in real time. UBS ETFs calculate the indicative net asset value every 15 seconds during normal trading hours.

Cost efficiency

ETFs do not incur any issue or redemption surcharges - just the transaction costs of buying and selling an ETF. Moreover, only a minimal management fee is charged.

Security

Like traditional funds, ETFs are mutual funds. They are unaffected by any insolvency of the ETF provider or custodian bank as the fund's assets are not included in the bankruptcy estate.

The objective of an exchange traded fund (ETF) is to track as closely as possible the index on which the ETF is based in order to provide investors in the ETF the same performance relative to the market underlying the index.

Indices are based on theoretical calculations, however, which means that costs incurred in practice, for example, for the purchase or sale of securities represented in the index are not reflected in the index calculation. Nevertheless, these costs are charged whenever an index and its performance are replicated for an investment.

How closely an ETF tracks the performance of its underlying index is therefore critical. Ideally, the performance of the ETF differs from that of the index solely in the costs and fees incurred. Since for example indices tracking only the stock market of a single country apply different criteria for index replication compared to an index containing stocks from multiple countries, the criteria for an exact index replication differ from index to index. For these reasons, UBS ETFs utilize a variety of index replication methods.

Full physical replication

The ETF invests in the securities represented in the index in accordance with their index weighting.

Optimized physical replication

The ETF invests only in those securities represented in the index that are needed to achieve a performance very close to that of the index.

Synthetic replication

The ETF invests in a securities portfolio and exchanges its performance for that of the index.

The purchasing process is in principle identical for all replication methods - however, physical delivery of the securities applies only to physically replicated ETFs.

- The investor purchases ETF units on the stock exchange or directly from a market maker or authorized partner (OTC trading)

- The market maker or authorized partner either pays cash (for physically and synthetically replicated ETFs) or delivers the requisite securities (only for physically replicated ETFs) to the ETF

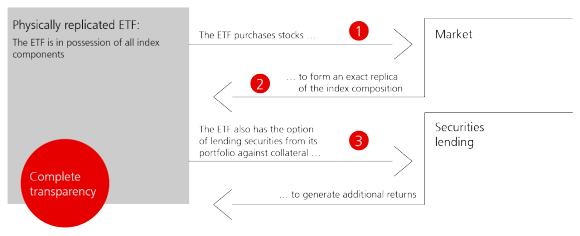

In the case of full physical index replication, the ETF acquires all securities represented in the underlying index in accordance with their index weightings. Hence, the ETF is in physical possession of the index components and thus an exact replica of the index. If any changes are made to the index, for example through index adjustments or capital actions of the represented securities, the ETF replicates these changes, making transactions necessary on a regular basis. The ETF regularly distributes income, in the form of dividends or coupons for example.

The full physical replication method is characterized by simplicity and minimal tracking error.

- The ETF is in physical possession of all securities represented in the index in accordance with their index weighting

- All index adjustments and capital actions are identically replicated

- Some ETFs lend out securities from their portfolio for a fee

Securities lending

A number of select physically replicated ETFs engage in securities lending in order to generate additional returns and reduce investors' net costs, whereby the ETF's securities are lent out for a fee. Securities lending transactions of UBS ETFs are over collateralized to a minimum of 105%.

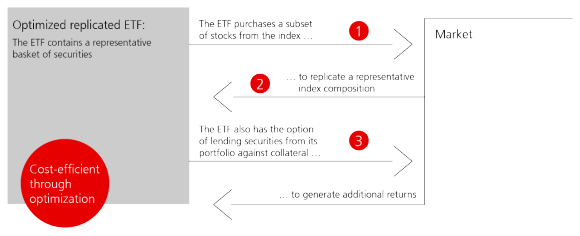

In the case of optimized physical replication, the ETF holds a sample of the securities in the underlying index. Analytical tools and mathematical optimization procedures are implemented to define a subset of the index constituents that will achieve a return similar to that of the original stocks represented in the index. The optimized physical replication method can be utilized to increase liquidity and minimize tracking error.

The optimized physical replication method is particularly suitable for very broad-based indices. For example, the MSCI World Index comprises approximately 1,600 stocks from a variety of markets, jurisdictions and currency zones. Accordingly, full physical replication of the index would involve high transaction costs. A number of these securities are not very liquid or have only minimal impact on the performance of the Index due to their low weighting. Transaction costs can be reduced by excluding these securities.

- The ETF is in physical possession of a subset of the index components, which is used either for very broad-based indices or for indices with illiquid securities

- Optimization procedures are implemented in order to lower transaction costs, increase liquidity and minimize tracking error

- Some ETFs lend out securities from their portfolio for a fee

Securities lending

A number of select physically replicated ETFs engage in securities lending in order to generate additional returns and reduce investors' net costs, whereby the ETF's securities are lent out for a fee. Securities lending transactions of UBS ETFs are over collateralized to a minimum of 105%.

Several factors contribute to pricing ETFs and affect individual ETF costs. The total cost of owning an ETF depends largely on your chosen portfolio strategy as well as the asset class the fund invests in. ETF fees are lower than traditional mutual funds however they do have a wide variety of different pricing terms. ETF spreads also vary in relation to ETF activity.

The tracking difference is the difference between fund performance and index performance. The fund performance represents all costs relevant to the fund and all income flows into the fund. Both the ETF total expense ratio and the tracking difference are published in the fund's semi-annual and annual report.

The total expense ratio is the ratio between total costs and the average fund size during a fiscal year. Costs are defined as all expenses in the income statement, including management, administration, custody, auditing, legal and advisory fees (operating expenses). The ETF total expense ratio is expressed retroactively as a percentage of the average fund assets and is calculated in accordance with the guidelines on the calculation and disclosure of the TER of collective investment schemes.

In the case of synthetic index replication, the performance of the index underlying the ETF is achieved through a swap. The ETF enters into a swap agreement with an investment bank, the swap counterparty. The content of this agreement is the transfer of the ETF's cash flows to the swap counterparty, which in return guarantees the performance of the tracked index to the ETF. The risk associated with precise index tracking is transferred from the ETF to the swap counterparty. As physical ownership of the securities represented in the index is no longer a prerequisite for participation in the index performance, it is possible to efficiently track markets that for example are impossible or difficult to access due to trading restrictions.

UBS employs two different swap structures in synthetic replication: the fully funded swap and a combined model (total return swap and asset portfolio with fully funded swap).

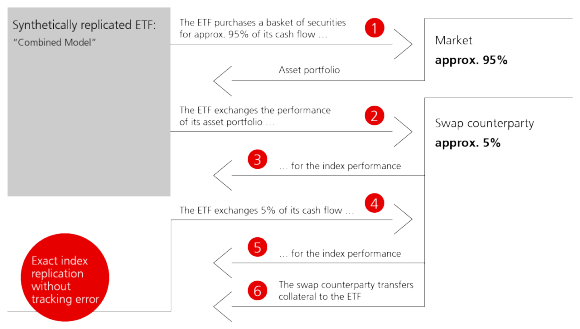

Combined model: Asset portfolio and total return swap plus fully funded swap (AP & TRS + FFS)

In this replication method, the subscriptions into the ETF are invested in a ratio of approximately 95:5 in a portfolio of assets (the "asset portfolio") and a fully funded swap.

Asset portfolio and total return swap (AP & TRS)

Roughly 95% of the fund assets are used by the ETF to purchase a basket of securities, the asset portfolio. The basket consists of a diversified and liquid portfolio of developed market equities and is optimized on the basis of liquidity considerations. The ETF also enters into an unfunded swap agreement with the swap counterparty to exchange the returns of this portfolio for the desired index performance. The swap counterparty generates this performance by investing in securities and derivatives that replicate the index performance.

Fully funded swap (FFS)

The remaining fund assets (roughly 5%) are used by the ETF to enter into a fully funded swap agreement with the swap counterparty under which the swap counterparty agrees to deliver the index performance.

Exposure to the swap counterparty

In order to protect the ETF against the risk of the swap counterparty defaulting on its obligations, the swap counterparty transfers collateral to the ETF in the form of G10 government bonds, supranational bonds and cash. The amount of collateral transferred is subject to haircuts and collateral assets are held at an external custodian bank in the name of the ETF (transfer of ownership). The ETF has immediate access to the collateral in the event that the swap counterparty defaults on its obligations.

- The ETF purchases a basket of securities with approx. 95% of its cash.

- The ETF pledges the performance of the basket to the swap counterparty.

- The swap counterparty pledges the exact index performance (less a fee drag) in return.

- The ETF enters into a fully funded swap with the swap counterparty for approx. 5% of its cash.

- The swap counterparty owes the exact index performance (less a fee drag).

- The swap counterparty transfers collateral to the ETF in the form of G10 government bonds, supranational bonds and cash. The amount of collateral transferred is subject to haircuts.

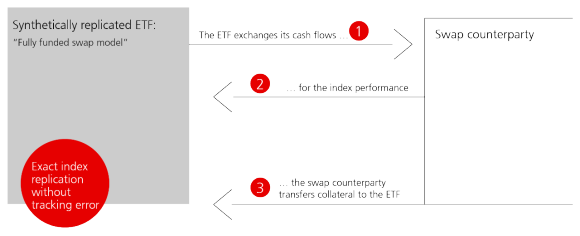

Fully funded swap model

In this replication method, the ETF transfers cash to the swap counterparty and in return receives the index performance via a swap contract. In order to protect the ETF against the risk of the swap counterparty defaulting on its obligations, the swap counterparty transfers collateral to the ETF in the form of G10 government bonds, supranational bonds and cash. The amount of collateral transferred is subject to haircuts and the collateral assets are held in a segregated account at an external custodian bank in the name of the ETF (transfer of ownership). The ETF has immediate access to the collateral in the event that the swap counterparty defaults on its obligations.

- The ETF enters into a fully funded swap with the swap counterparty.

- The swap counterparty owes the exact index performance (less a fee drag).

- The swap counterparty transfers collateral to the ETF in the form of G10 government bonds, supranational bonds and cash. The amount of collateral transferred is subject to haircuts.

For all synthetic UBS ETFs, the UBS Investment Bank is the exclusive counterparty for all OTC swap transactions. However, UBS ETF monitors the creditworthiness of the counterparty on a regular basis. The monitoring is performed by the directors of the board in the quarterly meetings. If the market circumstances require it, the review can even take place at an ad-hoc basis. Although UBS Investment Bank is the only counterparty to UBS ETFs' swap agreements, pricing is tested via a range of external panel banks on at least an annual basis. If a panel bank offers more favorable terms, then UBS Investment Bank has the ability to enter into a back-to-back swap agreement with the panel bank in order to achieve competitive pricing for the ETFs. Where permitted and operationally possible, we use multiple FX counterparties to facilitate our FX execution.

In ETF securities lending, the lender (UBS ETFs) transfers a certain number of securities from the ETF portfolio to a third party (borrower) for an agreed period in return for a fee.

- UBS ETFs engage in securities lending only for select physically replicated ETFs domiciled in Switzerland, Ireland, and Luxembourg.

- The objective is to reduce investors' net costs through additional income.

- Securities lending transactions of UBS ETFs are over collateralized to a minimum of 105%.

- A haircut is additionally applied to Swiss-domiciled ETFs.

- Careful selection of borrowers and daily mark-to-market valuation of collateral serve to minimize risk.

- High degree of transparency through daily publication of collateral assets for each subfund.

Yes, some UBS physically replicated ETFs domiciled in Luxembourg, Ireland and Switzerland participate in securities lending. However, for Fixed Income, ESG/SRI and precious metal UBS ETFs the fund management company does not carry out any lending transactions.

Securities lending by the fund generates additional revenues (typically 1-20 bp, depending on the index). Securities-lending revenues are reflected in the NAV, directly reducing the net cost to investors.

The borrower pays the ETF a fee for the duration of the securities lending period. In addition, all entitlements such as coupons or dividends paid on the securities while on loan are passed on to the ETF in the form of a manufactured payment. As such, securities lending enables the fund to generate additional revenues, which are reflected in the net asset value (NAV) and directly reduce net costs to investors as a result.

According to the European fund UCITS directive and the Swiss CISA, securities lending may be up to 100%. Actual lending rates for UBS ETFs have been considerably lower. UBS ETFs have set a cap of 50% of the net asset value of an ETF on securities lending, while some are capped at 25% in order to meet market requirements.

To minimize securities lending risk for UBS ETFs, borrowers are carefully selected and monitored on a daily basis. Before borrowers receive the securities, they must provide the lender - the ETF - with collateral. The collateral assets serve to secure the borrower's obligations to the lender. The collateral is transferred to a completely separate custody account or collateral account that is ring-fenced from the lender's balance sheet.

Securities lending may be terminated on demand by the lender on a daily basis. A daily mark-to-market valuation of loans and collateral ensures that the value of the collateral posted by the borrower is always adjusted to the correct level. In addition, securities lending transactions of UBS ETFs are always over collateralized to a minimum of 105%. For Swiss-domiciled ETFs, a valuation haircut is additionally applied to the underlying collateral. Securities lending ceases when it is terminated by the ETF or the borrower's demand is satisfied. The collateral held is returned to the borrower only after the securities have been returned to the ETF.

The securities lending agent for Luxembourg-domiciled ETFs is State Street Bank International GmbH, Munich, Germany, and State Street Bank and Trust Company. For Swiss UBS ETFs, UBS Switzerland AG acts as the sole borrower (principal) to the lending program.

State Street acts as lending agent. The borrower list of the lending agent is approved by UBS representatives. In addition, it matches with the UBS counterparty list. The counterparty risk is monitored on a daily basis by the lending agent, State Street. State Street also provides default indemnification in the event that a borrower is unable to return securities. Securities lending transactions of UBS ETFs are fully collateralized.

UBS Switzerland AG is the sole borrower (principal) in respect of the ETF and guarantees all contractual duties. To protect the ETF against UBS counterparty risk, UBS Switzerland AG provides collateral according to stringent FINMA regulations (Collective Investment Schemes Ordinance).

1. The terms of the trade are agreed between the lending agent and the borrower, and collateral is delivered.

2. Once the collateral has been received by the lending agent, the lent/borrowed securities are transferred to the borrower.

3. The lender (i.e. the ETF) remains the beneficial owner of the security on loan. As such, the lending agent collects all entitlements paid on each security whilst on loan and passes these back to the lender as a manufactured payment. The lender is in the same economic position as if the security had not been lent.

4. The borrower pays the lending agent the pre agreed lending fee. Payments are agreed and made on a monthly basis.

5. The borrower returns the securities once the demand is fulfilled, or earlier if the lender liquidates a position. All trades are recallable on demand on a daily basis and no fixed term trades are entered into.

6. Once the security has been returned to the lender's custody account, the lending agent returns the collateral held to the borrower.

1. UBS ETFs have given the securities lending mandate to UBS Switzerland AG, acting as principal securities lending provider.

2. UBS Switzerland AG re-uses the borrowed securities in line with demand from street-side borrowers and from UBS-internal sources. UBS deals with external and internal borrowers on an at-arms-length basis.

3. UBS ETFs only have credit risk towards UBS Switzerland AG, but not to street-side borrowers.

4. Fees received from the market borrower are shared according to a pre-agreed fee split arrangement between the UBS ETF and UBS Switzerland AG.

5. In case a security is on loan over a record date, UBS Switzerland AG passes on all corporate actions to the ETF. Coupons and dividends will be paid to the ETF via a substitute payment ensuring the ETF is economically at least in the same position as it would be if the securities had not been on loan over record date.

6. UBS Switzerland AG will return the securities to the ETF upon termination of the loan, or if the ETF wishes to regain the securities, for example in case of a sale. The ETF portfolio manager can sell securities anytime even if they are on loan. For this reason, securities lending does not interfere with the main investment process.

Securities lending transactions for UBS ETFs set up in Luxembourg are fully collateralized. The Luxembourg regulator requires a minimum collateralization of 90%; however, UBS ETFs overcollateralize to 105%.

The collateral is held in a custodian account that is ring-fenced from the lending agent's balance sheet. Further risk mitigation measures are careful selection of borrowers and revaluation of loans and collaterals on a daily basis.

Securities lending for ETFs domiciled in Luxembourg and Ireland

For UBS ETFs, domiciled in Luxembourg and Ireland, that engage in securities lending, the following types of collateral are currently accepted:

- Equities from the following indices are acceptable: AS30, AS51, ATX, BEL20, SPTSX, KFX, HEX25, CAC, CN20, DAX, HDAX, HSI, FTSEMIB, NKY, AEX, OBX, FSSTI, IBEX, OMX, SMI, SPX, MID, INDU, NYA, CCMP, RAY, RIY, UKX, SX5P, N100, E100, FTAW01

- Government Bonds from the following countries are acceptable: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Japan, Netherlands, New Zealand, Norway, Sweden, SNB Bills, UK and USA (including agencies)

Source: State Street, July 1, 2022

Type and level of collateralization required for Luxembourg and Ireland domiciled ETFs*

Type of borrowed securities | Type of borrowed securities | Type of collateral - Government bonds | Type of collateral - International equities | |||

|---|---|---|---|---|---|---|

International equities | International equities | 105% | 105% | |||

US equities | US equities | 105% | 105% |

Securities lending transactions for Swiss-domiciled UBS ETFs are fully collateralized. UBS Switzerland AG has a robust collateral setup which is in line with the FINMA Collective Investment Schemes Ordinance.

UBS ETFs receive collateral with a collateral value of at 105% of the market value of the lent securities. The collateral consists of liquid assets, including government bonds, liquid equities and bonds with a minimum rating stipulated by one of the FINMA approved rating agencies. When determining the collateral value of a security, its market value is reduced by a haircut of up to 8%.

Various concentration limits ensure proper diversification and liquidity of the collateral portfolio.

A daily mark-to-market process ensures that the collateral value is updated to reflect the loan value.

Collateral is held in the name of the lender in a segregated collateral account which is remote from the bankruptcy estate of UBS Switzerland AG.

Securities lending for Swiss-domiciled ETFs

For Swiss-domiciled UBS ETFs that engage in securities lending, the following types of securities are currently accepted as collateral (excluding securities of the borrowing counterparty):

- Government bonds issued by G10 countries. Government bonds not issued in the US, Japan, UK, Germany or Switzerland must have at least an "A" rating or equivalent

- Corporate bonds with minimum rating of "A" or equivalent

- Equities issued by companies represented on the following indices: AEX, ATX, BEL20, CAC, DAX, INDU, UKX, HEX25, KFX, OMX, OBX, SMI, SPI, SPX, SX5E

Source: UBS Switzerland AG, September 20, 2021

Haircuts and margin*

A 5% margin is added to the market value of the lent securities to determine the collateral requirement. The collateral value of a security is equal to its market value less a haircut as per the below table:

Collateral | Collateral | Haircut | Haircut |

|---|---|---|---|

Collateral | International equities | Haircut | 8% |

Collateral | Government bonds issued by US, JP, UK, DE, CH | Haircut | 0% |

Collateral | Government bonds with a minimum rating of "A" (excluding US, UK, DE, CH) | Haircut | 2% |

Collateral | Corporate bonds with at least an 'A" rating | Haircut | 4% |

UBS has limited lending by any one UBS ETF to 50% of its assets under management. In practice and as a rule, the proportion actually lent is significantly lower