Own home and mortgage affordability How much equity do you need to buy a house?

Buying a house in Switzerland: find out everything you need to know about equity and receive tips for buying a home!

Content:

Content:

- What counts as equity in addition to savings.

- Gifts and advance inheritances are eligible.

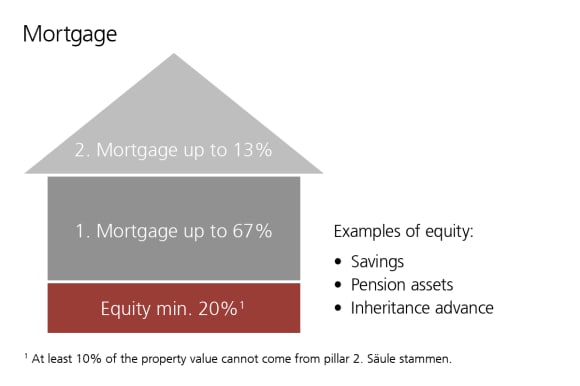

- For mortgage loans for owner-occupied residential property, you need at least 20% equity.

- Other rules apply to vacation and investment properties.

- Keep money in reserve for unexpected costs and renovations.

- To the conclusion

To obtain a mortgage to buy a home, you need equity. However, in addition to savings, there are other attractive ways to find the required equity. We show you how to find the required equity and ensure affordability.

In addition to obvious resources such as money held in savings and current accounts, securities and valuables - from paintings and jewelry to vintage cars - can be sold and thus also count as equity. So too does the surrender value of an insurance policy or unencumbered construction land.

Equity for the purchase of a house can also be increased by an inheritance advance or gifts from a family member. Furthermore, all of your pillar 3a retirement savings can be used to finance residential property and also count as equity.

All of the monies mentioned above count as “hard” equity. There is also “soft” equity, some of which can also be used to finance the purchase of a property. Here we are mainly referring to the advance withdrawal of retirement savings from pillar 2.

How much equity is required to buy a house

How much equity is required to buy a house

In Switzerland, 20% of the purchase price or market value must normally be financed by equity. A mortgage can be taken out for the remaining 80%. A distinction is made here between the first and second mortgage. Up to two-thirds of the purchase price can be covered by the first mortgage, which does not have to be amortized. The second mortgage, on the other hand, must be amortized within 15 years via regular repayments.

The following applies to equity: at least 10% of the financing must be provided by “hard” equity, the other 10% can be financed by an early withdrawal from your pension fund. Remember that with this model (“only” 10% hard equity) the mortgage will be for 90% of the purchase price. The 10% “soft” equity cannot therefore be used to reduce the mortgage amount.

How much will my mortgage cost?

How much will my mortgage cost?

With the mortgage calculator, you can easily and quickly find out whether you can afford your dream property.

Different rules for vacation homes and investment properties

If you want to buy a vacation home or a luxury property you will need more equity to obtain a loan, generally 40%. In addition, retirement savings from pillar 2 or pillar 3 accounts cannot be used as equity towards a vacation property.

In the case of investment properties, other rules apply: loans of up to 75% of the property value are possible, but the mortgage must be reduced to two-thirds of the property value within 10 years. Pension funds can be used if you inhabit part of the property yourself.

Challenges and risks when financing with a mortgage

Challenges and risks when financing with a mortgage

Certain risks are involved in financing with a mortgage. For example, price risk. If the value of your property decreases, in the worst case, the mortgage could be higher than the value of the property. In the event of a sale, you could be left with a considerable loss. The risk is particularly high if real estate prices have risen over a long period of time.

You should also take interest rate risk into account. Interest rates can rise rapidly, especially in times of rising inflation. If you have a mortgage with a variable interest rate (SARON mortgage), higher interest payments are then due.

Last but not least, you should not forget about general risks in life. Events such as losing your job, sickness, divorce or the need for nursing care usually have a negative impact on disposable income. In such cases, property owners may no longer be able to afford interest payments and amortizations.

Protect yourself against financing risks

Protect yourself against financing risks

You can insure yourself against many general risks. Term life insurance, for example, ensures that your surviving dependents, such as life partners or children, receive compensation that covers all or part of the remaining mortgage in the event of your death. The exact amount of compensation depends on the type of insurance.

You should always have certain financial reserves ready as a risk buffer before buying a house. In this way, you can ensure that at least temporary financial losses - such as unemployment or sickness - do not immediately jeopardize your home’s affordability.

How can I best protect my family?

How can I best protect my family?

- With Zurich Immo-Protect, you can insure against the financial risks of death or incapacity to work.

- You decide what risk you want to insure against and choose the amount of the lump-sum payment.

- Our experts explain what really matters when it comes to protecting your family and partner.

Tips and tricks for managing your equity

Tips and tricks for managing your equity

You should prepare thoroughly for a real estate purchase. To reach the required 20% equity, you should start saving or accumulating assets as early as possible. Voluntary retirement savings in pillar 3a are an especially smart choice. Up to a certain amount, these payments can be deducted from your taxable income. Thanks to this tax benefit, you can save the equity you require more quickly than if you simply park your money in a savings account.

Affordability: long-term financing of your home

Affordability: long-term financing of your home

Before granting a mortgage, the bank also checks whether you can afford the property in the long term. To do this, it compares the cost of your home against your gross income. The basic rule is that the imputed costs of running your home must not exceed a third of your gross income. This is the only way you can finance your property in the long term. Monthly costs include:

- Imputed mortgage interest

- Any amortization payments

- Maintenance and ancillary costs

How is affordability calculated

To calculate affordability, imputed interest is used, i.e., not actual interest, but assumed amounts. This is to ensure that a property is still affordable even if interest rates rise.

The mortgage costs are calculated at an imputed interest rate, normally 5 percent. This value is significantly higher than the current market interest rate for mortgages in recent years. In addition, there is the agreed amortization for the second mortgage together with an imputed 1 percent of the property value for maintenance and ancillary costs each year.

Financing examples with equity and affordability

Value of the real estate | Value of the real estate | Minimum equity required | Minimum equity required | Annual imputed costs* | Annual imputed costs* | Required minimum gross income* | Required minimum gross income* |

|---|---|---|---|---|---|---|---|

Value of the real estate | 600,000 | Minimum equity required | 120,000 | Annual imputed costs* | 35,333 | Required minimum gross income* | 106,000 |

Value of the real estate | 800,000 | Minimum equity required | 160,000 | Annual imputed costs* | 47,111 | Required minimum gross income* | 141,333 |

Value of the real estate | 1,000,000 | Minimum equity required | 200,000 | Annual imputed costs* | 58,889 | Required minimum gross income* | 176,667 |

Value of the real estate | 1,250,000 | Minimum equity required | 250,000 | Annual imputed costs* | 73,661 | Required minimum gross income* | 220,833 |

Value of the real estate | 1,500,000 | Minimum equity required | 300,000 | Annual imputed costs* | 88,333 | Required minimum gross income* | 265,000 |

Value of the real estate | 2,000,000 | Minimum equity required | 400,000 | Annual imputed costs* | 117,778 | Required minimum gross income* | 353,333 |

Common mistakes when financing a property

Common mistakes when financing a property

Confusing the purchase price with the market value

The bank uses the market value as the basis for financing and not the actual purchase price. This is because the bank has to follow the lowest-value principle, which can have consequences for the level of interest and amortization.

Excessive mortgage levels

In principle, financing should not leave the borrower too exposed. If interest rates rise or unforeseen expenses are incurred, money can quickly run out.

Underestimating the interest rate risk

In recent years, interest rates have been historically low and many property buyers have got used to this. However, history has shown that interest rates can quickly move in a different direction. To protect yourself against rising interest rates, it is advisable to take out a fixed-rate mortgage. However, in this case, you will not benefit from falling interest rates.

Underestimating renovation requirements

Existing construction defects, outdated windows or poor insulation pose a financial risk. Suddenly, unexpected renovation costs are incurred. You should therefore check the condition of a property in detail before buying it and assess what financial consequences any defects pose.

In principle, homebuyers must contribute 20% of the purchase price of the property in equity. Half of this must be “hard” equity such as money held in savings and current accounts as well as pillar 3a accounts. The other half can be raised through “soft” equity, such as the advance withdrawal of retirement savings from pillar 2. However, more equity is required in the case of vacation or investment properties.