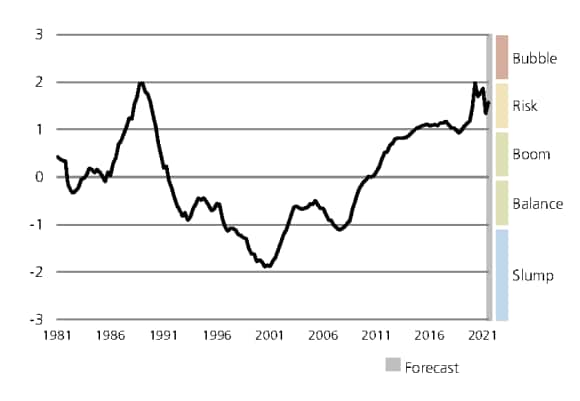

Real estate market Bubble index: real estate market still in risk zone

The UBS Swiss Real Estate Bubble Index fell briefly in Q3 2021. However, the housing market is still in the risk zone.

There are many reasons for owning a home. But does ownership also pay off financially? House prices rose by almost six percent year-on-year in the third quarter of 2021 – the strongest increase since 2013. But despite high purchase prices, owning your own home is generally still worthwhile because occupancy costs are around 10 to 15 percent lower than the regular costs of a comparable rental property. What's more, homeowners continue to benefit from very low mortgage rates. “Low occupancy costs are also one of the reasons for the continued additional demand for owning a home,” says Maciej Skoczek, Swiss & Global Real Estate Analyst at UBS.

One-off effect leads to a slight decline in the index

One-off effect leads to a slight decline in the index

Despite the fundamentally positive situation regarding home ownership, the rapid rise in house prices due to high demand should not be ignored. Does this also entail the risk of a real estate bubble, i.e., a significant overvaluation of real estate and the likelihood of an imminent price drop? The UBS Swiss Real Estate Bubble Index provides the following answer: according to the latest figures for the third quarter of 2021, the index has fallen from 1.87 to 1.35 – but remains in the risk zone. The main reason for the decline, however, is the sharp increase in economic output compared to the poor figures for the same quarter of the previous year. This is a one-off effect, especially since economic output fluctuates a great deal during a pandemic. The decline in the index must therefore be put into perspective.

UBS Swiss Real Estate Bubble Index

UBS economists use a model with different subindices to calculate the bubble index. In addition to the ratio of home prices to annual rents, other factors are also considered. These include the comparison of house prices to household income, house prices in relation to consumer prices, loan applications for buy-to-let properties and mortgage volumes in relation to household income.

A key market indicator is the relationship between purchase prices and annual rent costs. This ratio currently stands at 34 annual rents. In other words, the average cost of owning your own home is the equivalent of paying rent on a comparable property for a period of 34 years. In the cities, this factor is even higher, especially in Zurich where the gap between property prices and rents continues to widen. Currently, the costs of owning a property in Zurich are equivalent to around 40 rent years. An index value of 34 is almost exactly on the boundary between risk zone and real estate bubble.

Regional risks

Regional risks

From a regional point of view, there are increased risks, especially in some urban regions. These include the areas around Geneva and Lausanne, Basel-Stadt, the Zurich area, on Lake Zurich and in the Zug economic area. UBS economists point to overheating or fundamental risks. Overheating risks arise when significant excess demand causes prices to shoot up, fundamental risks when house prices increasingly diverge from rents and household income, as is currently the case in Zurich, Lake Zurich and Basel-Stadt, for example. The current risk map shows the different risks for a number of market regions in the cantons of Ticino and Jura and in some mountainous regions in the canton of Valais. Here, supply exceeds demand, making it difficult to sell property.

Signs of increased risk through year end

Signs of increased risk through year end

Our experts expect the real estate bubble index to rise in the last quarter of 2021. According to the latest estimate, the index could climb to 1.57 percent from 1.34 percent today. The main reasons for this are current price trends (i.e., the forecast of further rising prices) and growing mortgage volumes. Economic output at the end of 2021 will probably not be very much higher than it was last year, judging by what we saw in the third quarter. The technical effect that put a brake on prices in the third quarter will not apply. Experts therefore assume that the risks in the market will probably continue to increase, albeit to different degrees, depending on the property and the region. “This means that the index is significantly higher than in 2019 before the pandemic,” explains Maciej Skoczek.

Interest rates are an important means of adjustment

Interest rates are an important means of adjustment

Demand is unlikely to weaken while interest rates remain low. Currently, it seems unlikely that mortgage rates will rise significantly in the coming quarters. This will, in turn, support demand in the real estate market. There are also hardly any signs of a reversal in trends regarding factors such as economic output (household income), construction activity, mortgage volume, etc. In terms of scenarios, interest rates are considered the most important tool for market equilibrium.

Let us take a concrete example. Assuming a (hypothetical) interest rates rise of two percent, the 10-year fixed-rate mortgages popular today would become more expensive and cost about 3.5 percent. A homeowner would therefore need reserves of income to ensure their mortgage is still affordable should they require any follow-up financing. “If interest rates are higher, the occupancy costs of home ownership would increase significantly compared to renting and demand would shift back to the rental segment,” Skoczek predicts. In purely mathematical terms, such a scenario could cause property prices to fall by around 20 percent.

What does the current interest rate environment mean for me?

What does the current interest rate environment mean for me?

We are be happy to advise you personally and show you your options – conveniently, either via video consultation or in a branch. We look forward to seeing you.

Summary

Summary

A combination of high demand and low interest rates suggests that the imbalances on the real estate market will continue for the time being. However, homeowners and those trying to get onto the property ladder soon are well advised to take several factors into consideration. For example, if you buy a property in an urban area where prices are very high, you can expect a lower loan-to-value ratio. In addition, and as Maciej Skoczek explains: “Someone who purchases a property via bidding process in an area with high prices will usually pay above the usual market price.”