After work, Martin Meister goes to the supermarket and buys everything he needs for a delicious dinner with his family. The cash register shows a total of CHF 74.30. Martin holds his UBS credit card to the payment terminal and because the amount is over CHF 40, he has to enter his PIN code. He presses “OK” and almost instantaneously the cash register prints out the receipt.

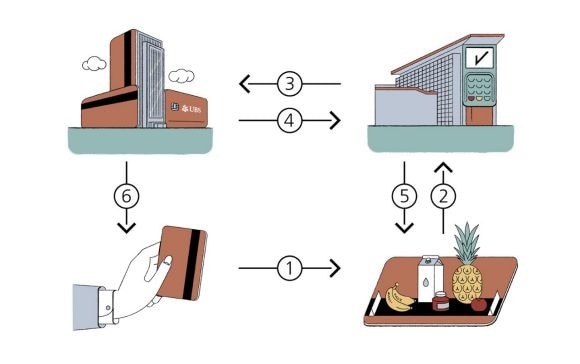

Since most payment terminals today have a dedicated line, the payment process takes virtually no time at all. And yet there’s quite a flow of information in the background before the payment is made. The answer to the question “How does a credit card work?” lies in what is known as the “four-party system". The parties: the customer, the merchant (e.g. Migros or Coop), the acquirer (e.g. SIX) and the card issuer (e.g. UBS Switzerland AG). The card organizations Mastercard and Visa operate the worldwide network that processes transactions and enable this “four-party system”. From the customer’s “OK” to the receipt, it then takes six steps that serve to process the payment and guarantee security.

Credit card transactions in six steps

Credit card transactions in six steps

- Martin holds his card to the merchant’s terminal, using either the contactless or card reader function, and in so doing launches the payment process.

- The merchant’s terminal transmits the transaction request to the acquiring bank, or acquirer, with whom the merchant has a credit card acceptance agreement.

- The acquirer then sends the request to the card issuer. UBS is one of the card issuers in Switzerland. Issuers issue the cards and provide the credit. They also check whether the card is blocked and whether the sum of CHF 74.30 is within the cardholder’s line of credit.

- If everything is “OK”, this approval is returned to the acquirer.

- From there, the “OK” is forwarded to the merchant’s payment terminal. Only then is the payment of the sum complete and the receipt is printed for Martin.

- The card issuer debits the transaction amount from Martin’s account with a slight delay, meaning that the transaction can be seen online before the monthly statement is sent.

Measures for secure credit cards

Measures for secure credit cards

The payment process of the four-party system incorporates various provisions to guarantee the security of a credit card payment. Marcel Drescher, Head of Fraud Services at the UBS Card Center, explains the checks for blocking and credit limit: “If a client has blocked his card, say because it was stolen, UBS sends a payment refusal to the merchant’s terminal via the acquirer, in order to prevent abuse of the card.” In the event of theft or abuse, Drescher recommends always blocking the credit card immediately via the UBS Mobile Banking app: “This lets the customer block the card within seconds without even the need for a phone call.”

As a card issuer, UBS offers its clients a number of other security-related features too. By means of a modern fraud early warning system, all transactions with UBS credit cards are checked in real time for possible fraud. If there is any doubt as to the authenticity of a transaction, UBS will immediately contact the client for confirmation.

Anti-fraud expert

Marcel Drescher heads Fraud Services at the UBS Card Center and is intimately acquainted with attempted card abuse. He is also the go-to expert for secure credit cards – the UBS Card Center does, after all, process 25 percent of all credit card transactions in Switzerland.

Security guaranteed

UBS guarantees you security when paying with your credit card in stores, when travelling and when shopping online. The credit cards and prepaid cards issued by UBS come equipped with the highest security standard and the latest technology. All the services and functions of credit cards are summarized on the UBS website under the keyword “Card services”, where you will also find tips on how to make payments securely.