Coronavirus: what can we learn from China?

Coronavirus emerged in China, but how has the Chinese government responded, what can we learn from China's experience and how should investors adapt?

Geoffrey Wong, Head of Emerging Markets and Asia Pacific Equities, Hayden Briscoe, Head of Fixed Income, Asia Pacific, and Projit Chatterjee, Senior Investment Specialist, Emerging Markets and Asia Pacific Equities, answered these questions and more at an exclusive webinar. Here are the highlights.

Coronavirus: what can we learn from China? Key takeaways

Coronavirus: what can we learn from China? Key takeaways

- The reaction to the outbreak has varied across countries as they have traded controlling the outbreak and fatalities on one side with the economic impact of the control measures on the other;

- Mainland China and some other Asian markets have weighed more on the side of control – wisely it now seems – because as the outbreak has escalated globally, a significant near-term economic impact is inescapable;

- However, China also gives us hope that the outbreak can be controlled and slowed down. And hence this crisis too shall pass;

- And while markets have understandably reacted negatively, that should not make us ignore the structural trends in China and emerging markets, and how some of these are accelerating and creating long-term investment opportunities;

- There is a compelling case for a dedicated strategic allocation to China - China Equity and Fixed Income offer very large hunting grounds for alpha and yield - and the world remains very underinvested in both.

Geoffrey Wong, Head of Emerging Markets and Asia Pacific Equities

Geoffrey Wong, Head of Emerging Markets and Asia Pacific Equities

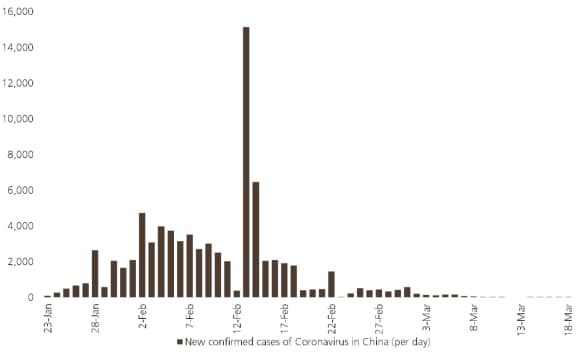

New cases of coronavirus in China have tailed off sharply

New cases of coronavirus in China have tailed off sharply

The number of new coronavirus cases being reported per day in China has tailed off sharply through March. New reported cases spiked in mid-February - because of a change in how infected cases were defined - but have fallen rapidly since then.

Most of the new cases being reported in China in the past few days have come from Chinese citizens returning with the virus from overseas, but domestic cases have been down sharply.

The number of new cases being reported per day in China has tailed off sharply through March

New confirmed cases of Coronavirus in China (per day), Jan 23, 2020-Mar 18, 2020

New confirmed cases of Coronavirus in China (per day), Jan 23, 2020-Mar 18, 2020

Some signs that China's economy is returning to normal

Some signs that China's economy is returning to normal

There have been upward trends in economic activity in China following Chinese New Year. Though yet to reach the same activity levels as last year, trends in traffic congestion and property sales offered some evidence that activity in China's economy is beginning to return to normal.

Short-and long-term impacts

Short-and long-term impacts

The immense precautions being taken will have a notable impact on global GDP. There is a growing consensus in the markets that there will be a global recession this year.

On the other hand, coordinated fiscal and monetary measures are underway which may have a countervailing impact on the global economy. In past global recessions, markets fell by as much as 50%, currently they are down about 25% so far. Although this does not at all necessarily imply that markets will fall to the 50% level, further downside from today is quite possible.

Other things will happen as well, stimulus is already happening, and there may be progress with a vaccine which may positively impact markets.

Markets will remain volatile but fundamental long-term trends in China and Asia remain intact, so the longer-term impact for investors over the next three-to-five years should be small.

Specifically, a series of trends are accelerating both in China and more widely in Asia which are part of ourinvestment strategies, including:

- Ongoing consolidation within many industries in China as smaller firms struggle;

- Shift from offline to online across business segments, especially after-school tutoring, financial services, and healthcare diagnosis;

- Investment in R&D and innovation, driven by growing demand for automated solutions;

- Shifts in supply chain; South-East Asia and India could benefit, plus reshoring back to US, Korea, Japan;

Investing in China is not about beta investing but accessing active return and investors can find rich alpha opportunities in China's A-share market.

There are two key factors for this: firstly, market inefficiencies caused by the retail-driven investor base and, secondly, long-term fundamental trends that are driving the economy.

Trends like the shift to a service and consumption-driven economy, ongoing urbanization, premiumization, increasing R&D and innovation, and China's aging society, are all long-term fundamental trends that are creating winners and losers.

Despite the near term challenge from coronavirus, we remain confident in the fundamental, long-term changes playing out in China and emerging markets and our strategies are focused on quality companies associated with them.

In closing, we continue to remain cautious, with no major portfolio changes yet, but remain prepared to make portfolio changes at appropriate price points, especially by adding to positions in high-quality industry leaders.

Hayden Briscoe, Head of Fixed Income, Asia Pacific

Hayden Briscoe, Head of Fixed Income, Asia Pacific

Coronavirus: the view from China's bond markets

Coronavirus: the view from China's bond markets

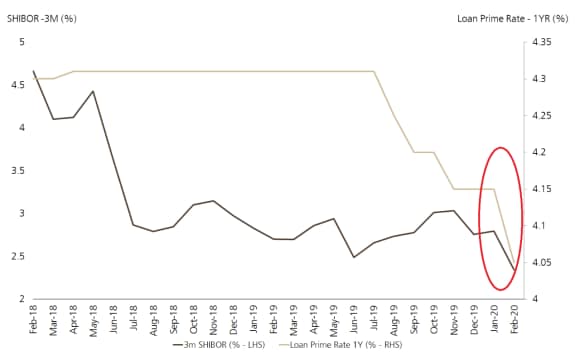

The Chinese government has flooded the market with liquidity and drastically eased monetary policy.

Key interest in China: SHIBOR and Loan Prime Rate (%), February 2018-February 2020

Key interest in China: SHIBOR and Loan Prime Rate (%), February 2018-February 2020

What hasn't been so widely reported is the extent to which the Chinese government has stepped in.

Effectively, they have lent directly into sectors and segments of the market and ruled out defaults in the market this year. This makes for a marked contrast to the rest of the world, and we have seen cases of spreads narrowing in Chinese markets.

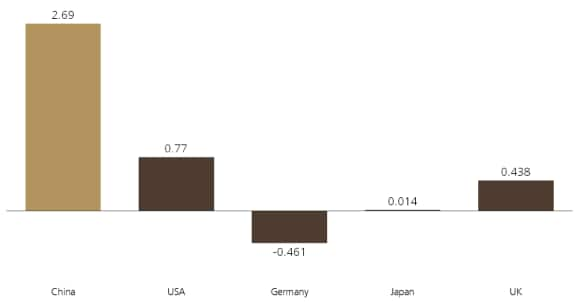

Looking globally, China government bonds continue to offer some of the highest nominal yields in global markets today, and look particularly attractive in a world of increasingly negative yield.

Nominal yields (%) on ten-year government bonds, March 17th, 2020

Nominal yields (%) on ten-year government bonds, March 17th, 2020

China's onshore markets remain relatively stable compared to other major markets globally, with volatility staying markedly below the US and Europe both historically and particularly during the recent bouts of market turmoil.

In this respect, China's fixed income markets remain a standout with relatively low correlation.

Q&A:

Q&A:

1. What lessons can the world take from how China handled COVID-19?

Geoffrey Wong (GW): China has done well after the initial hiccups in Wuhan. A few factors are key: firstly, very strict social distancing and quarantine measures; secondly, widespread testing and contact tracing of people and, finally, very clear statements on the economic side that they will do 'whatever it takes' to stabilize the economy.

In sum, fast decisive action to keep infection rates low. The Chinese authorities have wanted to keep the number of peak infections lower than the number of ICU beds that they have. This factor is vital because patients kept in ICU facilities have a much higher chance of survival.

Hayden Briscoe (HB): To adapt and adapt quickly. I have recently been in London and was shocked to see how few people were taking the virus seriously. For example, I was only one of five people at Heathrow airport wearing a mask – a stark contrast to Hong Kong and China, where everyone is wearing them.

2. You're both constructive on China; how are you factoring in the impact that the Western world's slowdown will have on China's economy?

GW: The long-term outlook still is optimistic for certain companies and industries. In the short term, a global recession seems to be likely. The medium market reaction will be a complex mixture of very bad economic and earnings, ample stimulus and the wildcard of progress (or lack of) on a vaccine. We can look at the stock prices being served to us daily, with a view as to whether individual stocks are compelling value if held for the long term. This is what we do.

3. How trustable are the numbers on activity in China?

GW: We supplement official numbers with data from alternative datasets. We set up a team called QED that supports us in these alternative data analytical efforts. Examples that help track China activity include: air pollution data, traffic congestion, property transactions, airplane and train ticket sales. These help to verify official data.

4. How are you continuing to have one-to-one meetings with companies amid the coronavirus outbreak, and how is this environment affecting your decision-making?

GW: The boots are off the ground at the minute, but we have our ears to the ground - we have ramped up the number of daily management telephone calls. So we are keeping in very close contact with the companies and the conversations we are having with them focus on the impact they are seeing and feeling from coronavirus.

5. What kind of impact will this crisis have on China's GDP numbers?

HB: We don't expect the economy to bounce back to 5%-6% any time soon. The thing to focus on now is not GDP, but what we call China's credit impulse – the growth rate of total credit in the economy as a percentage of total GDP. This is closely related to the outlook for the economy six-to-nine months ahead.

The credit impulse is turning positive, and we wouldn't be surprised to see it pick up markedly in the coming months. That's because the Chinese government has done an excellent job in driving cash into the real economy. Currently, overnight cash rates are very low at around 1.5%.

6. Has coronavirus strengthened the argument for investors to make a standalone allocation to Chinese assets in their strategic asset allocation portfolio?

GW: Yes, Coronavirus has been a very good test of the standalone China thesis. If you look at how global markets have performed, they have been down around 25%, yet the China A-share market has been down around 3%. The A-share market has a very different investor base, which is dominated by domestic retail investors.

Though Stock Connect is growing in importance, domestic investors in China still have very few avenues to send their money abroad, so they are concentrated domestically. These investors are driven by different factors compared to investors in say the US or Europe, and so the correlation between the markets is low.

The domestic Chinese citizens are reassured by the decisiveness of their government at this time, and so China's markets have been relatively stable. So this lack of correlation between what's happening in China and the rest of the world is a very strong argument for why global investors should look at China A-shares as a separate asset class.

Not only is the active return there – and that’s of course the primary reason to be there – but the correlation is low. So you will actually lower your overall portfolio risk with a moderate amount of China A-shares in your global portfolio. So this strengthens the argument for China as a separate asset class.

HB: Since the 1980s our entire industry has been based on negative correlation between fixed income assets and risky assets.That anchor has been taken away now you get to zero, so you have to rethink your strategy, or find assets that replace it.

Unfortunately, as we go into this slowdown, people are missing out on income and they don't have a defensive bond in their portfolio. It is likely that investors will shift to Chinese bonds only after they realize this.

It takes a big call for a CIO to embrace the peer risk here and make a higher allocation to China. If you just follow the indexes, China is only 6% of the index, but it’s the second largest market in the world.

It is not big enough to move the needle if you leave your China allocation inside an index, so you have to make a strategic allocation. We're saying that's somewhere around 40% to China, 40% to Treasuries, and the rest to other smaller fixed income markets like UK, Australia, and New Zealand.

We'd also advise doing it on a fully hedged basis. So CIOs need to make bigger calls. For 30 years, managers left it up to the indexes, but we're saying now that investors have to pick the countries, and rethink their allocations.

7. Will there be a second round of effects on China from a global slowdown?

HB: We are going into full lockdown in places like Taiwan and Hong Kong, with strict quarantine laws. There's going to be a slowdown, and that is positive for Chinese bonds, because it means more rate cuts, higher liquidity, and we will likely see a continued rally.

GW: Secondary effects will occur. We have to think now about how we use our risk budget. Markets have fallen about halfway, good quality stocks haven't quite fallen as much. From our portfolio action, we are still keeping dry powder to use for when all the bad news is out there. We have used some ammunition to buy into some selected stocks.

8. Can you comment on market liquidity situations that you are seeing?

HB: As for market liquidity, it's perfectly fine in the government space or onshore. All the onshore credits are actually bid, so the credit spreads are actually contracting. Offshore is more challenging, perversely there is more liquidity in the high yield markets because the Chinese investors are looking for hard currency, USD-denominated Chinese issuers. Conditions are challenging in investment grade assets.

GW: Generally, we are still able to adjust our portfolios. Obviously when you are buying and selling the selling is slightly more difficult that the buying in this environment and spreads during the day can be fairly large. With the exception of the Philippines, we have had continuous trading in other markets, so markets are still functioning.

9. What kind of flows have you seen for China equities and fixed income strategies?

GW: On the wholesale side we have seen decent inflows YTD. On the institutional side we have had two fundings and one redemption in the last month. Net-net, investors seem to be looking at the current situation as an opportunity. Partly, that's because we have one of the top-performing products. Generally in Asia, there have been redemptions, but we haven't seen much of this so far.

HB: We have seen a lot of clients selling negative-yielding assets or EM debt and then switching into China fixed income for higher yields and more safety.