Macro Monthly Navigating the return of inflation risk

For now, the mere re-emergence of inflation risk is the more pressing consideration for investors, not what inflation will be one or two years down the road.

Highlights

Highlights

- Inflation risks are tilted to the upside for the first time in at least a decade.

- We believe this changing balance of risks should prompt a rotation of flows away from growth stocks and other high duration assets and towards beneficiaries of firmer economic activity and price pressures.

- We continue to prefer procyclical relative value positions in earlier-cycle European, Japanese, and value stocks, and more recently EM ex-China equities. Yield curves should steepen, led by rising longer-term yields, while the US dollar weakens.

- Considerable uncertainty as to the persistence of inflation will remain in place through year end. This will add to its longevity as a market catalyst and spark bouts of cross-asset volatility over the coming months.

- The evolution of price pressures this year will not jeopardize the Federal Reserve’s patient, structurally dovish reaction function on rates.

The expansion following the financial crisis was a Goldilocks environment for markets, with growth and inflation neither running too hot nor cold. Early on in this cycle, the outlook for those key macro variables is both higher and more uncertain.

For the first time in at least a decade, the balance of risks for inflation is tilted more to the upside than downside. In our view, appropriate risk management entails that investors need to act and adjust portfolios to account for a potential fundamental change in the landscape – even if they believe those price pressures ultimately prove to be temporary. The key point is that markets will need to trade this shift in the risk distribution now, regardless of what inflation ends up being in a year or two.

We believe this should catalyze flows away from long-duration assets like growth stocks and sovereign bonds in favor of assets that benefit from higher nominal growth. As such, we expect the dollar to continue to weaken, particularly against high-beta emerging market currencies, developed market bond yields to rise as curves steepen, and procyclical relative value positions in European, Japanese, EM ex-China, and value stocks to outperform. We are positioned for both growth and inflation to be cyclically stronger during this expansion than the prior one, but do not expect the type of upward spiral in inflation that would serve as a sustained headwind to risk assets. That being said, inflation’s ascension as a threat to certain portions of the equity market is one reason why we have moderated our overall risk asset exposure.

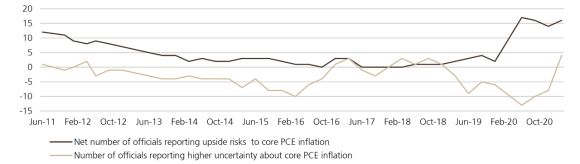

Exhibit 1: The Fed views inflation risks as tilted to the upside and uncertain

Exhibit 1: The Fed views inflation risks as tilted to the upside and uncertain

Short-, medium-, and long-term inflation dynamics

The case for inflation demands investors’ attention because it involves many layers that may unfold over different time horizons.

Base effects, shortages in certain goods, and a rebound in items linked to economic reopening are adding to readings of annual inflation now. A potential burst of pent-up demand may soon amplify inflation more broadly in services sectors, as well. Energy costs could continue to rise as vaccinations allow for increased mobility and, in turn, demand for gasoline. We expect broad measures of the annual rate of US inflation to peak in the second quarter. But there is considerable uncertainty surrounding how much and how quickly these pressures will fade, especially in light of this unprecedented economic freeze and thaw.

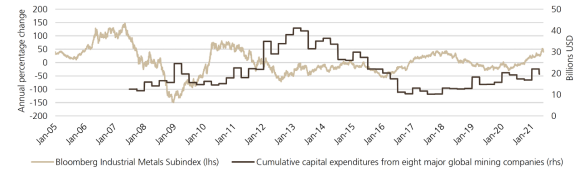

Other potential drivers of inflation could have longer-lasting effects, like supply shortages in industrial metals that cannot be quickly resolved. More crucially, monetary and fiscal policy that is structurally more supportive of growth and fostering superior labor market outcomes relative to past cycles could spur cyclical, and perhaps even structural, price pressures.

This multi-faceted case for inflation must be respected, particularly as this phenomenon is relatively foreign to a generation of investors. But so too should the powerful structural forces that have kept price pressures subdued across advanced economies through those decades be acknowledged – aging demographics, technological innovation, and globally integrated product and labor markets.

Transitory, or persistent?

By the end of 2021, the state of inflationary pressures is likely to be in the eye of the beholder – depending on the measure being referenced – and these differences in perspectives will have consequences for financial markets.

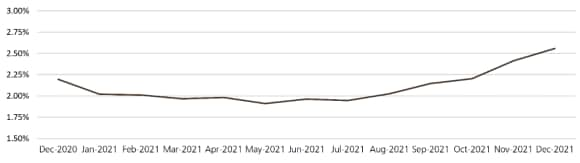

We expect a substantial gap between the rate of headline CPI inflation and core PCE inflation to linger well into 2022 because of differences in the composition of these indexes. Shelter costs, which have a much higher weighting in CPI compared to PCE, are poised to steadily accelerate as the lagged effects of the increase in new rental prices filters into the existing stock. Energy prices, absent material declines, should contribute to put considerable upward pressure on CPI through year end. Elsewhere, some items will likely show an ebbing of inflationary pressures as prices normalize to pre-pandemic levels, consumption rebalances from goods to services, and base effects contributing to stronger annual inflation drop out of the readings.

Exhibit 2: Period of underinvestment may fuel sustained price gains in metals

Exhibit 2: Period of underinvestment may fuel sustained price gains in metals

Exhibit 3: US housing inflation poised to accelerate, which will contribute more to CPI than PCE

Exhibit 3: US housing inflation poised to accelerate, which will contribute more to CPI than PCE

This deceleration in inflationary pressures will be most evident in the core PCE price index, because of the aforementioned lower weighting towards shelter. PCE is the Fed’s preferred gauge of price pressures, with the core number (excluding the more volatile energy and food prices) utilized to assess the underlying trend. By the fourth quarter, the downward trend in core PCE is likely to be sufficient corroboration for the central bank’s view that this bout of above-target inflation is transitory.

The Federal Reserve is aiming to look through inflationary pressures that are not clearly linked to a tightening labor market. One part of the central bank’s dual mandate – maximum employment – is being viewed as a necessary prerequisite to sustainably attaining the other – price stability – on a sustained basis.

In our view, an enduring, meaningful discrepancy between the measures that investors and the Federal Reserve use to evaluate price pressures will have market ramifications. Primarily, the central bank’s tolerance of inflation will prompt market participants to attach more weight to scenarios in which price pressures run hotter on a cyclical basis, as well as tail scenarios involving the perception that the Federal Reserve has fallen dangerously behind the curve. This could cause supporting curve steepeners (a rise in the spread between long-term and short-term yields) and underweight positions in global duration. If those tail scenarios creep more towards becoming part of base case outcomes, this would likely involve a significant steepening of the yield curve that sparks equity volatility as well.

Why inflation alone won’t spark a Fed about-face

In our view, it would take a combination of many factors to get the Federal Reserve to reevaluate the prudence of its current framework during 2021. Context is key: core PCE inflation, the Fed’s preferred guide of underlying inflationary pressures, averaged 1.6% during the last cycle, and officials are aiming to make up for some of this prior shortfall in inflation relative to target. Shorter-term, annualized measures of trimmed and median inflation compiled by regional Fed branches would need to show persistence in core PCE price pressures through the fourth quarter. Survey measures of long-term inflation expectations from professional forecasters would need to be at risk of becoming unanchored to the upside. Perhaps most importantly, labor supply would need to remain a constraint on activity even in the midst of robust wage increases and a full, durable economic reopening. Combined, these three factors could provide a feedback loop for wage inflation to translate into consumer price inflation on an enduring basis.

However, this would likely force the Federal Reserve to accept a definition of maximum employment that would be below what prevailed in early 2020 across many measures, which the central bank seems extremely reluctant to do. The Federal Reserve’s desire to test the boundaries of what constitutes maximum employment predates the COVID-19 downturn, and is informed by years of consultations with community and business leaders. The central bank believes maintaining accommodative monetary policy allows for an improving labor market to benefit historically disadvantaged groups.

Other central banks, particularly those in emerging markets, do not share this reaction function and are not exercising the same discretion on inflation. In places like Brazil and Russia, monetary accommodation is already being withdrawn, with a signal of further tightening to come. This, in concert with resilient commodity prices, should continue to support emerging market currencies. By contrast, the Federal Reserve’s patience should keep real yields well-contained, which would weigh on the US dollar.

Fixed income implications

The cyclical increase in inflation and inflation risk informs our underweight positioning in developed market sovereign bonds.

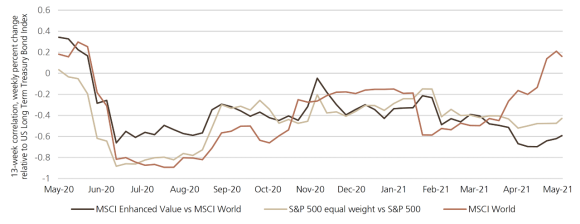

Recently, the typically negative correlation between longer-term US Treasuries and global equities has flipped positive. Indeed, government bonds do not offer good protection to the risks that a higher inflation regime would pose to certain segments of the equity market. In particular, secular growth companies in the US and China, which command large weightings in global equity benchmarks, could be challenged.

Nonetheless, safe sovereign bonds can still play an important diversifying role in portfolios by protecting against downside in procyclical, relative value positions. The correlations between long-term US bond indexes and S&P 500 equal weight vs. the S&P 500, as well as value stocks compared to the MSCI World (two of our preferred equity trades) have remained reliably negative in 2021.

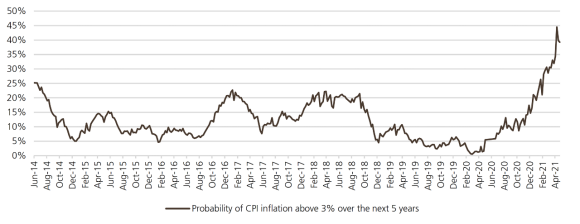

Exhibit 4: Probability of CPI inflation above 3% over the next five years

Exhibit 4: Probability of CPI inflation above 3% over the next five years

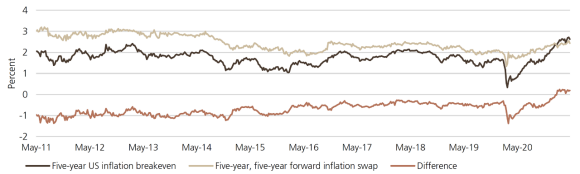

Exhibit 5: Markets pricing cyclical, not structural inflation pressures

Exhibit 5: Markets pricing cyclical, not structural inflation pressures

Exhibit 6: Bonds are still hedging procyclical equity risk

Exhibit 6: Bonds are still hedging procyclical equity risk

Conclusion

We are embracing the brighter outlook for underlying inflationary pressures as a signal of a more robust global growth backdrop. This force has returned to the forefront of the market’s psyche. That informs how we prefer to take risk: in procyclical relative value equity trades and emerging market currencies.

That being said, we are cognizant that even as the case for inflation is many-sided, the purest expressions of inflation risk, as well as market perceptions, are much more volatile. In large part, these are driven by oil prices, which are vulnerable to be whipsawed by geopolitical developments and discretionary decisions made by large producers that can quickly upend supply/demand dynamics.

For now, the mere reemergence of inflation risk is the more pressing consideration for investors, not what inflation will be one or two years down the road. Even so, we will continue to monitor the evolution of underlying drivers of inflation that can prove more enduring: structurally higher fiscal support, faster rises in labor compensation, and supply shortages that will take considerable time to resolve. In short, the inflation debate is unlikely to be settled any time soon, contributing to a choppier environment for global risk assets as a whole, and better opportunities in relative value.

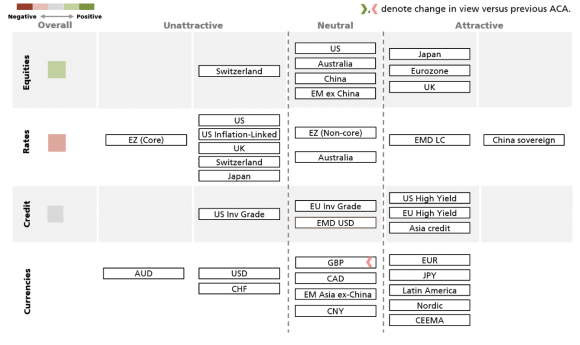

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 25 May 2021.

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD $149.1B billion (as of 31 March 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.