Asia Now

Asia Now. Our Asia stocks and bonds experts joined a webinar to discuss the investing outlook for 2021 and 2022 and identify new opportunities

Asia Now – stock and bond 2021 investing outlook – 10 key points

Asia Now – stock and bond 2021 investing outlook – 10 key points

- The Asia ex-Japan regional economy will grow by an estimated 8.6% y-o-y in 2021, and 6.0% y-o-y in 2022, according to the International Monetary Fund.

- Asia is also now leading in innovation with more patents filed in Asia.

- In general, Asian companies are fundamentally healthy, with low debt and rising cash balances, and Asia stock valuations are cheap compared to major asset classes.

- A number of themes, including shifting consumer patterns, increasing e-commerce, rising credit penetration, and digital transformation, will likely be secular growth drivers for the future.

- Asia small cap companies are under-researched and can give investors exposure to the many thematic trends playing out both in Asia and the world.

- Asia’s V-shaped economic recovery provides a strong backdrop for Asia high yield and investment grade credit, where yields currently look attractive.

- China’s bond market is growing rapidly and offers attractive yields and low correlation compared to most major global asset classes.

- ESG is important, so it has been part of our Asia teams’ investment processes for the past 10 years or so, certainly before it became as fashionable as it is now.

- Asian countries like Vietnam are growing rapidly, and it is possible to get exposure to the growth dynamic by investing in companies listed outside the country.

- The greater inefficiency with Asian markets and big trends playing out in the region create winners and losers, making it possible to generate active returns.

Asia now dominates the world not only in terms of population, but importantly also in terms of market and economic influence.

In 2021, the International Monetary Fund1 estimates that Asia will contribute 45% of global economic output, and this contribution is expected to increase going forward. Asian companies account for 40% of the Fortune 5002. Asia's retail market is already the largest in the world3.

But it's not just about the largest megatrends, but also how you as investors from across the globe can participate in them. And that's also what we explored with our panel of experts from UBS Asset Management,

We all know that GDP growth in Asia in the long run has been much stronger and is expected to continue to be much stronger than the EU and US.

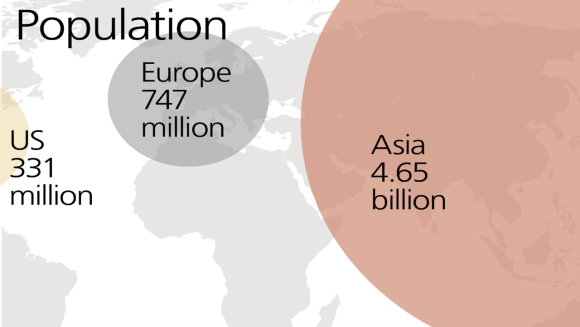

We know Asia is large, but as a reminder of the scale, Asia's population of 4.65 billion dwarfs the other regions

And, of course, this consists of three major population centers.

We have China and India, each with a billion people, but ASEAN (Association of Southeast Asian Nations) itself has 670 million people, so roughly the same size as the population of Europe.

More of the world’s production and consumption has to take place in Asia

More of the world’s production and consumption has to take place in Asia

The complaint in the past was that yes, we have a large population, but it's lagging in spending power.

That's no longer the case.

If we look at the number of billionaires in Asia, it exceeds that of the US and Europe, so spending power has grown tremendously and will likely continue to grow.

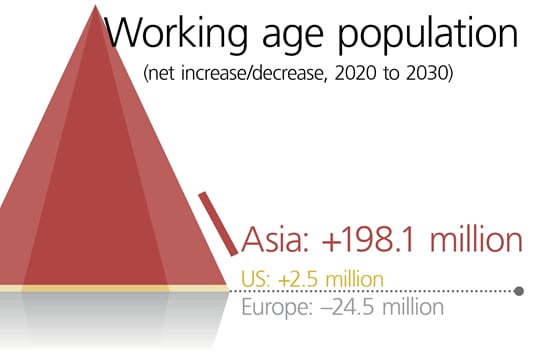

If we look not just at the population, but within that the working age population, we find that over 100% of the world's workers for the foreseeable future will be coming from Asia.

So particularly in the fast growing populations of India and ASEAN.

Growth in the working population in the rest of the developed markets overall is either flat, as in the case of the US, or actually shrinking, as in the case of Europe. So more of the world's production and consumption has to take place in Asia.

Asia is also now leading in innovation as well. There are more patents filed in Asia in China, Japan, Korea, Taiwan and so on than in the US and Europe combined. And R&D spending also exceeds the US and Europe.

If there is any headwind right now I would say it is COVID-19.

It is fair to say that the vaccine rollout in the US, in particular, is going quite well, and Europe is probably going to catch up fairly quickly. The lower income countries within Asia, such as Indonesia or India, will struggle in the near term, so this is a headwind.

GDP growth will in the near term be not as fast within the emerging markets, and this historically has led to a headwind in performance. But we believe this will be a short-term impact and towards the end of the year we could see a catch up within the Asian economies and the Asian markets as well.

Asian companies are fundamentally healthy

Asian companies are fundamentally healthy

If we look at companies within Asia, what we see is pretty good health, there's no build-up of excess capacity, which is usually what brings a major downturn in the cycle.

In fact, there's been low capital expenditure for a few years, and that's showing up in the form of shortages, most obviously in semiconductors, and in certain commodities like copper and nickel. These shortages will likely mean certain industries having very good margins.

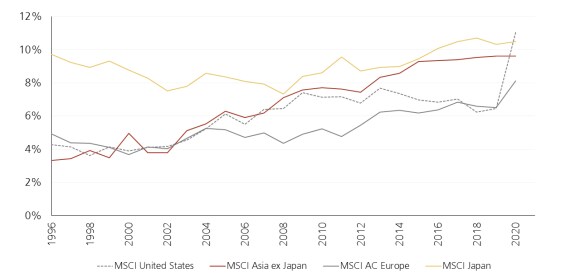

Turning to balance sheets. Cash as a percentage of assets for Asian companies is at a historical high.

Similarly, debt is near a historical low for Asian companies.

Now these are the large index companies, of course there are smaller companies and private individuals who do have debt issues, but in the large index companies that we typically invest in, debt levels are moderate, and cash levels are quite high.

Cash as % of assets, 1996-2020

Cash as % of assets, 1996-2020

Higher interest rates are not necessarily a headwind.

Higher interest rates are not necessarily a headwind.

Recently there's been some fear in the market about rising bond yields.

Now our belief is that central banks will continue to keep short-term interest rates low, but the long end of the yield curve is steepening.

Historically, there's been a rather loose correlation between the equity index and the yield curve. On average, you would say a steepening yield curve has been generally good for Asia, although that relationship is fairly loose, so we're not too concerned about rising rates at the long end.

US Yield spread vs MSCI Asia ex Japan Index

US Yield spread vs MSCI Asia ex Japan Index

If we look at valuations, no major asset class is cheap compared to its history, and that includes Asian equities.

However, when we look cross-sectionally at Asian equities compared to other major asset classes, it is one of the cheaper of the major asset classes.

It pays to invest actively within Asia

Finally, I would like to end on the merits of active investing within Asia.

Asian equities are quite different from US or other developed market equities, and it is possible to have very high active returns. If you look at the performance of our Asian equity portfolio over the past six years, you can see the cumulative total return from our active portfolio has been twice that of the index.

If we look at small caps, it's even more dramatic over the past eight years. We had almost three times the return from our active portfolio compared to the index, so it really pays to be active within Asia and also within small caps.

This is driven by two effects. Firstly, the greater inefficiency within the Asian markets, especially small caps, but also Asia is a changing region - and that gives rise to big trends and themes. If you're able to identify the winners from these trends and themes and avoid the losers, you can make very strong active returns which can amount to very healthy total returns for your portfolio.

There are a number of themes that we are observing in Asia that we believe will provide secular growth drivers for some of the companies in this part of the world.

One of the themes we are excited about is the change in consumption patterns as Asian economies develop.

So what does it mean?

Basically, as the economy develops, where and how you spend your money will change.

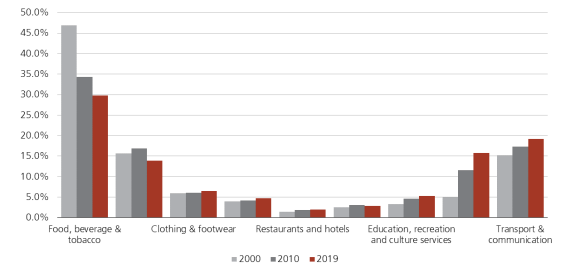

Look at the change in wallet share in India.

Twenty years ago, half of consumption expenditure went on basic items like food, beverages and tobacco; now the structure is around 30% for these basic items, with more spending going into things like education, transport, and communications services.

India's change in wallet share (2000-2019)

India's change in wallet share (2000-2019)

So, if you are able to find companies that are taking advantage of these trends, you could get yourself very good investment candidates.

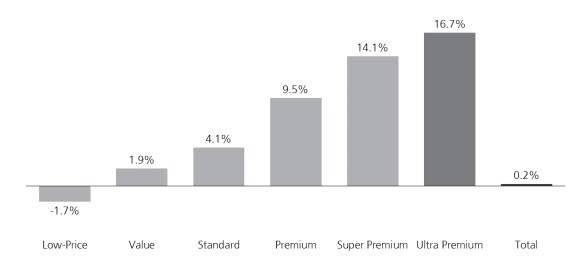

As consumers become more affluent, even within the same product category, we can see a very clear and discernible trend that consumption patterns are moving from basic functional brands to premium brands.

Look at the consumption of baijiu, a liquor made in China, over the past few years. Overall consumption growth is expected to be relatively flat, but sales of premium brands are expected to grow at mid-teen rates.

China: Baijiu volume CAGR (2018-2023E)

China: Baijiu volume CAGR (2018-2023E)

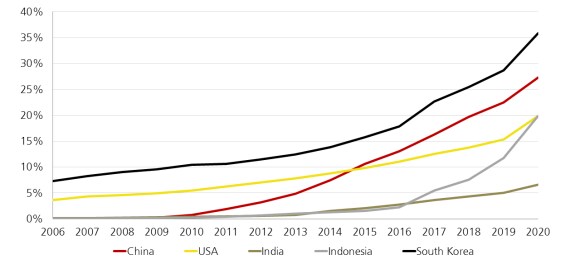

Let’s also look at e-commerce.

Digital transformation is taking place across many industries. In the case of retail, one can see that, e-commerce penetration is increasing.

In some parts of the world the trend has been accelerating faster than markets such as the US. There are countries still relatively less penetrated, like India and Indonesia, but we expect they will catch up.

E-commerce penetration: countries compared, 2006-2020

E-commerce penetration: countries compared, 2006-2020

Online sales as % of total reatil sales

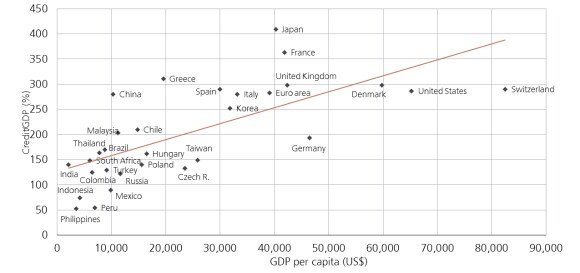

As economies develop, so do financial markets, but credit as a percentage of GDP is still relatively low in a lot of Asian countries.

Now that means when the economies develop, the credit market will likely grow faster than GDP. If you can find banks that are taking market share, you may find good investment candidates.

Total Credit/GDP vs GDP per capita

Total Credit/GDP vs GDP per capita

Good banks are actually quite visible because a lot of the time private sector banks gain market share at the expense of state-owned banks because they don’t have the burden of legacy and policy loans.

We are also quite excited about the semiconductor sector, which has been consolidating.

Two important events have reshaped the world and will probably continue to do so going forward. One is COVID-19, and another one is geopolitical tension between the US and China.

Both these events brought the importance of supply chain control for any region and country into sharper focus. Currently, there’s a semiconductor shortage affecting many products.

And that's why the US is encouraging the likes of Samsung and TSMC to set up factories in Arizona.

China, on the other hand, is actually increasing semiconductor investment because they need to catch up so that they would not always be beholden to sanctions by the US.

The most advanced manufacturing assets are actually located in Asia. The majority of semiconductor manufacturing assets are also located in Asia, such as in South Korea, Taiwan, China, and in Singapore.

So you can find good investment candidates for the semiconductor sector in Asia. That’s because China will likely be investing aggressively to try to catch up, and at the same time you can also already invest in global leaders in places like South Korea and Taiwan.

So why Asian small-and mid-caps?

The first reason why you want to consider investing in small-and mid-caps in Asia is really no different from why anyone would want to consider investing in small caps in any market.

We're looking for undiscovered gems, and we're investing in some of these stocks at a much earlier stage of their life cycle.

Or to put it in simple terms, we're trying to spot future winners early.

So that's no different in Asia as it is in other markets and one of the indications we use when we talk about undiscovered stocks really is the amount of research coverage that we have on stocks.

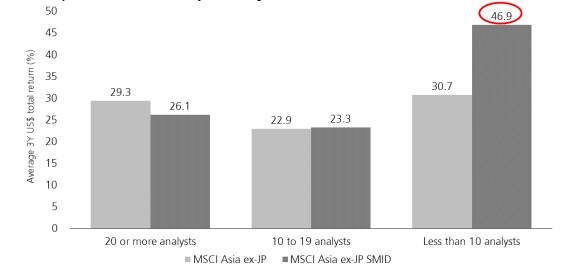

Only 6% of the small-and-mid cap index constituents are covered by 20 or more analysts, versus 31% for the larger universe, and actually not even 50% of the index in the small-and-mid cap index is covered by five or more analysts, whereas if you look at the larger universes it is over 90%.

And so why is that important? Stocks with low levels of coverage in Asia have generally tended to outperform over time.

3 Years performance (%) & analyst coverage

3 Years performance (%) & analyst coverage

The second reason to consider the Asian small-and-mid cap asset class is you can think of it as a diversifier and as a complement to some of your larger cap portfolios.

What do we mean by that?

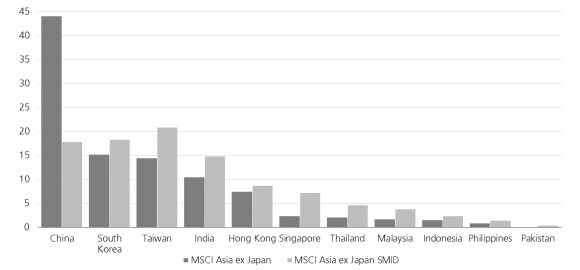

Look at the index constituents of the MSCI All Country Asia ex-Japan Index versus MSCI Asia ex-Japan Small-and-Mid Cap Index.

In the MSCI All Country Asia ex-Japan Index, China is 43% of the index, dwarfing every other country.

If you look at the small-and-mid-cap universe, there's a larger number of stocks in the universe and it is much more balanced across China, South Korea, Taiwan and India.

Country weights in MSCI Asia Ex-Japan index & MSCI Asia Ex-Japan small and Mid companies index

Country weights in MSCI Asia Ex-Japan index & MSCI Asia Ex-Japan small and Mid companies index

Source: The information should not ne considered as a recommendation to purchase or sell any security

Source: UBS Asset management, POP, as of end December 2020

For our Asia small-and-mid cap strategy no major market really dominates the allocation.

Actually, we are overweight markets that typically you will not be overweight in, for example Thailand and the Philippines.

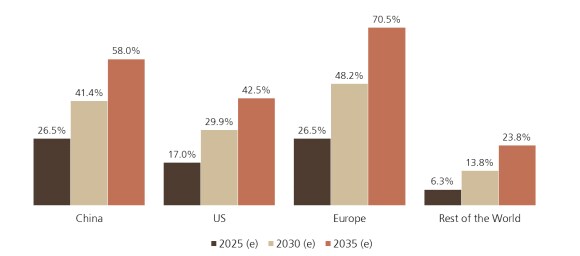

The third and final reason why you should consider small-and mid-caps as an asset class is that small-and mid-caps may be a more preferable way for investors to access certain thematics.

One of the themes we like is really the proliferation of electric vehicles (EVs).

Electric vehicle penetration (estimated) by country, 2025-2035

Electric vehicle penetration (estimated) by country, 2025-2035

But why not invest in the pure play EV stocks in the large cap universe?

We are not entirely sure who will be the eventual winners as the industry matures. Also, if you look at some of these large-cap EV stocks, we struggle to make the valuations work.

We need to project our earnings up to and beyond 2030 to justify some of the valuations today and, actually, we can't really justify why to invest in a large-cap EV stock with a USD 70 bn+ market cap which today generates zero revenue.

So rather than invest through the large caps, we believe we can play the EV thematic through some small-and mid-cap stocks. Here are some examples.

Firstly, we invest in a South Korean company which is a material supplier to the Korean battery industry that is taking market share from Japanese suppliers.

Secondly, we also invest in a Chinese company becoming the global leader for battery housing for electric vehicle batteries. That company has defeated German peers to be the sole supplier for Volkswagen's electric battery platform in Europe.

The third company is a Malaysian company that is taking market share in the automotive lighting sector. If you think about what is important for EV manufacturers, they need to focus on three things: energy efficiency, unique design and product differentiation. We believe lighting is going to be a key part of that.

It's clear that in Asia we have gone through a V-shaped recovery.

While the rest of the world was cutting rates to zero and below, Asia has been cutting rates too. However, the most important thing is that in Asia they haven't reached the lower bound, so there's still a lot further to cut.

In places like India, South Korea, and Malaysia, there's still a lot more flexibility to both ease monetary policy across the board and still a lot more flexibility on the fiscal side.

Turning to the recovery, Asia is displaying a strong recovery and we believe it is going to continue in 2021 and into 2022.

So what does that mean for credit? It means that there is a higher growth trajectory across Asia relative to the rest of the world due to higher earnings power and the ability to pay back on debt.

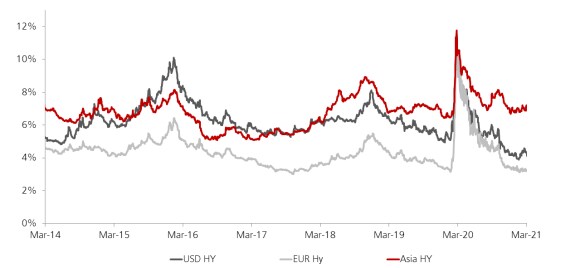

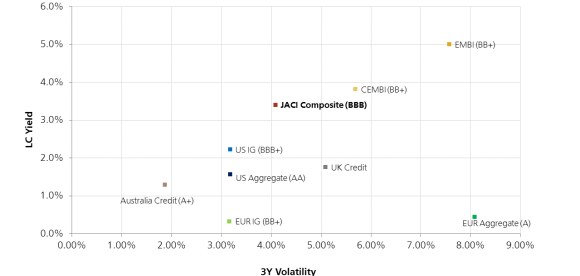

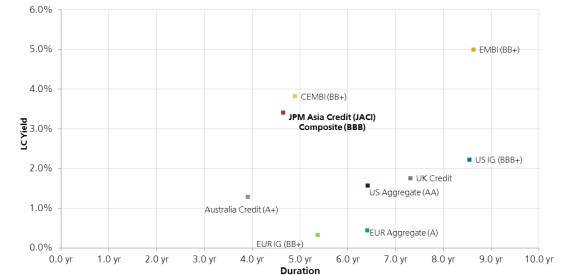

Where does Asia credit fit relative to the rest of the world? Asia really stands out.

Looking at the JACI Composite in the chart, this Asia credit index is about 80% investment grade and 20% high yield, and you can see that Asia Credit stacks up really well relative to other markets around the world.

Yield & Volatility

Yield & Volatility

Past performance is not a guarantee to future results.

Duration is where it gets interesting. You can see duration has really lengthened in the past eight years for the developed markets.

Yield & Duration

Yield & Duration

Past performance is not a guarantee to future results.

As a word of warning, a lot of credit markets now are getting longer in duration and we have not yet had a big volatile period where interest rates have tested the longer dated exposures.

Meanwhile, Asian duration has remained relatively low and stable, Asian bonds are offering substantially higher yields, and they’re less exposed to any volatility spikes.

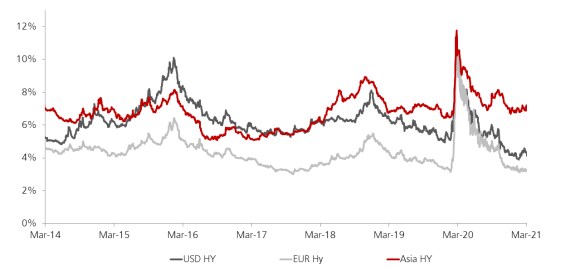

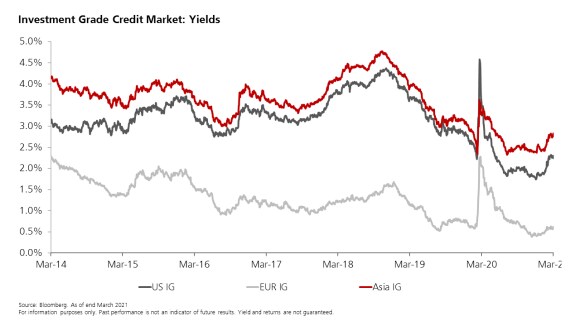

When we look at Asia from a credit or yield perspective, we can clearly see that Asia in the red line here relative to US and Europe, on both the high yield side and on the investment grade side has a substantial pick up in yield gap.

High Yield Credit Market: Yields

High Yield Credit Market: Yields

Past performance is not a guarantee to future results.

Investment Grade Credit Market: Yields

Investment Grade Credit Market: Yields

Past performance is not a guarantee to future results.

In a world where capturing income remains difficult, Asia delivers high income and underlying exposures to some of the fastest growing firms and countries globally.

A clear message here is that Asia fixed income stacks up from a risk and return perspective relative to other markets. Looking forward, we think Asia offers substantial pick up relative to the risk that you've got to take to go into the US market, in particular, today.

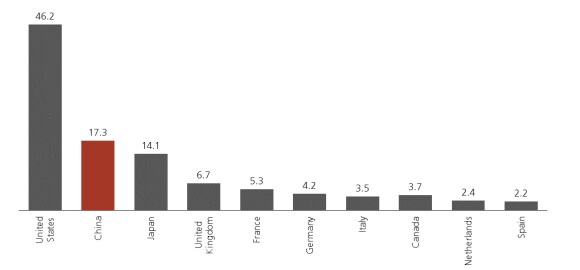

Now we'll turn our attention to China. China’s bond market size is around USD 17 trillion, and there has never been a bond market in the history of the world this large that hadn't been included in indices until recently.

So the clear message to all CIOs around the world is: everything that you currently own is going to be sold as China becomes more included in the global indices around the world.

On top of that, there is a tectonic shift inside China's debt capital markets, going from the loan to bond markets. And the Chinese bond market has essentially been doubling in size every five years.

So this story is not a static one, and we believe you're going to see the Chinese bond market closing the gap to the US market within the next five years.

Bond market size (USD trn)

Bond market size (USD trn)

So how much should you allocate to the Chinese bond market?

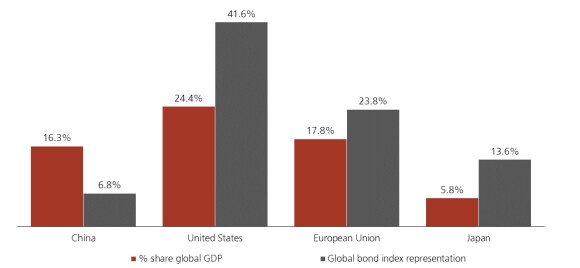

Compared to China’s contribution to world GDP, China’s weight in global bond indices shows it is clearly under-represented.

We believe China’s weighting in the Bloomberg Barclays Global Aggregate index is going to be north of 15%, China bonds will end up about 20% of everybody’s portfolio.

% of Global GDP and representation in global indices

% of Global GDP and representation in global indices

But do we actually want to buy a Chinese bond?

Well, obviously the answer is yes.

It's offering one of the highest nominal yields in the world today compared to other developed markets and is offering one of the highest real yields in the world today in bond markets.

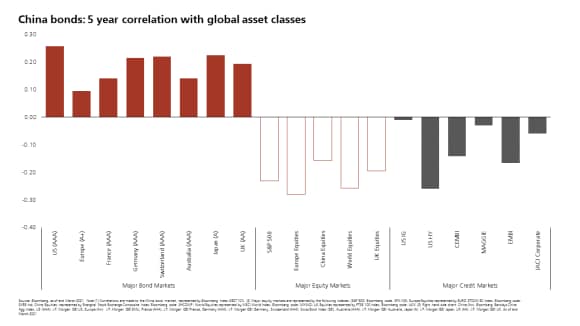

When we have bonds in our portfolio, we're looking for negative correlation to risky assets to create that barbell or convexity within our portfolios.

Chinese bonds have very low correlation to other bond markets, as well as equity and credit markets.

China bonds: 5 year correlation with global asset classes

China bonds: 5 year correlation with global asset classes

When we look at other bond markets around the world today you’ll find either negative or zero yields and negative real yields. What's more concerning is that we can start to see some bond markets exhibiting equity-like volatility characteristics.

And the reason for that is, firstly, indices are just getting a lot longer in duration.

Secondly, as bonds move closer to 0 or negative yields, the sensitivity of the bond markets goes up.

So just to sum up. Asian credit looks like it offers a lot of value today relative to other markets. When we consider the risk as well, the assessment looks even better, particularly on the investment grade credit side.

With a huge structural change that's underway on the Chinese bond market side, both from an index perspective as well as from a normal and real yield volatility and correlation perspective, we think that Chinese bonds have a place in everybody's portfolio today.

Audience Q&A

Audience Q&A

Geoffrey Wong (GW): Increased regulation is a fact of life, especially in China.

It's clear that, philosophically, China’s government prefers a more activist regulatory regime, so we need to take that into account.

And we need to see for which companies and where this is a moderate hindrance and where perhaps it might be lethal.

Now taking the two sectors that we look at.

Starting with internet. We have already seen the fine on Alibaba. We are also seeing moves toward anti-monopoly laws being executed and enforced.

These are things which will no doubt slow the growth potential of some companies in the sector.

But we feel that their natural growth and potential arises not from the exercise of monopoly power, but from the basic natural laws of greater efficiency through the use of technology, such as network effects.

The government is not necessarily taking away the impact of these natural network effects. So companies in the sector can continue to grow - albeit at a slower rate compared to in the absence of regulation - but still they will make good profits and I would expect other countries might see similar regulations in the future.

Now education is also an area where China’s regulators have been active, and no doubt new regulations are going to hit the entire space. Education companies will have to pay more attention to anti-monopoly measures, like being careful about misleading advertising.

Regulators are also talking about restrictions on Saturday classes, so the public school system will supply some activities for Saturday, possibly supplanting some of the activities of the private education companies.

But the underlying driver for the tremendous demand for education in China is the desire to give children every advantage in getting into a good university, and this is common among East Asian cultures, and we do not believe it can be changed by regulations.

We've seen this attempted before in Singapore, for example, where there was concern about too much tuition. In the end, however, the natural desire of parents to do the best by their children remained a great driver.

We saw a bout of regulation in the education sector in 2018 as well. In some ways the stronger players were helped because the weaker players have a harder time dealing with the regulatory burden.

So we feel that the stronger players will face more regulatory pressure in the short term, but will actually gain a relative advantage and perhaps take market share faster than they would have in the absence of regulation.

GW: I won't attempt to predict the course of COVID-19. Many experts were confounded by the second waves that we're seeing in India and other countries as well, so that it's intrinsically hard to predict.

But when we look at the portfolio, there are number of things we have to do.

Firstly, avoiding companies that have any sort of a balance sheet or cash flow issue.

So we need companies that can withstand a prolonged lockdown situation. Now that means having good cash flow, low fixed costs, and not having too much leverage.

And when we form the portfolio we balance the so-called COVID-19 beneficiaries as well as the recovery beneficiaries.

COVID-19 beneficiaries are obviously in the online space, so online education, e-commerce, and social media streaming, which people need to consume more of if we have continued lockdowns.

And then, on the other hand, we do have some of banks that will benefit from the recovery, so we tend to hold a fairly balanced portfolio with strong companies that can withstand the buffeting of COVID-19.

HB: So we actually had quite strong currency performance across Asia over the last couple of months. Currencies have been appreciating against the US dollar as it started to get weaker. However, India has been on the weak side, so in a way it gives you opportunities in an active sense to leg into those currencies where the blocks are stronger.

I would then say on the credits we are avoiding consumer cyclical names that are linked to COVID-19.

Particularly in India we've been underweight, but we're now looking into it as an opportunity to get back involved in that market, as that's starting to look attractive to us from a valuation and risk perspective.

HB: Yes, it is relatively expensive to hedge. But there are ways to structurally hedge the portfolio today.

The RMB looks on the strong side. There are those that want to be active on the currency.

That doesn't necessarily mean you have to be 100% unhedged. You might want to be 50% unhedged.

We would use the trade weighted basket as a guide. If you're on a Bloomberg Terminal, that's called the CFETS basket and essentially that has been in a range from 92 to about 96, and we're sitting at about 97 today.

That index is the way that the Chinese manage their currency. They introduced a policy in mid-2016, which is to say that they want to have a very low volatility currency to their key countries that export food and energy to them.

So of that basket, for instance, South Korea would be 10% of it. So when it's up around 97, we know the currency is expensive. You've heard a lot of jawboning from the central bank already talking about wanting the currency to come back down.

When it's at 92, we would probably be fully unhedged and above 96 fully hedged to manage your portfolio if you think the hedge cost is too expensive, or to take some different views to the Euro or Swiss Franc in particular.

Shou Pin: Sure, let's talk about India.

For the largest personal care company in India, basically what they report is that across almost all their product categories, things like shampoo, detergent, tea, cosmetics and so on, their premium brands are selling at twice the rate of the more generic brands. You can also see that in the auto sector. Sales of larger premium brand motorcycles are actually selling better than the industry average.

Take a look at South East Asia, and Vietnam in particular. Maybe it's not a country that is investible right now, but if you look at what's happening there, the trends look clear and visible. In beer, for example, the premium brands or the mass premium brands are actually selling or taking market share from the mass consumption brands.

Raymond: I think we see this for example in cosmetics. It's not just Chinese people who want to buy better cosmetics, but actually across all markets people are graduating from the more mass market to the more premium brands.

Raymond: There have been certain periods when small-and mid-cap companies have been more risky than large caps, but at other periods of time actually they're not.

Importantly, having an investment in an active fund is probably the preferred approach to a passive index in this investment class.

Simply because, in an active fund, you're able to filter out some of the more risky stocks or risky companies in the universe and therefore able to control risk in the portfolio. So having a quality bias really helps in controlling that aspect of the investment class.

GW: There are a couple of reasons.

Firstly, I’ll talk about Iiquidity. The Vietnam stock market trades with a turnover of roughly USD 400 million per day. So it's hard to get big exposure.

Secondly, listed companies don't necessarily reflect the best parts of the Vietnamese economy.

For example, you may have a milk company and then a lot of state-owned banks which may not give you the full benefit of the dynamism of the Vietnamese market.

On the other hand, there are companies around the region that are making money selling into Vietnam, whether it's beer, cement, internet, or other services, for example.

So these companies may be better placed, but may also be listed in Thailand or even Singapore or Indonesia or elsewhere.

GW: We have always felt that ESG is important, so it has been part of our investment process for the past 10 years or so, certainly before it became as fashionable as it is now.

We think in a form of ‘corporate karma’ that the good companies are going to do better than the bad companies in the long run.

However, I would say for Asia, and in common with other emerging countries, there is still not a good appreciation of the importance of disclosure among the companies.

A lot of Asian companies may have reasonable practices, but they don't disclose it.

Certainly from a Western lens, the expectation is that your annual report, or specific ESG report, would actually have disclosures of all your policies.

Where some Asian companies are following ESG practices but not really talking about it we, as active fund managers, have to engage with the companies.

When we read an ESG report from a specialist, we will go to the company if there are any issues that are raised and flagged as a concern.

If it is a matter of disclosure, we will encourage the companies to get in contact with ESG specialists and then make the appropriate disclosures.

If there is in fact a material shortcoming on the part of the company, we do engage with them and encourage them to improve.

If there is a serious problem and the company is not showing progress, we may divest from the company.

So ESG has always been important to us, but certainly it's gaining much more importance in the entire investing world.

1 International Monetary Fund, January 2021 (https://www.imf.org/en/Publications/WEO/Issues/2021/01/26/2021-world-economic-outlook-update)

2 Fortune, August 2020 (https://fortune.com/2020/08/10/fortune-global-500-china-rise-ceo-daily/)

3 Digital Commerce360.com (https://www.digitalcommerce360.com/article/asia-ecommerce-top-retailers/)

4 Worldometers, Mar 2021 (https://www.worldometers.info/world-population/asia-population/)

Explore more insights

Original articles and videos with expert analysis, views and opinions on a broad range of asset classes and themes.