Seizing AI opportunities

Artificial Intelligence (AI) is set to be transformational and could provide fundamental investment ideas directly to portfolio managers and analysts in 2021 and beyond.

Are we ready for AI?

24 Nov 2020

8 min read

Bryan Cross

Head of Quantitative Evidence and Data Science (QED)

Over the din of the lunch hour cafeteria, there was a shimmer in the air − a sense that something great was being discovered. This was different than a normal lunchtime at Los Alamos National Laboratory in 1950 where the Cold War had mobilized the West’s brightest minds.

During a normal lunchtime one could expect breakthroughs in particle physics or in fusion power, but there was a buzz today that could not be attributed to the Chicken Kiev. Three great minds were at work solving one of life’s great existential questions − are we alone in the universe?

The Manhattan project alums were scribbling calculations on napkins, debating, questioning:

- How many stars in the universe?

- How many are like the Earth’s sun?

- How many have planets?

- How many have planets that are old enough to transmit information as far as the Earth?

It was a frenzy. A crowd began to gather − many aware of the recent reports of UFO sightings nearby. Finally, as the calculations poured in and the Coke bottles slurped the last gasp of soda, the math was obvious – there must be intelligent extraterrestrial life in the universe − the vastness of the universe assured the outcome to be true.

BAM! The hand of an Italian-American physicist from the University of Chicago slammed the table. The “architect of the nuclear age” was troubled, the conclusion did not make sense to Enrico Fermi − “But where is everybody?”

The contradiction between the obvious math and the lack of a conclusion has become known as Fermi’s Paradox – if intelligent extraterrestrial life is such an obvious conclusion, then where is it?

A Nobel Laureate perspective

A Nobel Laureate perspective

Robert Merton, winner of the Nobel Memorial Prize in 1997 in Economic Sciences for establishing a new method to determine the value of derivatives

Artificial intelligence (AI) is rapidly advancing many industries around the world. To what extent will it transform financial services?

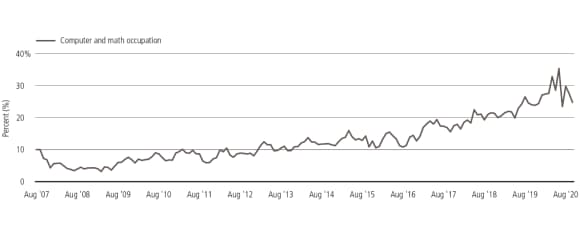

Share of finance job openings that are computer/math oriented

Share of finance job openings that are computer/math oriented

An investor’s dream – a computerized Buffett in every team

An investor’s dream – a computerized Buffett in every team

Just as those scientists looked to the stars for signs of intelligent life, investing has for decades looked to computers and quantitative methods for signs of Artificial Intelligence that can help make smarter decisions. But after decades, finance is confronted with a similar paradox.

There is a persistent dream of putting an AI-driven version of Warren Buffett in every investment team, one with all the positive qualities but none of the negative biases and behavioral errors that come pre-installed in humans.

The excitement of building such a revolutionary computer-based system to pick investments has driven billions of dollars of investment into building systems and hiring big-brained PhDs. The share of job openings in finance that are computer or math driven has nearly quadrupled since the Great Financial Crisis.

But most actively managed assets are still non-quantitative in nature Despite all the investments, decades of academic papers, computer systems, and fortunes made in quant investing, the vast majority of actively managed assets are still non-quantitative in nature.

Traditional active managers will tell you quantitative techniques are not long-term enough and question how a diverse portfolio can really know anything about the “risk” of a company

Traditional active managers will tell you quantitative techniques are not long-term enough and question how a diverse portfolio can really know anything about the “risk” of a company.

Quantitative practitioners will fire back with a long dated backtest or logic derived from perhaps flawed statistical techniques and say, “Isn’t it obvious that quantitative techniques are superior to anecdote and heuristic-driven investment?”

The two schools of thought are seemingly opposed and have spent the better part of seven decades without reconciliation. Sure, some quantitative techniques have permeated into risk management or screening for stocks − but there is no AI analyst working side by side with humans to make investment decisions better. Why not?

Combining human-driven investment research with enhancement from a junior AI researcher could leverage the best of both worlds. A team like that would combine the long-term, complex thinking of a human with unbiased quantitative evidence based decision making of AI.

Combining humans with AI to perform investment research seems like such an obvious goal and the resources being thrown at the problem are vast – but where are the AI investment analysts? In order to resolve this similar paradox, we need to rethink how finance approaches the use of AI.

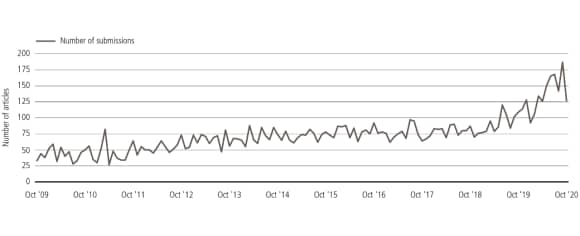

6-month average article count for “Quantitative Finance“

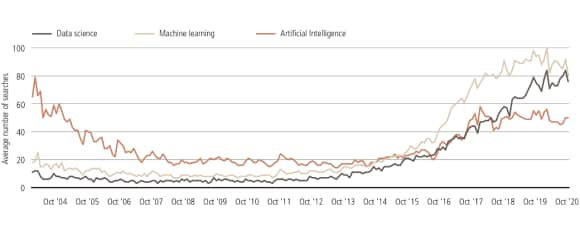

6-month moving average Google trends search interest

The goal of embedding AI has failed so far because the aim is misguided

The goal of embedding AI has failed so far because the aim is misguided

In a classic scene from the movie Jurassic Park, which has now become a meme, the mathematician Ian Malcolm wonders aloud that scientists “were so preoccupied with whether or not you could, you didn’t stop to think if you should.”

This is emblematic of the state of AI research and specifically in its application to quantitative finance. Everyone is so eager to demonstrate that they are “state of the art” that there is no thinking going towards applying AI in the right way.

The above search trends demonstrate the fashion of doing something “fancy” rather than building something transformative in the right manner. In quantitative finance, this trend has manifested itself in the overuse (and potentially misuse) of alternative data combined with machine learning. Rather than thinking about the longer term solutions to the problem, the field is rushing to outperform each other in using niche data to perform task specific solutions.

As a result, the alpha itself is fleeting and the applications do not generalize across a broad spectrum of investment problems. Additionally, the industry is laden with tales of good intentions that fail to get adopted into the traditional investment workflow.

Aligning AI with how investors think is the key to progress

Aligning AI with how investors think is the key to progress

If one stops to think about what makes a great investor, it’s not typically a niche task specific process that differentiates the legends from the temporarily lucky.

Because markets are complex systems whose dancing landscapes are constantly changing, the best investors are generalists by nature. They take mental models and are able to apply them over and over again.

They do not merely learn facts, rather they learn models and systems which they can reach into their toolkit and apply when appropriate.

The computational complexity is low and the objective is to handicap all possible outcomes – to discount the implied market not to forecast. They think about what investments present asymmetric payouts from a probabilistic perspective in a folksy back-of-the-envelope manner.

To build AI that can successfully be implemented in investing, we must align the design of the machine with the cognitive tasks of great investors.

To build AI that can successfully be implemented in investing, we must align the design of the machine with the cognitive tasks of great investors.

QED is working on building an improved approach to AI

QED is working on building an improved approach to AI

Our team at UBS-AM, called Quantitative Evidence and Data Science, has taken the approach of focusing on investor workflows as a guiding principle – we want to understand what are the things that investors do in order to help them form the investment mosaic to help them make a decision.

In the next several years, QED will be spending more and more time focusing on how to generalize these workflows and to combine them with heuristics (problem solving techniques to generally use self-educating and trial and error methods) to form investment conclusions.

Our goal is to create a form of Artificial General Intelligence (AGI) that can apply reasoning to identify and apply mental models hidden in novel problems and then to, ultimately, make an investment recommendation.

QED has focused on aligning our machines with real investment work- flows. In the next year we will focus on an effort to generalize those workflows so that ultimately the machine can make real investment recommendations.

This may seem to be an audacious goal; however, the process to get there is the best way for us to help drive science into the fundamental investment process.

As we solve problems in the path towards AGI, we can directly apply the solutions into the investment workflows.

Our goal is ultimately to create a form of Artificial Intelligence that can apply reasoning to identify and apply mental models hidden in novel problems and then to, ultimately, make an investment recommendation.

Markets remain human constructions

Markets remain human constructions

Does this mean that QED is trying to disintermediate human financial analysts? Not at all. In Philip K Dick’s ‘Do Androids Dream of Electric Sheep?, – the basis for the classic film Blade Runner – humans apply the Voigt-Kampff test to potential replicants (AI’s) to determine if they are human or AI.

The test presents disturbing images to the subject, if the subject shows empathy he/she is human, if not the test proves the subject is AI.

Empathy is the secret weapon of human analysts and because human goals – like saving for retirement, investing in a climate aware manner – are the raison d’etre for investing, we will always need people in the loop.

While QED’s goal is developing AGI, it is doing so in the context of having an empathic human in the loop and machine process working together towards better client outcomes.

Finding Artificial Intelligence—The human plus AGI analyst team of the future

Finding Artificial Intelligence—The human plus AGI analyst team of the future

The benefits of an AI/human partnership to client outcomes are clear and should motivate us to pursue this opportunity. The effort to build a successful integration of AI into the investment process doesn’t need to yield inconclusive results like Fermi’s paradox. Finance must align the design of AI with how investor’s think and as part of an empathic human partnership or else the efforts are in danger of becoming just a fancy tool that operates at the periphery and we’ll all be left to ponder that if it was so obvious then where are all the AI analysts?