The RMB Bloc

The RMB is set for a much more influential role in the global economy – we detail what to expect.

The RMB Bloc – in 60 seconds

The RMB Bloc – in 60 seconds

- China's integration with global financial markets is increasing;

- That's because China is widening access to its onshore markets, pushing ahead with trade deals, and expanding Belt & Road;

- As such, China's influence is growing, as is the role of the RMB;

- The RMB is unlikely to supplant the USD as the world's largest reserve currency, but it is likely to become influential as a regional reserve currency, creating a RMB-bloc in Asia.

Much of newscycle these days is about when or whether China will take global supremacy over the US, and currencies are a case in point.

The inclusion of the RMB in the IMF's SDR basket in 2015 was seen as a watershed moment presaging the decline in the USD as the world's reserve currency.

But the USD remains no. 1, and will likely remain so in the coming years. Despite China's opening up steps, its capital account remains closely managed, and that's a major barrier.

But the RMB's influence is growing

But the RMB's influence is growing

But that doesn't mean the RMB isn't influential.

Indeed, a recent IMF study looked at the influence of the RMB on currencies globally and found some thought-provoking results.

That study looked at how currencies around the world move together with changes in the RMB.

In London, RMB trading volumes eclipsed those for other major currencies in H1 2019

The results from the study showed a firm relationship between global currencies, particularly in Asia and in BRICS countries, and the RMB, with the conclusion that the RMB had a dominant influence on the currencies of countries who contribute approximately 31.6% of global GDP1.

Unique forces are behind this, and we believe they will become increasingly influential over time. We'll start by looking at financial markets.

And accelerating as onshore markets open and key commodities get traded in RMB

And accelerating as onshore markets open and key commodities get traded in RMB

Since 2015, China has been opening up access to its financial markets.

Key policy moves like the Stock & Bond Connects, supported by more detailed policies aimed at easing trading conditions and widening the range of asset classes open to investors, have driven a sustained increase in foreign investors' onshore holdings.

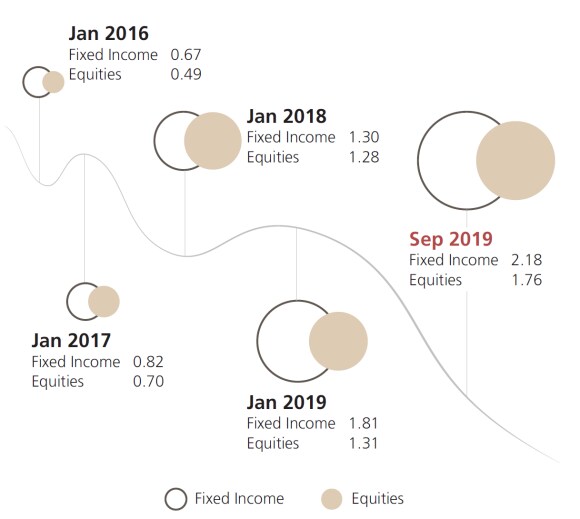

Overseas investors' onshore holdings in China (RMB trillions), Jan 2016-Sep 2019

And that's only going to increase with the index inclusion process. China's equity and bond indices are gradually being included into global benchmarks, and that's driving what we see as a major global reallocation of capital to reflect China's growing status in the global economy.

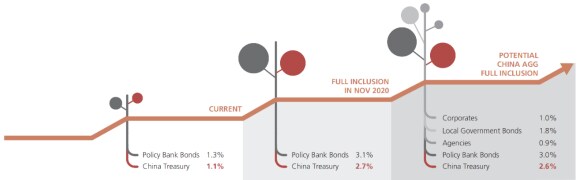

China Bonds: Bloomberg Barclays Global Agg Index Inclusion: Current, November 2020 and Potential Full Inclusion

China Bonds: Bloomberg Barclays Global Agg Index Inclusion: Current, November 2020 and Potential Full Inclusion

the internationalization of the RMB by building onshore markets for key commodities.

Starting in 2018 with oil and following in 2019 with gold, China has launched RMB-denominated trading contracts for these key commodities to ensure that trading is done in the RMB and not in the USD.

Beyond Trump. China's aggressive trade agenda

Beyond Trump. China's aggressive trade agenda

For all the column inches devoted to the Trump-driven trade wars, it's worth remembering that 94% of China's exports go to markets outside of the US.

And China is stepping up its trade agenda and signing a raft of free trade deals to give its companies access to overseas markets. China has concluded 17 global free-trade agreements (FTAs), is currently negotiating another 14, and is at preliminary stages with nine other parties as of November 2019.

One of these agreements, the Regional Comprehensive Economic Partnership stands out. That links China with nine other Asian in a free-trade union. The deal, will further integrate China into link with 16 economies in Asia, including India, Singapore, Indonesia, and Vietnam, at a time when the IMF projects the region is projected to lead global growth, with 6%+ annual GDP growth forecast in 2019 and 2020.

Belt & Road

Belt & Road

And as China’s trade ambitions grow, so the Belt and Road Initiative will boost the use of the RMB as a trade and financing currency.

Modernizing the trading routes along the Belt and Road should not only increase RMB cross-border trade with these countries, but also further promote the currency in the offshore market.

Not only will Chinese companies be able to use their RMB balance sheets to fund projects along the Belt and Road, but they will increase RMB liquidity in those countries thereby enabling further RMB business.

The RMB Bloc

The RMB Bloc

All these factors add up to a more weighty role for the RMB in global affairs, and in the most recent of UBS's annual survey of central banks and sovereign wealth funds2, 40% of respondents expect that the RMB will become a leading reserve currency on par with the USD and the euro.

In other words, the majority of central banks believe that the international payment and financial system will gradually shift to a multi-polar currency system with three leading currencies competing.

Given China's efforts to increase its influence in the Asia region, plus the steady opening of its financial markets, we expect that the RMB will assume a regional role not merely as a currency used in settling trade-related transactions, but also as an investment and reserve currency, hence the very real prospect of an RMB bloc.