Macro Quarterly 2022: The year of pent-up production

Macroeconomic themes and tactical asset allocation opportunities

Highlights

Highlights

- In our view, a key theme in 2022 will be production catching up to strong demand.

- Global manufacturing surveys suggest conditions for production are improving, while rebounding auto production indicates subsiding shortages.

- Better public health outcomes after Omicron will likely drive more labor market healing.

- Strong growth in output should also allow developed market central banks to reduce monetary stimulus, pushing bond yields higher and weighing on equity valuations.

- However, strong earnings growth means equities should still advance this year, with better performance from cyclically-oriented regions and sectors.

Related

Macro updates

Macro updates

Keeping you up-to-date with markets

Following each COVID-19 wave, there has been a surge in activity driven by pent-up demand. Strong fiscal support meant that households could afford to boost purchases of goods and services. But lingering effects of the pandemic meant that in many cases, consumers couldn’t access them.

In our view, one of the defining characteristics of the year ahead will be a better bridging of this gap between what consumers are able to buy and companies are able to supply. We believe that over the course of this year, supply chain stresses will ease, inventories will be rebuilt, consumption patterns will normalize, labor participation will rise, and productive capacity will increase. As such, 2022 is shaping up to be a year in which growth and inflation moderate – but inflation slows by more than growth, and economies still expand at an above-trend pace.

As this pent-up production allows strong demand to be more fully realized, cyclically-oriented sectors and regions of the equity market should outperform. Bond yields, meanwhile, are poised to move higher amid central bank tightening as economic interactions normalize and the expansion matures. Overall, this backdrop should be positive for equities, in our view, because earnings should continue to expand at a healthy pace in an above-trend growth environment. However, valuations will continue to come under pressure as monetary stimulus is withdrawn, which should contribute to more volatility in risk assets than was seen in 2021, on average. Of course, the ongoing pandemic could introduce setbacks that delay some of these optimistic outcomes from coming to pass, but pessimism on this front should not be overstated based on the evidence to date.

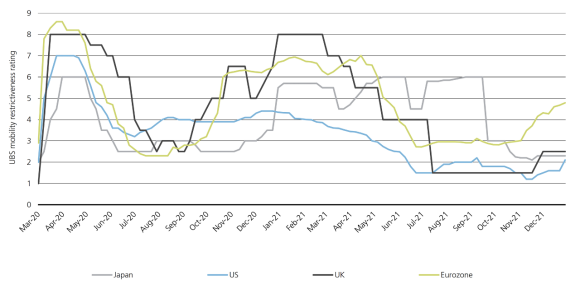

Exhibit 1: Reduced appetite for mobility restrictions in developed markets, especially ex-Europe

Exhibit 1: Reduced appetite for mobility restrictions in developed markets, especially ex-Europe

(Higher numbers indicate more government-imposed mobility restrictions.)

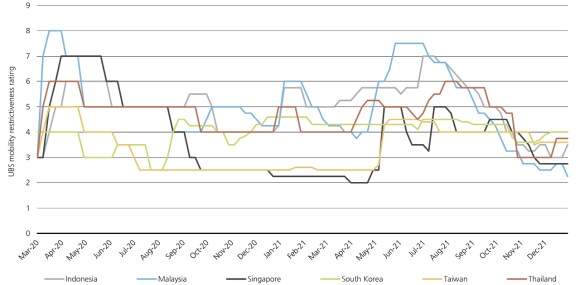

Exhibit 2: Few mobility restrictions in many important Asian manufacturing hubs

Exhibit 2: Few mobility restrictions in many important Asian manufacturing hubs

(Higher numbers indicate more government-imposed mobility restrictions.)

Internals improving

Internals improving

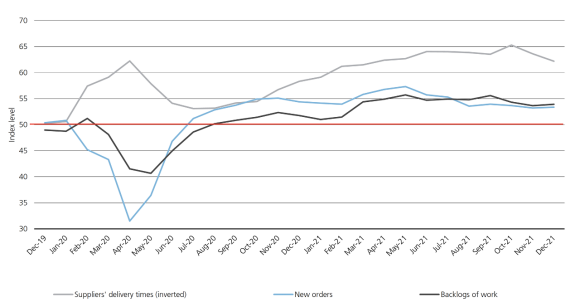

A high-level look at global manufacturing suggests that conditions for production are getting better. Backlogs of work and new orders remain elevated. The message is there’s lots of work to catch up on – and even more to get to after that.

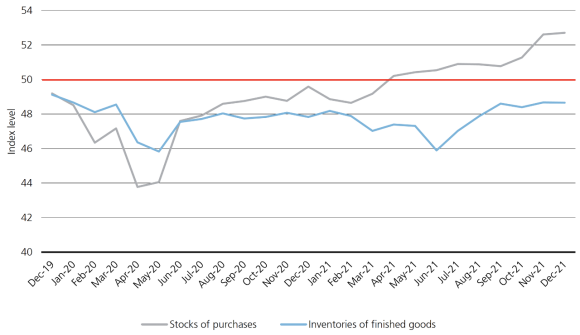

Encouragingly, other PMI details suggest the wherewithal of manufacturers to make good on past and new orders is improving. The supplier delivery times sub-index of the global manufacturing purchasing managers index is off its peak, suggesting some alleviation in the supply chain snarls that have impeded activity. As well, manufacturers’ inventory levels for inputs are rising much more than inventories of finished goods are improving. Rising inputs give factories the ability to increase output to both replenish retailers’ inventories and meet strong end-user demand.

The spread of the Omicron variant is likely to exacerbate lingering production and shipping challenges in the short term. But at present, a number of critical Asian manufacturing hubs are not seeing the same degree of mobility restrictions as when the Delta wave was in ascension. Many governments in the region have moved away from very strict measures to control the spread of the virus, though this could change should public health outcomes deteriorate materially.

The course of the virus in China could also play an outsized role in how much manufacturing operations are impaired, in aggregate. However, it is important to remember that in 2021, COVID-19 didn’t prevent China from posting consistently strong export growth – even around the period when mobility restrictions were the most severe.

So far, any chain disruptions linked to the Omicron variant appear to be less severe and of a shorter duration than previous iterations of the virus.

Exhibit 3: Global manufacturing orders, backlogs strong as supply stresses lessen

Exhibit 3: Global manufacturing orders, backlogs strong as supply stresses lessen

Exhibit 4: Global cyclical outlook better than before the pandemic

Exhibit 4: Global cyclical outlook better than before the pandemic

Auto production

Auto production

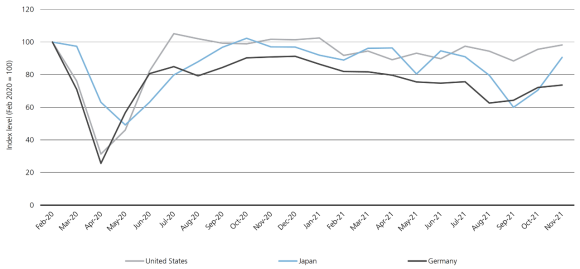

Semiconductors have been the poster child of the shortage-stricken global economy. A dearth of chips has widespread negative ripple effects downstream because of the importance of this input. Nowhere has this been more evident than in automobiles. The surge in used car prices is proof that demand is robust – and yet production has not been able to return to pre-pandemic levels.

We do not expect a full resolution of this scarcity of semiconductors in the very near term; demand is high and lead times for new supply are long. But there is still good news: manufacturers say that the severity of semi shortages has peaked, and recent data suggest chips are sufficiently available to believe that global auto production is turning the corner.

In real terms, industrial production of autos and related products has increased in the United States, Germany, and Japan in back-to-back months, as of November. That is the first time all three countries have seen improvements in consecutive months since the initial restart of economic activity in mid-2020 following the COVID-19–induced recession.

Most impressive is the progress in Japan, where the volume of motor vehicle exports jumped by more than 40% month-on-month in November. This helps inform our optimism for Japanese equities, which are heavily weighted towards industrials with very strong earnings revisions that stand to benefit from thawing supply chain stresses, above-trend growth across developed markets, and a stabilization of activity in China.

Strong demand to create labor supply

Strong demand to create labor supply

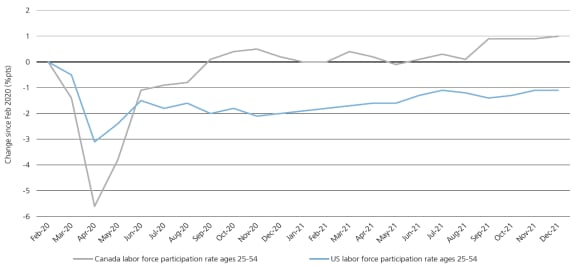

The recovery in labor supply has meaningfully lagged the recovery in demand, particularly in the US. This contributes to bottlenecks across the global economy, as well as driving underlying inflation via strong wage growth. But our view is that labor supply will continue to pick up, helping to facilitate solid increases in output in both goods and services sectors.

One lesson learned from last cycle was not to underestimate the cyclicality of the labor force participation rate. A strong economy keeps workers in their jobs – or moving to ones with better pay – and raises the rate of immediate job attainment for new entrants.

As recent expansions have matured, the labor force participation rate has tended to rise after the unemployment rate fell substantially, offsetting structural downward pressures from an aging population. We would expect this to occur in a normal cycle, but even more so in this one because public health concerns – which we expect to subside – continue to weigh on employment.

In December, 1.1 million Americans said they hadn’t been looking for work because of the pandemic. Nearly 1.7 million people reported having a job but not being at work in December because of an illness. As the Omicron wave recedes, the share of the population with some form of immunity from COVID-19 increases, and new anti-virals proliferate, we believe this will be accompanied by a more durable recovery in labor supply.

Different advanced economies are seeing varying levels of labor force attachment and churn, in part linked to the type and generosity of fiscal measures deployed over the past two years. Some research suggests that lower-income US households do not have significant cash buffers after drawing down some excess savings. This may drive a need to re-engage with the labor market.

There is a risk of some structural change in labor force participation, but in our view it is more likely that prime-age Americans will re-eclipse the same participation rates that prevailed pre-pandemic, as their neighbors to the north in Canada have already achieved. Jobs in the 24-54 age group would need to be 1.9 million above current level to return to where the US prime-age employment to population ratio was in February 2020.

Exhibit 5: Recovery in auto production gaining momentum across different regions

Exhibit 5: Recovery in auto production gaining momentum across different regions

Exhibit 6: US prime-age participation rate has room to rise, supporting employment growth

Exhibit 6: US prime-age participation rate has room to rise, supporting employment growth

Most developed market central banks, including the Fed, have signaled they will not wait for a full recovery in inflation before raising policy rates. New workers as well as capital deepening should drive growth in the years to come, likely allowing central banks to reach higher terminal rates this cycle than the market is currently pricing in. Over time, the expansion remaining intact as monetary accommodation is removed should put upward pressure on interest rates across the yield curve.

Asset allocation

Asset allocation

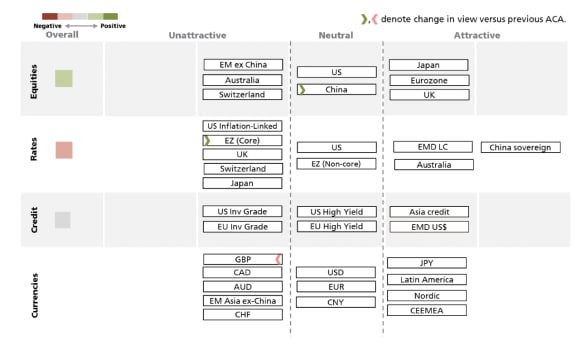

The continued recovery in labor markets and easing of supply chain disruptions should combine to help foster a healthier nominal growth environment – more production, and less inflation.

Risk assets have endured some volatility at the start of the year. A surge in US real rates is hitting more speculative pockets of the equity market, where valuations are stretched and profits scarce.

Ultimately, we believe that global equities are well-positioned to move higher in 2022 on robust earnings growth. In our view, bond yields should trend higher as the economy continues to expand amid central bank tightening, and inflation remains elevated even after peaking.

To be sure, there are risks to this view. While we have high conviction in the outlook for growth, we also acknowledge high uncertainty in judging when, and by how much, inflation will decelerate. A sufficiently large spike that brings 10-year US real rates above zero could exert enough pressure on equity valuations at the index level to overwhelm the positive effects of earnings growth. This would likely be fueled by uncomfortably high inflation that would elicit more aggressive rate hikes from the Federal Reserve as well as a hawkish pivot from the European Central Bank.

We continue to find the beneficiaries of strong production growth – cyclical sectors like Financials and Energy, as well as regions like Europe and Japan – more attractive than broad equity beta. These sectors have fared quite well in the early weeks of 2022, and though it will not be a straight line, we expect more outperformance in the months to come.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities(ex. China) | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt - US dollar / Local currency | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Chinese Sovereign | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 165 billion (as of 30 September 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.