Driving the change

Investors are increasingly engaging with companies on climate issues. These collaborations are critical. They can drive improvements by companies that help mitigate climate risks across the wider economy and society.

In this paper we take a closer look at three elements which we believe are fundamental to the successful integration of climate change considerations across both active and passive strategies. They are:

- Engagement

- Proxy voting

- Partnerships

Climate engagement in practice

Climate engagement in practice

2020 marks the fifth anniversary of the UN Paris Climate Change Agreement. This was a landmark agreement for many reasons, but for investors it was particularly crucial.

By setting a concrete goal – to keep global warming at 2°C or below – the UN gave investors a clear target against which they could align their investments. This in turn made it possible to set models and frameworks for integrating climate factors within the investment process. In this paper we highlight the roles of climate engagement, proxy voting and collaborations within UBS Asset Management’s (UBS-AM) own climate aware investment framework. We explore the ways in which they can enhance the investment process and improve dialogue and understanding with investee companies.

Put simply, investors need to know whether, and to what extent, a company is meeting its climate commitments. We’ve recently seen a marked rise in engagement with corporates on their climate strategy, governance and disclosure, both from institutional and private wealth investors. Collaborating with company management to address climate transition risks and opportunities is a critical way of driving improvement at the company level and thereby extending the mitigation of climate risks into the wider economy and society.

A climate engagement framework in practice.

A climate engagement framework in practice.

The following diagrams illustrate:

- The engagement selection criteria

- The engagement objectives, and

- The impact that engagement program represents in terms of GHG emissions

In this example, the benchmark index is the FTSE Developed and the companies in the engagement list represent 27% of CO2 emissions (scope 1 and 2).

Target companies

Target companies

- Focus on companies in oil and gas, utilities (ex. water) sectors that are underweighted in the climate-aware model

- Among underweighted companies, select those which we believe offer the most potential for successful engagement

- Engagement with 50 companies (22 oil and gas, 28 utilities)

- Regions: North America, Europe, Asia and Australia

Engagement objectives

Engagement objectives

- Alignment with the Taskforce on Climate-related Financial Disclosure

(TCFD)’s disclosure recommendations on governance, strategy, risk management, metrics and targets - Progress on climate issues at the board level, either through management incentives relating to climate issues or the appointment of at least one director with expertise in climate issues

- Evidence of 2°C scenario testing, demonstrating the impact of a 2°C scenario on the business model

- Disclosure on strategy and initiatives for reducing GHG emissions

- Disclosure of goals and progress to reduce normalized GHG emissions

Example engagement focus list:

Example engagement focus list:

We’ve recently seen a marked rise in engagement with corporates on their climate strategy, governance and disclosure, both from institutional and private wealth investors.

Proxy voting

Proxy voting

The rise of shareholder resolutions

Between 2009 and 2018 investors saw a growing trend of shareholder resolutions in company meetings relating to climate change. Like engagement, proxy voting can be a valuable way to address climate change head-on with companies.

During 2019 the widely varying levels of support among asset managers for climate-related shareholder resolutions came under close scrutiny. In November 2019 Share Action (the responsible investment campaign group) ranked UBS as the leading asset manager for voting on climate resolutions.

They examined the shareholder votes cast by over 50 of the world’s largest asset managers on a total of 65 proposals that would speed up corporate action on climate change, including emissions reduction targets, climate reporting and governance, and corporate lobbying.

Overall, it found that institutional investors in Europe are more prepared to hold companies accountable on climate issues versus their US peers. We’re proud to have been ranked the best performer, supporting over 90% of the climate resolutions in the study.

Like engagement, proxy voting can be a valuable way to address climate change head-on with companies

Driving climate action through partnerships

Driving climate action through partnerships

Accelerating the transition

Collective engagement – speaking with one voice

Given the existential threat posed by climate change, investors need to act collaboratively to address the issue and support their efforts so they achieve maximum impact. That means investor partnerships are essential. Bringing together diverse stakeholders and uniting around the common goal of addressing climate change is critical if action is to be taken at the scale needed to meet the climate challenge.

Fortunately, several important collaborative partnerships have emerged in recent years. This suggests that investors are indeed starting to act at scale, offering a hopeful signal that tangible action is being taken which is capable of generating results.

The work of Climate Action 100+ (CA 100+) is arguably one of the most successful collaborative engagement efforts in history. It offers a powerful example of the way investors’ collective engagement with companies can drive the low-carbon transition. Formed in 2017, it’s coordinated by five partner organizations: Asia Investor Group on Climate Change, Ceres, IIGCC, UN Principles for Responsible Investment and the Investor Group on Climate Change.

In September 2019 its membership base numbered 450 signatories, representing over USD 40 trillion in assets under management. Together, they’re engaging with 161 global companies across 33 markets21.

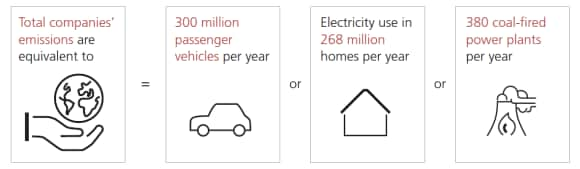

Those companies are either key to the low-carbon transition, or considered systemically important greenhouse gas emitters. They account for over 80 percent of corporate GHG emissions, based on 2018 data reported to the Carbon Disclosure Project, and CA 100+ analysis. As such, they’re critical to the de-carbonization of investment portfolios and the global economy.

Institutional coalitions can deliver a unified message to industry on climate change

Institutional coalitions can deliver a unified message to industry on climate change

As well as improving insights and best practice, investor coalitions can effectively deliver a unified message to industry on climate change – a powerful incentive for investee companies to focus and act.

As noted earlier, the IIGCC initiative is perhaps the most significant initiative to explore the alignment of investment portfolios to the goals of the Paris Agreement. This collaborative project is being led by a steering committee of leading European investors. Through the sharing of best practice among both asset managers and asset owners, the IIGCC provides a mechanism for investors to work together more quickly to align their portfolio strategies with the Paris Agreement.