China equities market update and outlook

China equities – what is the market outlook for A-shares and H-shares in 2021? Markus Egloff, Head of Wholesale Asia, sat down with Bin Shi, Head of China Equities, for an hour-long chat to find out. Read more below.

China equities update and market outlook 2021 – 10 key points

China equities update and market outlook 2021 – 10 key points

- China’s economy will grow 8.4% y-o-y in 2021, and 5.6% y-o-y in 2022, according to April 2021 estimates by the International Monetary Fund.

- China’s government is targeting stable growth, so future changes to monetary policy won’t be that drastic.

- Bin Shi feels that the Chinese government has done more to control risks than other more developed nations, which will make the Chinese economy healthier in the long run and create good prospects for China equities.

- China’s A-share markets have seen a correction, but Bin Shi sees more opportunities to buy into high quality companies and is comfortable to add to current holdings.

- New regulations on the after-school tutoring market will likely benefit leading companies because lower quality players will exit the market.

- Bin Shi believes that, despite hope and expectation around electric vehicles, the industry structure in China remains unstable and he is not willing to buy at high valuations at this point.

- Bin Shi remains positive on consumer, health care and financial services sectors.

- US embargoes have given China’s domestic semiconductor industry a huge boost and Bin Shi believes they are creating a huge competitor to the US semiconductor sector.

- Bin Shi believes it is likely we have seen the worst in terms of anti-trust penalties on Chinese tech companies.

- Chinese pharmaceutical companies' strong R&D skills mean they can compete with leading international competitors and Bin Shi remains positive on their long-term outlook.

Markus Egloff, Head of Wholesale Client Coverage Asia Pacific

Markus Egloff, Head of Wholesale Client Coverage Asia Pacific

Before we look forward, let’s start by looking back.

Almost a year to the day, we held a webinar asking if China really was ‘out of lockdown and into recovery?’

In the months that followed, the answer was clear.

Absolutely.

Despite the difficulties experienced across the world, China’s economy roared out of its Q1 2020 COVID-19 slump and rebounded in the second half of 2020.

Now, the IMF estimates that China’s economy will grow 8.4 % this year – far faster than other major global economies.

China’s economic outlook in 2021 compared (y-o-y growth/%)

China’s economic outlook in 2021 compared (y-o-y growth/%)

- China 8.4%

- United States 6.4%

- World 6.0%

- Euro Area 4.4%

- Japan 3.3%

But what explains this rebound?

A few factors are key, including rigorous controls to limit the spread of COVID-19 within China; innovative tech innovations to help with contact tracing, and strong government policy support

From a market perspective, these factors helped drive China’s equity markets, making them top performers in 2020.

But that momentum has slowed recently. Indeed, China’s onshore markets have weakened slightly YTD.

Naturally, after such a strong year in 2020, investors have a lot of questions:

- Has China’s post-COVID equity rally now come to a halt?

- What next for government policy?

- Where are the opportunities now?

- How to position for the next five years?

Against this backdrop, we now turn to Bin Shi for an expert view on China’s markets.

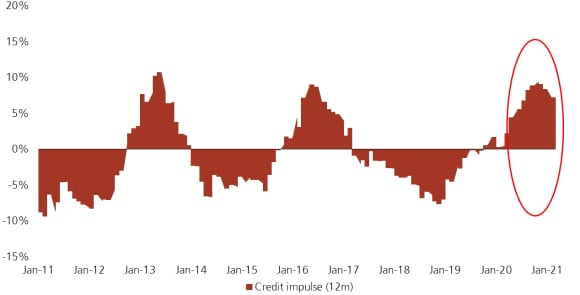

China credit impluse (YoY Growth/%), Jan 2011-Jan 2021

China credit impluse (YoY Growth/%), Jan 2011-Jan 2021

The Chinese government is targeting stable growth, so the withdrawal of liquidity probably won’t be that drastic.

As for the comments from Governor Guo Shuqing, it’s his job to warn of potential risks within the financial system and within the property sector. If risks in these areas are left unchecked, it could lead to a potential crisis.

But compared to a lot of major economies, China has done a good job in terms of controlling risks within the financial and property sectors, and we feel pretty comfortable with the overall situation.

We feel that the Chinese government has done more to control risks and been more disciplined in terms of the size of stimulus measures, and we think that will make the Chinese economy healthier in the long run, and that is good for prospects for Chinese equities.

ME: Turning to markets in particular, volatility has risen and the A-share market has pulled back – do you expect the recent current market correction to continue?

BS: So far this year, the rapid rise and subsequent decline in the A-share market has been pretty dramatic.

We think that some of the rise wasn’t really supported by fundamentals, and was rather supported by liquidity and higher subscription to mutual funds, which then had to deploy quite quickly.

Following the decline, I think expectations are much more realistic now and the mood is probably more rational.

After the correction, we actually see more and more opportunities to buy into high quality companies and we feel more comfortable to add to our holdings at this point.

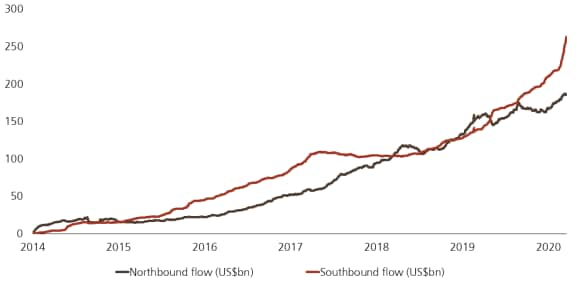

ME: It has been a strong year for IPOs, especially in Hong Kong – what are the driving forces for this?

BS: Usually, a strong market will lead to more IPOs.

But when we look at the IPO market, we need to focus on two things. One is quality and the other is valuation.

Usually, in the early stage of a bull market, quality is good and valuations are sensible.

In later stages, the quality is usually less good and valuations higher because people have unrealistic expectations.

So I think at the later stage we need to be more careful and disciplined and look at all companies on a case-by-case basis.

Overall, we have participated in fewer names, but if the right company comes out at the right valuation, we will be more than happy to participate.

ME: Given recent market trends, how have you managed risk since 2020 and how have your strategies evolved since then?

BS: For us, we focus on the long term, and also on the quality of companies. We feel that’s the best way to manage risk in the long run, no matter if it a strong market or a weak market.

You always want to buy high-quality companies. Even though you might not buy them at the perfect time, in the long run we believe that positions in those companies will work out. In contrast, we believe that if you buy into lesser quality companies, the longer you hold them the more money you lose.

Obviously you need to make some changes from time to time - in bull markets even high-quality companies can get overpriced - but we try to be consistent with our focus.

For example, there have recently been a lot of IPOs, but in many cases even though we recognized some high-quality companies, we felt the expectations and valuations were unrealistic and quite detached from reality, so we took some profit on those names.

We have also kept some cash until we can identify reasonably priced high-quality companies. Our cash levels may have hurt us last year, but this year they have helped us, to some extent.

ME: What is your thinking around cash now? We note that your China onshore strategy is under 5% but the China offshore portfolio is over 10% cash. What does that tell us about how you’re viewing both markets?

BS: Our cash levels are not really a market timing tool, they are really a result of investing with discipline.

Lower cash levels in the onshore strategy mean we feel more comfortable at this point to either add to our recent holdings or buy some of the high-quality names.

As for our offshore strategy, if ADRs correct, most likely our cash levels will go down.

A key determining factor is: if we buy these companies today, can we expect a reasonable return over two-to-three years? If we feel we can, then we should buy them because trying to predict the next upturn is very hard to do.

ME: How are your portfolios positioned right now, and what are some of the notable changes you’ve made recently?

BS: We have always positioned ourselves for long-term capital appreciation but obviously macro dynamics are different under different circumstances. So we made some adjustments, but we haven’t really deviated much from our core approach.

In terms of changes we have made, probably at times of uncertainty and market weakness I think it is more important to focus on quality, valuation, and discipline.

So, in terms of changes made, we have taken profits in some of the IPOs and stocks that have done extremely well, but we think that fundamentals need some time to catch up. We have also invested more in quality names in some less glamorous sectors, such as the more innovative banks in the financial services space.

In terms of changes made, we have taken profits in some of the IPOs and stocks that have done extremely well, but we think that fundamentals need some time to catch up.

We have also invested more in quality names in some less glamorous sectors, such as the more innovative banks in the financial services space.

ME: You mention that ‘boots-on-the-ground’ research is a key part of your process, have COVID-19 controls and travel limits affected this? If so, how have you responded?

BS: Travelling is more difficult, which makes our due diligence work more difficult, but we have followed many of the sectors we focus on for a very long time and established a lot of industry contacts, who help us to track trends in China.

We also have people based in Shanghai, and our analysts in Hong Kong have travelled to mainland China and gone through quarantine processes in order to do necessary due diligence work. In all, we have to get the job done and we have to have strong convictions in companies before we deploy our investments.

So while COVID-19 has had some impact, overall it has been quite minor on our research approach.

ME: Can you talk about ESG as part of your investment process?

BS: Actually, ESG has been a very important part of our investment process for a very long time. We are long-term investors, so we tend to focus on the factors that decide the long-term success of a company.

Our focus on quality has an ESG element to it, such as corporate disclosure, quality of governance, and whether the company is environmentally friendly, and these have been elements of our process - well before ESG has become everybody’s buzzword.

The attention on ESG has been helpful for our work too. In the past there were few resources available, such as external databases.

Now there are a lot more resources available that actually make our assessments easier than before. At UBS Asset Management we also have a separate ESG team that look at all the holdings we have to assess if they meet our standards or not.

One thing to emphasize though is that business practice in China is quite different to other more developed markets, so sometimes you have to take into account some of the local factors in order to come to the right conclusion on the ESG front.

ME: The Chinese government appears to be taking a tough stance on anti-trust regulations – what impact do you see for large players like Alibaba and Tencent?

BS: To put it precisely, anti-trust law has existed in China for quite a long time and it has only been strongly enforced recently.

I think it is a fact that a lot of the platform companies have become so big that they have a huge influence on their industry, the economy and their competitors.

So there is a need for standard procedures to deal with anti-competitive behavior from the platform companies, and that’s what this is all about.

When the Chinese government handed out the Alibaba penalty, they actually emphasized the benefit of platform companies and their positive impact.

So I think the government’s objective is not to kill the platform companies but to deal with some of the negative impacts from them becoming so large.

ME: You have mentioned the growing presence of longer-term institutional investors in the A-share markets – does this mean reduced potential to generate alpha in the future, and where do you look to find the new rising stars?

BS: Institutional investors’ participation in the China A-share market has definitely been going up, from both foreign and domestic sources. We do expect the China A-share market will become more efficient, as we expect participating investors will be more sophisticated.

But that doesn’t mean alpha opportunities will disappear. If we keep improving our investment capability, we can continue to deliver alpha. If you look at our offshore products, based in markets with higher institutional presence than in the China A-share space, we have delivered strong alpha over the years as well.

Audience Q&A

Watch our presentation ‘China equities: the alpha opportunity’ here