Playing by the rules

Incorporating sustainability factors in rules-based equity strategies

This paper focuses on the practicalities of incorporating sustainability factors in rules-based equity strategies in a robust and efficient way.

This paper focuses on the practicalities of incorporating sustainability factors in rules-based equity strategies in a robust and efficient way.

Not many investment themes have sparked as much controversy and divergence in opinion as sustainable investing. This is not surprising—most investment strategies are constructed with the intention or expectation to achieve certain risk and/or return objectives that are well defined and measurable.

Sustainable investing, on the other hand, tends to be multidimensional, and its impacts on long-term risk and return are not yet fully understood. Additionally, this investment style is characterized by a number of complexities, including multiple objectives (e.g. ethical and long-term investment) and modelling difficulties arising from data coverage, quality and standards. While there is a growing belief that rules-based strategies incorporating sustainable factors may offer investors potential long-term outperformance compared to standard market cap weighted indices, sustainable strategies are not yet directly associated with a particular risk-return profile.

Replicating ESG/SRI indices: portfolio management Aspects

As the ESG/SRI index space has grown and evolved rapidly over the past several years in terms of number of different index series and construction methodologies, so have the portfolio management considerations related to implementing these indices efficiently, including liquidity, turnover, valuation levels, and treatment of corporate actions. These considerations are particularly relevant to non-market cap weighted indices that either weight stocks by sustainability metrics or by a combination of sustainability and risk premia metrics.

The implementation process of index portfolios combining sustainability and risk premia factors involves timely, detailed, precise and pragmatic consideration of liquidity (tends to be lower than market cap), turnover and cost (tends to be higher than market cap), and corporate events (specific rules apply to treatment of corporate actions).

Applying ESG/SRI exclusions to rules-based portfolios

Many institutional clients maintain lists of stocks/sectors they do not want to hold in their portfolios because these stocks/ sectors contravene their ethical policies. There are two potential approaches to implementing exclusion lists in index equity portfolios. In the first approach, stocks/sectors are excluded both from the index and from the portfolio, therefore the portfolio tracks a modified version of the original index, assuming these stocks do not exist. In the second approach, the original index remains unchanged, but stocks are excluded from the portfolio by using stratified sampling or optimization techniques to minimize tracking error. Clients often ask us which approach is better. We implement both approaches successfully and recognize that both have merits and deficiencies.

Constructing custom rules-based portfolios via tilts

A number of sustainable investing themes have emerged recently, including:

- Determining potential sources of material risk and alpha. For example, the opportunities emerging from the transition to the low carbon economy are likely to be a potential source of long-term returns.

- Impact investing, characterized by a move from output-driven ESG integration to measuring and reporting the social and environmental impact of investments in companies, funds, etc.

- Increasing the diversity of approaches to integrate sustainable factors in rules based portfolios, driven by heterogeneity of investors’ time horizons, risk tolerance, beliefs relating to sources of risk premia, etc.

Some of the factors behind this increasing diversity of approaches include:

- Different motivations for ESG integration: ethical and/or value-based considerations (e.g. labor management), or long-term risk-return management (e.g. risk and opportunities arising from the transition to the low carbon economy).

- Different data sources in terms of coverage and quality: e.g. MSCI ESG Metrics, Trucost, Sustainalytics, South Pole, etc.

- ESG data is increasingly seen as an additional source of information, unrelated to traditional sources of risk premia (e.g. governance-related factors).

- Different levels of investors’ knowledge, awareness and preferences for implementing sustainable factors (e.g. exclusions, tilts, engagement, etc.).

We next review two examples of our work in this area: incorporating climate-related factors in a portfolio, and integrating governance scores in a portfolio.

Case study 1: Constructing the UBS Climate Aware Rules-Based Global Equity Strategy

Case study 1: Constructing the UBS Climate Aware Rules-Based Global Equity Strategy

According to recommendations by the Financial Stability Board’s (FSB) Task Force on Climate-related Financial Disclosures (TCFD), climate change is one of the most significant and yet misunderstood risks that companies and financial organizations face today. The potential impacts are physical, regulatory and technological, and manifest both in the short and long term. In April 2016, 174 countries and the European Union officially signed the UN Climate Change Paris Agreement to reduce greenhouse gas emissions, limit global average temperature to a maximum of 2ºC above preindustrial levels and accelerate the transition to a lower-carbon economy.6 This transition will create both risks and opportunities and will affect all sectors and industries across the globe.

Achieving this mission will not only require action by governments and companies. Investors also have a crucial role to play and need to adopt more resilient, long-term strategies to tackle climate change, including investing in climate solutions, engaging with companies to encourage implementation of the TCFD disclosure recommendations, and adopting scenario analysis to assess climate-related risk and opportunities. Anyone who simply excludes this sector is unable to exert any influence on the means and timing of such a transition. Many responsible investors believe that being part of this process is an essential component of driving effective and long-lasting solutions.

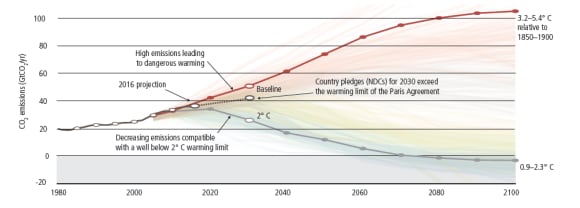

Exhibit 3: Global carbon emission by target

Based on the scenario analysis related to the 2º C target, we have constructed an innovative forward-looking rules-based equity strategy that continues to invest in carbon-emitting companies, but engages with companies appearing less well positioned for the needed transition, and supports companies developing new technologies necessary for the transition. We adopted a forward-looking approach based on tilts and engagement, as we believe that an approach relying solely on historic carbon emissions data and exclusions has deficiencies, including:

- Unintended exposures to sector, country, style factor, beta, etc.

- Failure to consider the multi-dimensional aspects of climate change and carbon data itself.

- Possibly leading to unintended risks by focusing only on carbon risk.

- Failure to acknowledge the uncertainties of climate change.

Exhibit 4: UBS climate aware strategy - Positive and negative tilts

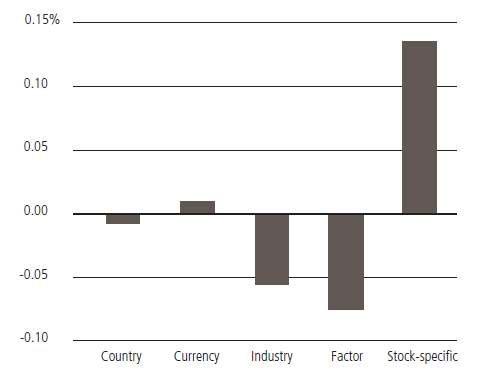

Amongst the back-test simulation data we generated, we looked at performance attribution. In Exhibit 5, we summarize the average monthly performance attribution by risk factor over the examined timeframe. It is notable that stock-specific risk, which can be viewed as an approximation to carbon risk, has been the dominant effect on performance attribution historically.

Below we outline some of the innovations we introduced in the construction of the strategy, which we believe differentiate it from more conventional approaches used to reduce a portfolio’s carbon footprint.

- Based on a probabilistic structure that explicitly recognizes the uncertainties related to CO2 emissions data.

- Incorporating carbon-related, forward-looking measures that reward companies moving towards an absolute target figure of 2º C set by the United Nations at the 2015 Paris Climate Change Conference.

- Incorporating qualitative insights, e.g. source and quality of reported data, disclosures on implementation of policies, objectives, initiatives related to carbon efficiency metrics.

Exhibit 5: Average monthly performance attribution in USD (December 2011-2017)

A key feature of our Climate Aware strategy is the voting and engagement element. Our approach reflects the long-term journey that the transition to a low carbon economy requires. The destination is reasonably well defined but precisely how the journey will unfold is more uncertain. Our voting and engagement approach aims to encourage companies to:

- Report carbon emissions data.

- Have clear strategies and goals for reducing emissions and to commit to regular reporting on progress.

- Comply with best practice in reporting on their governance, strategy, risk management, metrics, and targets, in line with the recommendations of the TFCD.

- Undertake scenario testing and report implications in their annual reporting.

As mentioned above, climate change is an evolving and dynamic process. Our solution should thus keep pace with both the problem itself (for example, carbon as a core risk related to climate change) and the available data/research/ innovations.

To that end, we have set up an advisory group that aims to keep abreast of climate-related trends and developments that impact listed companies, monitors the ongoing voting and engagement activities and continuously enhances the methodology applied by our approach.

Case study 2: Integrating the UBS Governance Score in the MSCI ACWI Index

Case study 2: Integrating the UBS Governance Score in the MSCI ACWI Index

Corporate governance has been a widely discussed ESG factor from the perspective of investment process integration since the early ’90s. One of the most notable publications on this topic is the 1992 Cadbury report published by the Committee on the Financial Aspects of Corporate Governance. The committee established by the Financial Reporting Council and the London Stock Exchange, recommended best practice designed to achieve high standards in corporate behavior. In another paper on this topic, by Gompers et. al. (2003), a Governance Index is constructed to proxy the balance of power between shareholders and managers. Companies are scored based on the provisions that reduce shareholder rights, and Democracy and Dictatorship portfolios are formed. Ferreira and Laux (2007) examined corporate governance from a different angle: in their paper they showed that companies with strong corporate governance policies exhibit lower future idiosyncratic risk.

In this context, and in collaboration with our Global Sustainable Equities team, we have developed a rules-based global equity governance aware strategy. The large availability of ESG data, broad range of approaches across data/index vendors, and biases in data collection provide an opportunity to enhance ESG factors, such as corporate governance. In our governance aware strategy, we constructed a composite governance factor capturing a range of metrics.

To construct the strategy, we used the MSCI ACWI investment universe. We built quarterly rebalanced long-only portfolios aiming to minimize the tracking error vs. MSCI ACWI Index and the transaction costs. We applied a series of relative constraints, including stock, country, sector, size level. Two important aspects in the construction and implementation of our strategy stood out:

- Isolating the added value associated with the exposure to the governance metric, i.e. removing the effects of other factors.

- Controlling the exposure to developed and emerging markets: companies in developed markets tend to show higher governance metrics and better coverage than in emerging markets, thus a governance aware strategy can build an unintended bias towards developed markets.

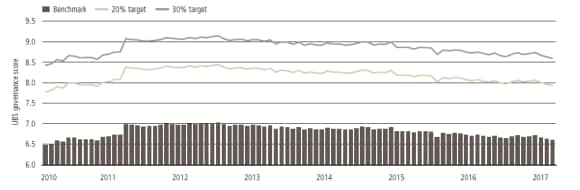

In Exhibit 8, we show the back-tested governance score for the MSCI ACWI Index and for two versions of the strategy: one, aiming to increase the governance score by 20%, and the other by 30%, vs. the underlying index.

Exhibit 8: Governance score for MSCI ACWI Index and for UBS Governance Strategy (20% and 30% target increase)

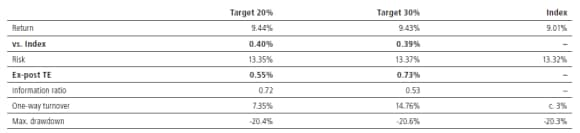

The simulation results shown in Exhibit 9 suggest that both versions of the governance strategy achieved annualized outperformance vs. the index of approximately 0.4% p.a. over the back-test timeframe. The ex-post tracking error fluctuated between 0.50–0.75% p.a., while the information ratio was higher for the 20% target version of the strategy.

Exhibit 9: Selected annualized metrics in USD for the UBS Governance Strategy vs. MSCI ACWI Index

While we acknowledge the limitations of our analysis, including a fairly short timeframe, changes in data disclosure across companies, and subjectivity on the data disclosure and measurement, we nevertheless find these initial results encouraging and indicative of a positive relationship between good governance and returns.