Is 2021 a defining year for sustainable investing in Europe?

With sustainable investing higher on the agenda, we look at how international developments and new regulation is shaping the landscape in Europe, and why it's never too late to invest sustainably.

Sustainability is defined as the ability to meet the needs of today without compromising the potential for future generations to meet their own needs in the years to come.

At UBS-AM, we continue to focus on integrating environmental, social and governance (ESG) considerations into our product solutions in an effort to invest in a more sustainable future.

Wherever possible we aim to engage with companies to drive positive changes and realize improvements that will also contribute to our investment thesis.

Active management + ESG = the perfect match?

Active management + ESG = the perfect match?

In our view there is no better partner for sustainability than active management. Active fund managers help to operate efficient capital markets by providing essential funding for growth opportunities such as renewable energy. As active investors, we have more incentives to engage with companies and do not simply rely on one-dimensional screening techniques based on ESG scoring.

ESG factors are integrated into our bottom-up investment research and decision making process. Firstly, we monitor both internal and external ESG ratings of companies using our proprietary ESG risk dashboard. Given that there is a low correlation of scores across different data providers, we use several sources for the sustainability signal because we believe that the greatest sustainability risks can be identified when several ratings consistently score poorly.

How is the ESG landscape in Europe evolving?

How is the ESG landscape in Europe evolving?

We think that Europe in general is ahead of its peers in terms of sustainability. Governance has been deeply ingrained into most European companies for many decades while more recently COVID-19 has shone light on the importance of "S" in ESG.

On the environmental front, the EU has pledged to achieve carbon neutrality by 2050. The large amount of stimulus and continued support from EU governments should support the growth of smaller emerging renewable energy companies.

Sustainability, digitisation and clean energy

Sustainability, digitisation and clean energy

Climate case study: European utility company

Climate case study: European utility company

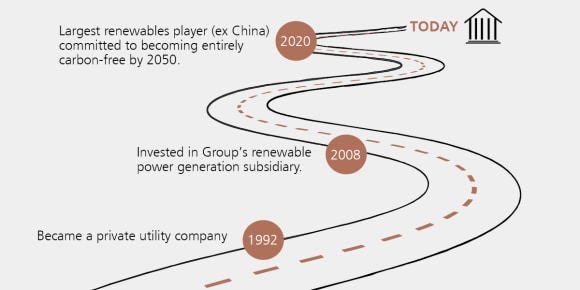

Among the larger renewable players, one that we continue to favor is a European utility company that has a large and growing wind and solar portfolio. The company is well positioned in transitioning to a low carbon economy given several years of experience in renewable energy and its strong focus on digitalization of networks.

The company had originally set an ambitious target to be a net zero emitter by 2050 and recently further strengthened its ambitions with a scope 1 emission intensity target reduction of 80% by 2030 and an absolute scope 3 emissions reduction of 16% by 2030.

It is also one of the companies that we collaboratively engage with as part of Climate Action 100 +, which has resulted in improvements on several milestones on climate change.

How will new EU regulation drive further growth in sustainable investing?

How will new EU regulation drive further growth in sustainable investing?

The year ahead will be an important one for financial companies in the EU as sustainability-related disclosures regulation comes into effect. This is part of the European Commission’s broader Sustainable Finance Action Plan to support a transition to a greener future.

Firms will face greater regulatory scrutiny that will require measures such as disclosing the proportion of fund assets invested in green activities and the methodology used to assess the sustainability impacts of these investments.

The issue we currently face is a lack of commercially viable energy efficient alternatives. We need more time for this energy transition, which must be done in a way that minimizes the negative impacts on stranded communities and workers.

Therefore we choose to invest in companies that are committed to reducing their carbon emissions and are investing in renewables to meet the growing demand for the future.

Why it's never too late to invest in sustainable products?

Why it's never too late to invest in sustainable products?

Investors are becoming more ESG conscious for a variety of reasons, be it social and moral considerations or the desire to generate more alpha. For us, it is common sense that only by investing in long term sustainable businesses can we generate long term financial returns.

Secondly, we must not underestimate the risks associated with not taking ESG factors into account, as this can result in significant financial, legal and reputational costs for companies.

Companies with stronger ESG profiles also benefit from valuation premiums and enjoy a lower cost of capital. The opposite is true for companies with deteriorating ESG profiles or bad scores. We think that companies with a sustainable competitive edge will outperform over the long-term.

By combining material sustainability data with our fundamental understanding of companies, we believe we are better equipped to make better-informed investment decisions.

Find out more about our latest European portfolio with a sustainable focus.