China consumer demand: A four horse carriage

China’s USD 4.9 trillion retail market1 took the lead as the world’s largest in 2016 and it is now at the heart of the growth strategies for global consumer products companies like Apple, Burberry, and Volkswagen.

China’s consumer is at the heart of the economy, contributing 53.6% of GDP in 20172, marking a dramatic rebalancing from 2009 and 2010 when exports and fixed asset investment dominated growth.

But there is still room for growth. At 53.6% of GDP, private consumption as a share of GDP in China still lags behind the 86.9% in the US, 84.2% in the UK3, and 77.6% in France3.

Policy support is lining up with recent tax cuts for low-income earners, tax breaks on education spending, relaxed rules on rural-urban migration, and roll-out of social services around the country.

China GDP growth by source, 2009-2017

Fundamentally, there are three ongoing drivers to propel consumer demand in the coming years:

While the three above demand-side factors are fundamental to the long-term outlook, there is an important structural change playing out on the supply-side that offers growth opportunities in the future.

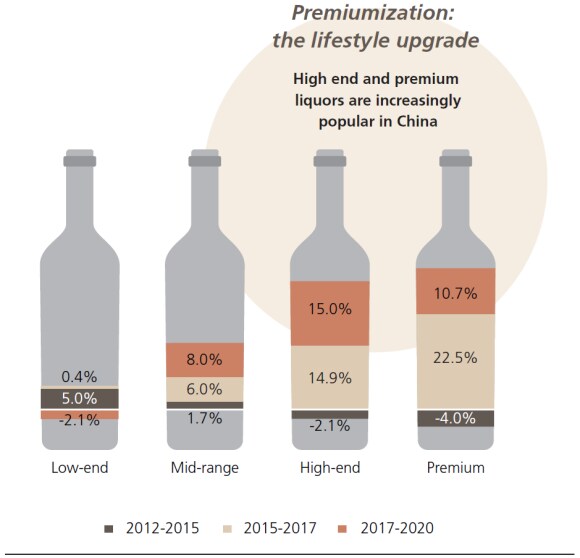

Sales of liquor by sales segment, 2012-2015, 2015-2017 (est.), and 2017-2020 (est.)

Transition from unorganized to organized retail

Supermarkets, hypermarkets, 20186 and e-commerce outlets all make up part of the fast-growing organized retail sector, and this sector has a lot further to grow since approximately 55% of China’s grocery retail sector consists of traditional mom-and-pop stores and old-style, informal wet markets.

How China makes this shift toward organized retail in the coming years is a key part of the consumer story and the recent introduction of ‘New Retail’ formats is a trend that offers strong growth potential for companies leading the charge.

New retail basically means bringing the online retail management expertise and practices that propel China’s fast-growing e-commerce sector into the offline retail world.

China grocery retail: channel distribution,2016

That means applying the latest technology to improve in-store experiences, consumer choice, supply chain management, and delivery efficiency. Examples of ‘new retail’ approaches include:

Benefits

These aspects have clear benefits for consumers in terms of rapid delivery, cheaper prices, and convenience, but for companies the benefits are:

And initial data that compares order numbers at one leading new retail format store, Alibaba’s Hema, show a marked advantage compared to two established supermarket chains in China, indicating a strong response from consumers to new formats.

The transition to organized retail being driven by new retail formats that give consumers better experiences and promotes stronger competition is one aspect of China’s ongoing consumer story that has plenty of room to run in the coming years.

This transition, coupled with the strong underpinning outlook for fundamental demand drivers, will present excellent opportunities for investors in the companies that manage the infrastructure, i.e. IT platforms, and deliver the products, i.e. companies in consumer sectors, as China’s consumer story continues.

Daily retail transactions per store