The century club

The rising prospect of living ten decades

In this first global issue of UBS Investor Watch – the largest recurring survey of wealthy investors in the world – we explore the interplay among wealth, health and longevity. Nearly 5,000 investors in Germany, Hong Kong, Italy, Mexico, Singapore, Switzerland, Taiwan, the US, UK and UAE shared their views with us. This included over 400 in the UAE.

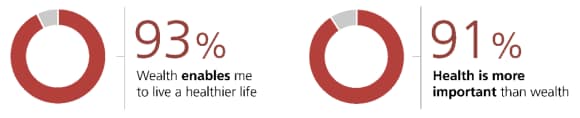

We found that nearly half of wealthy individuals in the UAE expect to live 100 years. Regardless of how long they expect to live though, health is of paramount importance to nearly everyone. In fact, most consider their health to be more important than their wealth.

Many wealthy people in the UAE expect to live for 100 years

Many wealthy people in the UAE expect to live for 100 years

Nearly half (45%) of wealthy individuals in the UAE expect to reach age 100. This is considerably higher than the current 80-year life expectancy in most developed countries. Expectations for reaching this age are even higher for those already over the age of 65. Despite the fact that women typically have longer life expectancies, wealthy male investors are more likely to believe they will reach this milestone.

Waiting for one hundred

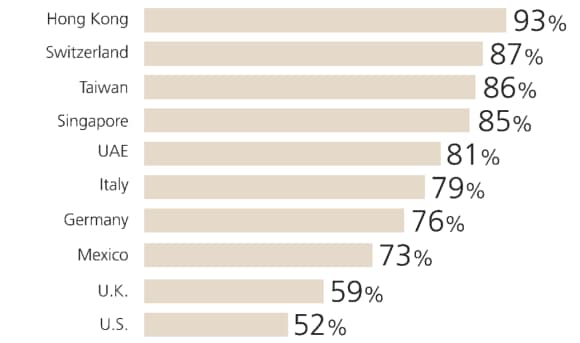

Percentage of investors who expect to live to 100

Health is more valuable than wealth

Health is more valuable than wealth

Being healthy is the top priority – and the top concern – for wealthy individuals in the Emirates. In fact, 91% say investing in their health is more important than growing their wealth. At the same time, 60% worry about their health deteriorating in the next decade, though this concern is lower than elsewhere across the world.

The amount they spend on health is also significant, especially among younger people.

It’s not just their own health that matters though. Over 90% believe it’s their "duty" to help less fortunate members of society stay healthy. As a result, over 70% have invested in an area of health to drive positive social impact, and 56% want to increase impact investing in health in the future.

Health over wealth

Most believe working longer is positive for their health

Most believe working longer is positive for their health

Most wealthy individuals in the UAE see work as inseparable from longevity. On one hand, 81% believe work has positive effects on health and want to continue working for as long as they can. On the other hand, many of the wealthy in the UAE believe they will have to work longer to afford the years ahead.

Seven in ten are already working beyond traditional retirement age, or would consider doing so, in order to maintain their lifestyle. Local culture is also a factor in this mindset. Nearly 40% believe they are expected to work until they’re no longer able to, and a similar number simply enjoy work too much to give it up.

Is working longer the fountain of youth?

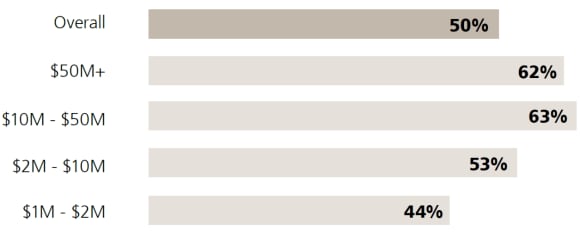

Percentage who believe working as long as possible is good for health

Longevity is prompting investors to act differently

Longevity is prompting investors to act differently

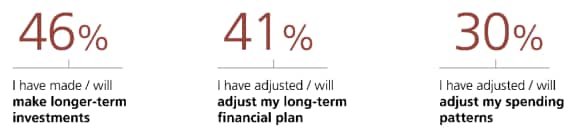

Almost all wealthy individuals in the UAE say they have made or will make financial changes in response to rising life expectancy. While 30% are adjusting their spending habits, the top strategy is to make greater use of long-term investments. Male investors, and those age 35 to 50, are particularly focused on this.

The wealthy in the UAE place great value on allocating wealth to equities, real estate and bonds for the very long-term. Real estate investments are held in particularly high regard by women. Like most other countries, wealthy people in the UAE view healthcare as a highly promising sector for long-term investing. However, the energy sector is the most attractive industry by far to invest in for the very long-term, especially among younger groups.

Longevity impacts investing, planning and spending

Percentage who have responded to increased life expectancy

If you want to know more

If you want to know more

Come and see us so we can find out more about what matters to you.

About the survey

About the survey

UBS Global Wealth Management provides financial advice and solutions to wealthy, institutional and corporate clients worldwide. As part of our leading research capabilities, we survey global investors on a regular basis to keep a pulse on their needs, goals and concerns. Since 2012, UBS Investor Watch tracks, analyzes and reports the sentiment of high net worth investors.

UBS Investor Watch surveys cover a variety of topics, including:

- Overall financial sentiment

- Economic outlook and concerns

- Personal goals and concerns

- Key topics, like aging and retirement

For this edition of UBS Investor Watch, we surveyed almost 5,000 high net worth investors (with at least $1 million in investable assets). The global sample was split across 10 markets: Germany, Hong Kong, Italy, Singapore, Switzerland, Taiwan, UAE, the U.K., Mexico and the U.S. In the U.S., over 1,600 people were surveyed, while a minimum of 400 responses were gathered in each of the other eight markets. The research was conducted in the U.S. in March 2018 and in the other markets between December 2017 and January 2018.