Our service

Helping you manage your wealth. You can do anything when you manage your wealth in the right way. Whether you want to grow, protect or pass your wealth to the next generation, our customized solutions will help you achieve your goals.

It's good to know you have a strong team on your side. As we have offices in over 50 countries, you can access the world's leading financial centers and diversify your wealth globally.

We’d like to meet you

Passing on your wealth can be emotional and complex. You'll receive support and advice to make sure your wealth reaches the right hands at the right time.

Invest to make it happen

Invest to make it happen

Now we understand your dreams, ambitions and needs, successful investing could help bring them to life. Our experts can support you in creating a portfolio that aims to deliver the returns you expect; all in line with your financial plan and risk tolerance.

Bank on us every day

Bank on us every day

We offer financing options like mortgages and lending, as well as services for trusts, so you can find everything you need in one place. You can also get advice on philanthropy and sustainable investment.

Serving the world's wealthiest

Serving the world's wealthiest

Services for business

Services for business

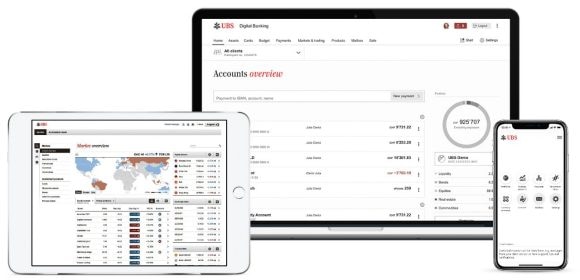

Digital Banking

Digital Banking

UBS Digital Banking lets you have better control of your investments with a fast, personal and secure banking experience.

Private Client

Private Client

As the world's leading wealth manager, we are constantly looking at how we can bring the best of UBS to our diverse group of clients and how we can continue improving our services and offerings to meet their evolving needs.

We’d like to meet you

We’d like to meet you

Come and see us so we can tell you more about what we can offer you.